2022 in the Rear View Mirror

Inflation, the Fed’s response and rising interest rates, a sharp falloff in stock and bond prices, uncertainty of a looming recession and Cryptocurrency implosion were all part of the investment landscape in 2022. Although we don’t know what’s ahead, glad this year is behind us.

Inflation and Interest Rates

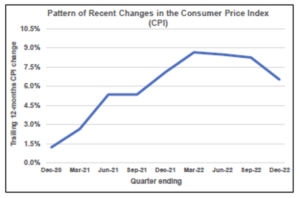

Inflation and the Fed’s response dominated the investment environment. 2022 saw the inflationary effects of prior years’ stimulus payments, supply chain disruptions, war in Ukraine, and an accommodative Fed – too much money chasing too few goods. The pattern of inflation, measured by prior year changes in the CPI, is shown in the accompanying chart. Throughout the past year, the Fed worked to bring inflation in check without triggering a recession. While some would argue a little late, the Fed ratcheted up the Federal Funds Target rate continuously from 0.75% to 4.50%. While it is too early to declare victory, a quick look at its recent trajectory shows the pattern of our measure of inflation bending in the right direction.

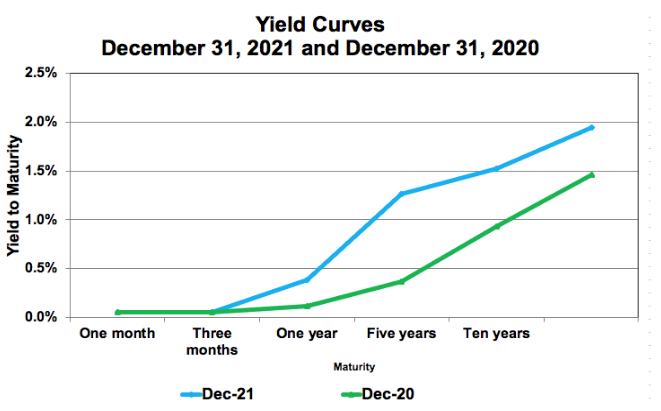

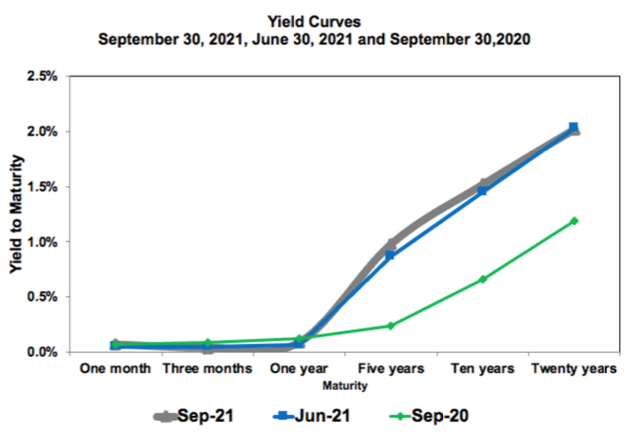

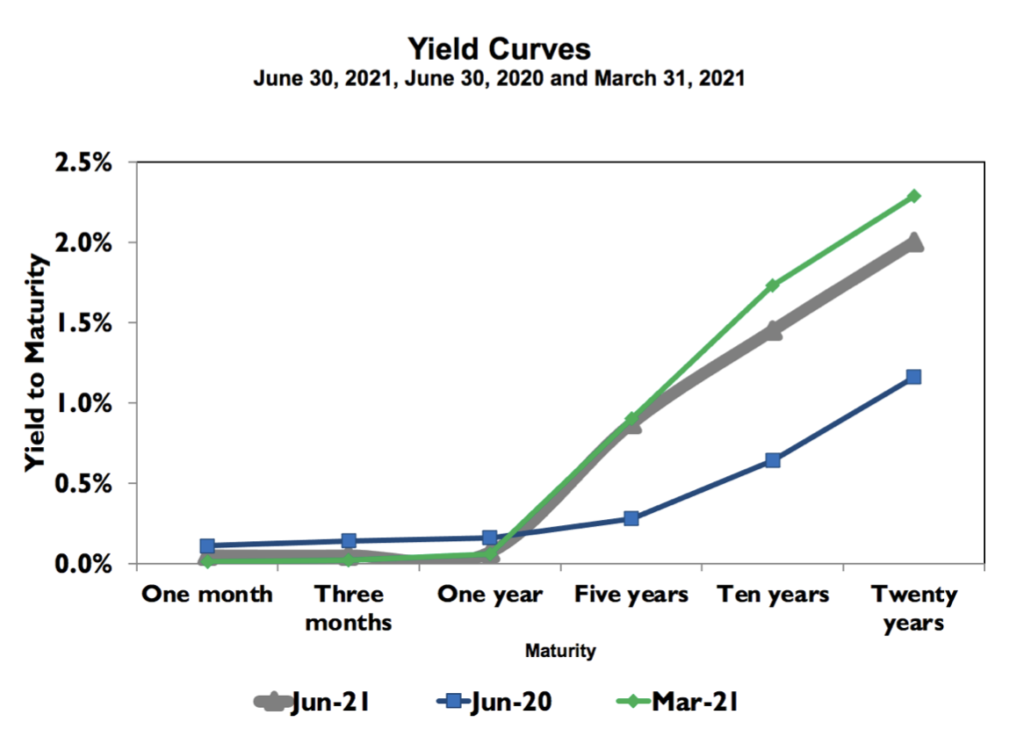

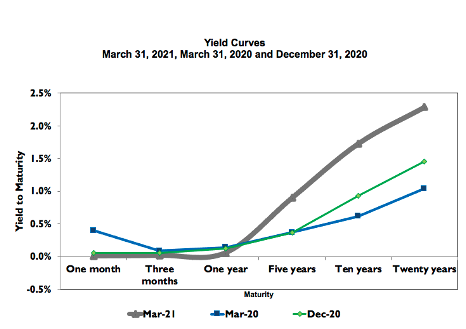

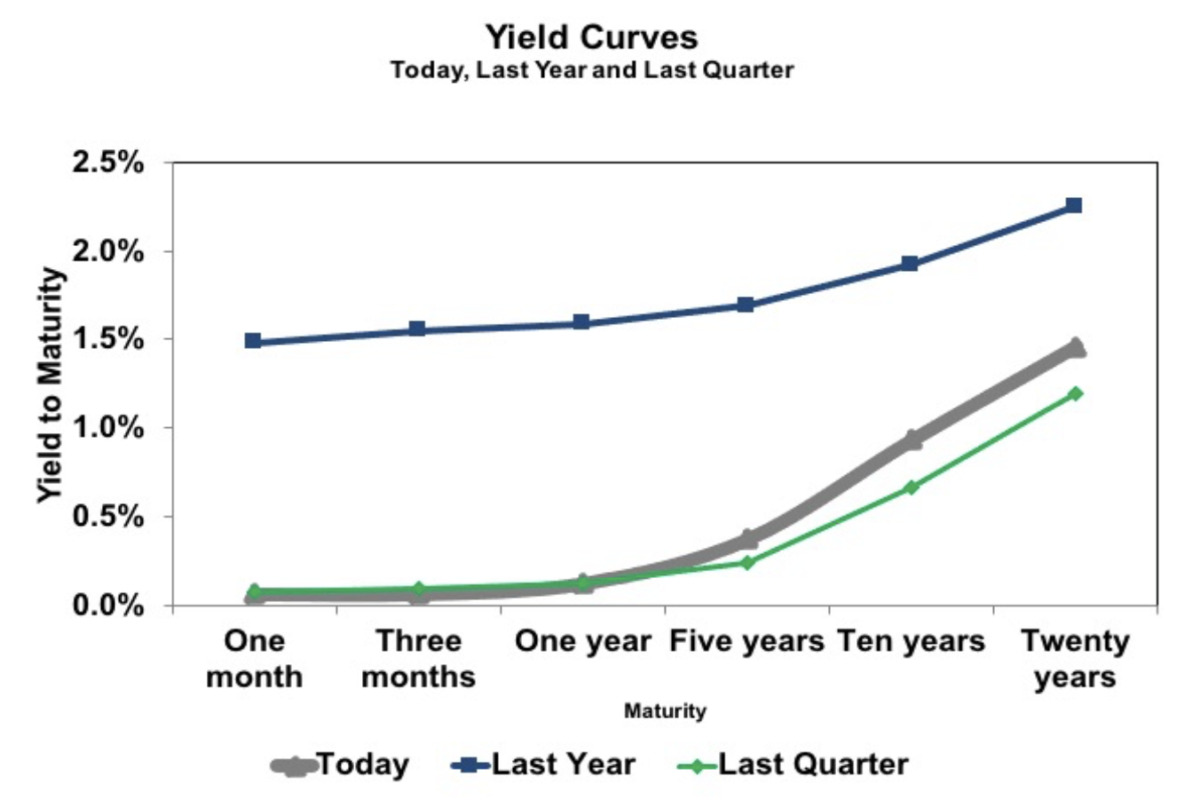

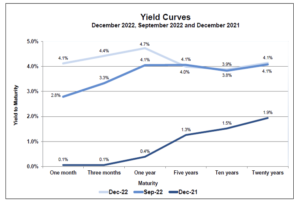

The rising interest rates in 2022 are seen in changing Yield Curves. (Yield Curves show the pattern of returns for holding various Treasury securities to maturity. Generally short-term yields respond to monetary policy; longer-term yields reflect market expectation for future interest rates.) The upward push in yields moved bond prices and returns lower – an index of long-term bonds was down over 14% in 2022. The December 2022 curve showing an upward slope for shorter intervals, then falling off is especially noteworthy. The short run pattern is consistent with the Fed’s continued tightening. The downward slope beyond a year projects interest rates to fall. Often this shape is explained by an anticipated need for an accommodative monetary policy down the road to spur economic growth in a recessionary environment. A more optimistic reason might be an expected reduction in inflation. We’ll see.

Stocks

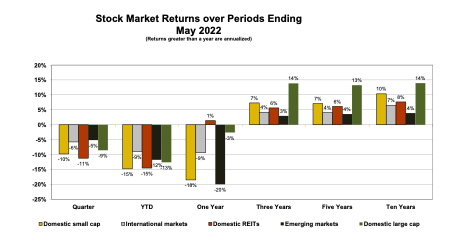

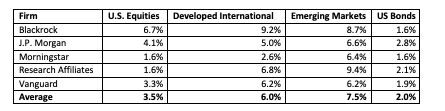

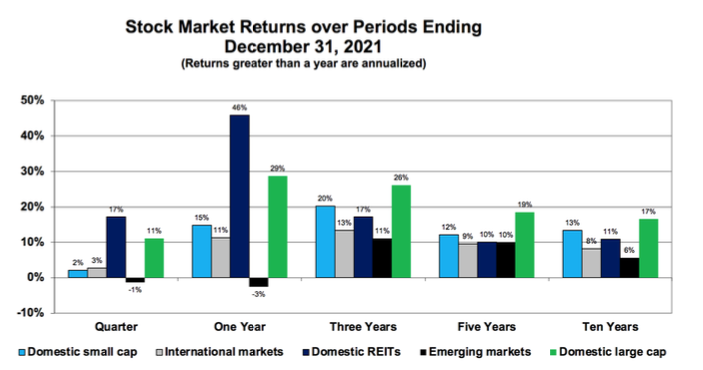

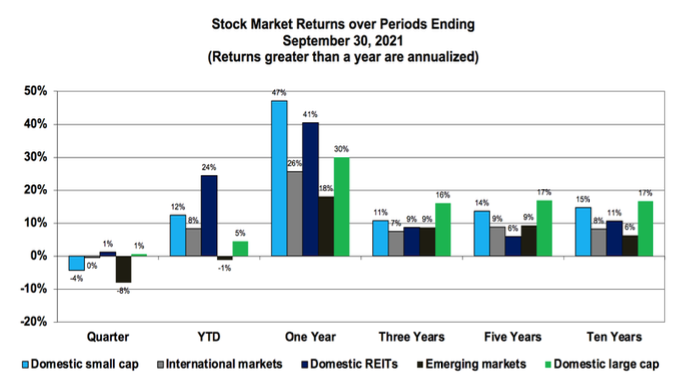

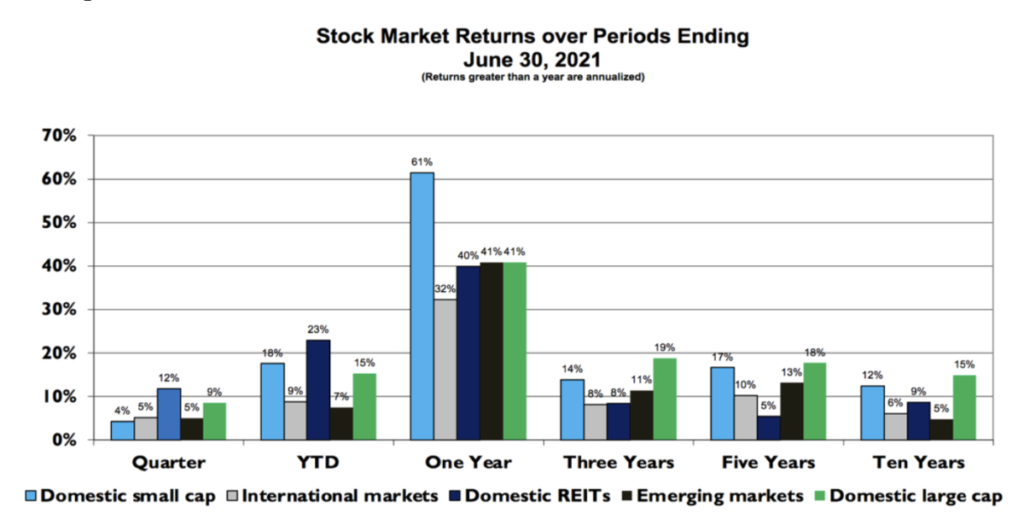

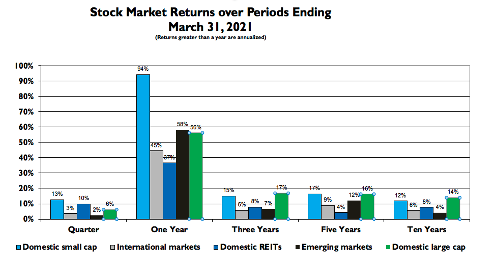

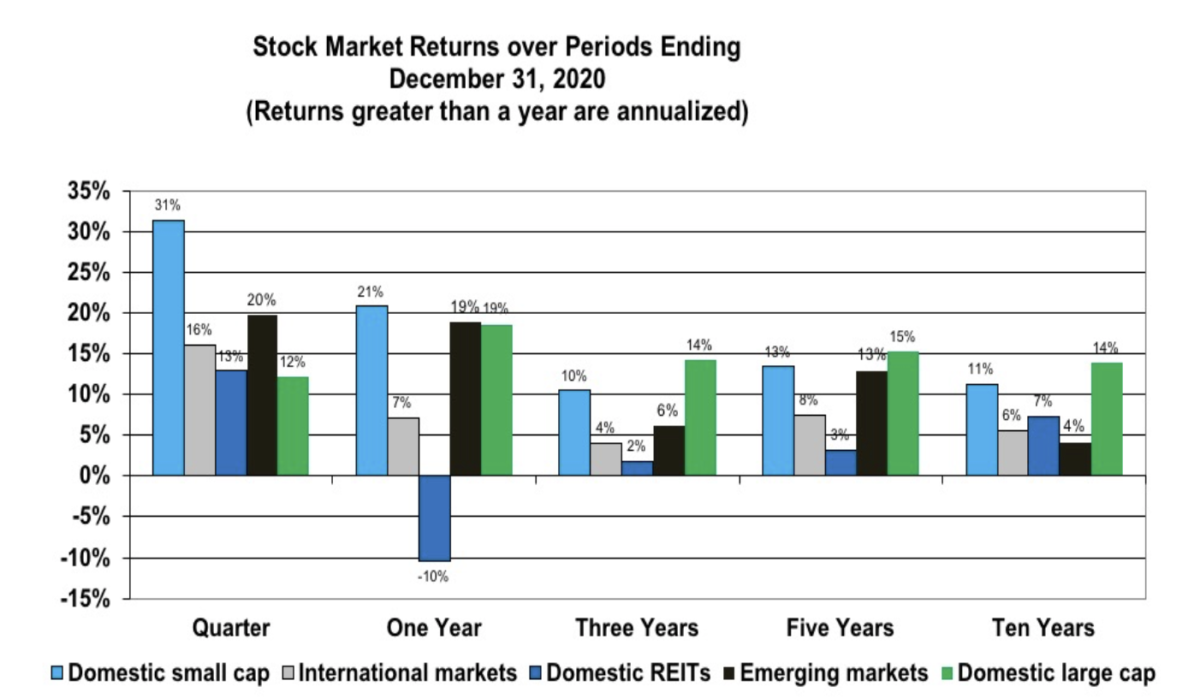

Although the recent quarter was positive, 2022 was a down year for stocks, reflecting emerging inflation, increasing economic uncertainty and rising interest rates. A globally diversified stock portfolio finished the year down 18% – a sharp and unsettling change from recent market trajectories.

Stock price reflects the present value of expected future cash flows – as interest rates increase present values (prices) fall. The farther away are the cash flows, the greater the impact of interest rate changes on prices. Consequently, growth stocks lagged value stocks in 2022. Domestic tech stocks were especially hard hit – an equally weighted portfolio of Apple, Microsoft, Amazon, Google and Meta (Facebook) was down nearly 40%.

Inflation and the Fed’s response produced surprises and market volatility in 2022. No doubt we are in store for surprises going forward, some may even be positive.

Cryptocurrency

The Cryptocurrency phenomenon seems to be unwinding. Bitcoin, the most popular of the lot, fell by almost 70%. The Cryptocurrency exchange, FTX, blew up. While it appears the cause of FTX is simple fraud, greed and embezzlement, it prompted a discussion of the Cryptocurrency technology and its expected role going forward. There are two technologies involved – Cryptocurrency as money and “blockchain” to keep track of transactions. It is hard to imagine Bitcoin, or any other Cryptocurrency as money. After 14 years, Bitcoin is nowhere near a meaningful medium of exchange. Its volatility precludes Cryptocurrency as a store of value or unit of account. Blockchain technology was developed to keep track of Cryptocurrency transactions and holdings. While blockchain technology may eventually prove to be useful in certain roles, keeping track of Cryptocurrencies will not be one.