Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

April 15, 2021

Investment Committee

Stock Markets

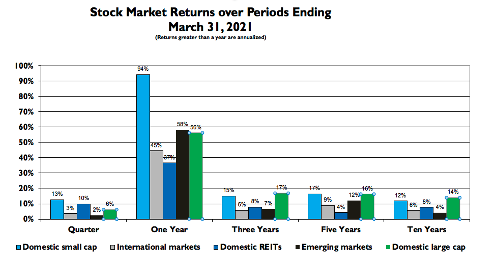

Stocks continued to climb in the first quarter and these results are signaling a robust economy ahead. Markets have made a dramatic rebound since the sharp fall in the first quarter last year. Look at the returns over the past twelve months in the chart to the right. Also note that stocks traded in domestic markets have outperformed in all periods. However, avoid extrapolating past results over long periods into the future.

Recent periods demonstrate the importance of diversification, which is the only “free lunch” in investing; it can increase expected returns without increased risk. To realize these benefits it is necessary to buy low and sell high; and while this sounds easy, it is not.

Monitoring a diversified portfolio must also be done with care. The usual process is to compare results against popular indices. Yet, a diversified portfolio will always behave differently from these benchmarks. Making good long-term decisions means understanding variances, not just measuring them. The slight variations among the portfolio’s allocations versus that of a benchmark is apt to have a profound impact – comparisons must be done with care.

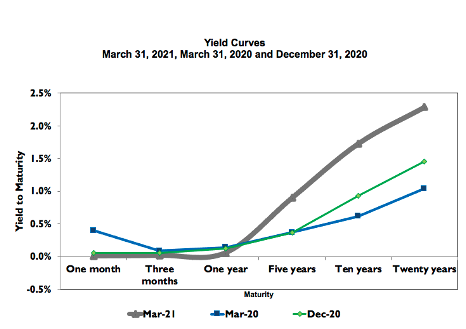

Bond yields at the longer end were up in the first quarter – the bellwether 10-year Treasury yield was up 0.8% this period. Short-term yields stayed at zero reflecting the Fed commitment to keep interest rates low. Bond returns are inversely related to changes in yield, which meant returns of about zero on short-term bonds – an index of long-term Treasury bonds was down almost 6% this quarter.

Bond Markets

The Yield Curve shows the pattern of yields to maturity of U.S. Treasury securities over several maturities can be thought of as a series of expected future short-term interest rates through time. The difference between the one-year yield and 10-year yield on Treasury securities is about 1.75% today. While the absolute levels of bond yields are low, this difference is large by historical standards and may be signaling higher rates ahead.

The Fed has been fighting the pandemic-induced recession by doing the best it can to keep interest rates low. Even though the Fed has announced it will maintain this strategy over the next few years, a more robust economy will provide cover for a rise in interest rates.

Based on the steepness of today’s Yield Curve, a robust recovery and extraordinary government spending, “up” is the most likely answer to the question: Where are interest rates going? We will see.

Inflation

Inflation is beginning to be a concern. The $1.9 Trillion stimulus package plus talk of a $2 Trillion Infrastructure package all on top of a $3.1 Trillion deficit is unprecedented and brings uncertainty. The inflationary impact of spending to lessen the pain of a 100-year pandemic if managed well can be temporary. However, stimulus spending in a sharply growing economy, which many expect, can produce a sustained upward pressure on prices. Although there is no sign of anything that looks like inflation yet, from a historical perspective the ingredients are there.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.