Does it seem like there’s been an extra level of uncertainty lately, threatening your investment plans? Of course, there are always big events going on; that’s the world for you. But today’s brew of geopolitical threats, inflation trends, rising interest rates, recessionary fears, and lingering COVID concerns may feel especially daunting. The market’s volatile reactions to it all may have left you wondering whether, this time, seemingly heightened risks call for a higher-alert approach to your investment selections.

If you’re seeking clarity, the daily spew of financial commentary won’t help. To cut past the clutter, let’s revisit our investment selection process. Reviewing the steps involved speaks to the importance of looking past today’s unsettling news in pursuit of your greater goals.

Step One: Eliminate the Ineligible

Chocolate or vanilla? Back in the 1970s, when Vanguard’s John “Jack” Bogle introduced the first retail index fund, there were similarly limited choices available to satisfy an investor’s tastes. For better and worse, the volume and variety of investment flavors has certainly changed over the years, with a glut of product providers adding to an ever-growing menu of selections.

Fortunately, out of the universe of investment products, we can promptly eliminate most of them. No, it’s not about how they’ve been performing lately. Instead, we weed out the speculative, or traditional active product providers who are playing an entirely different game from the one we have in mind.

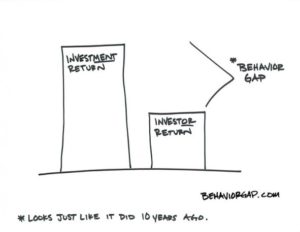

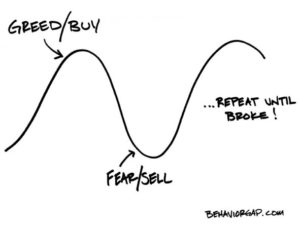

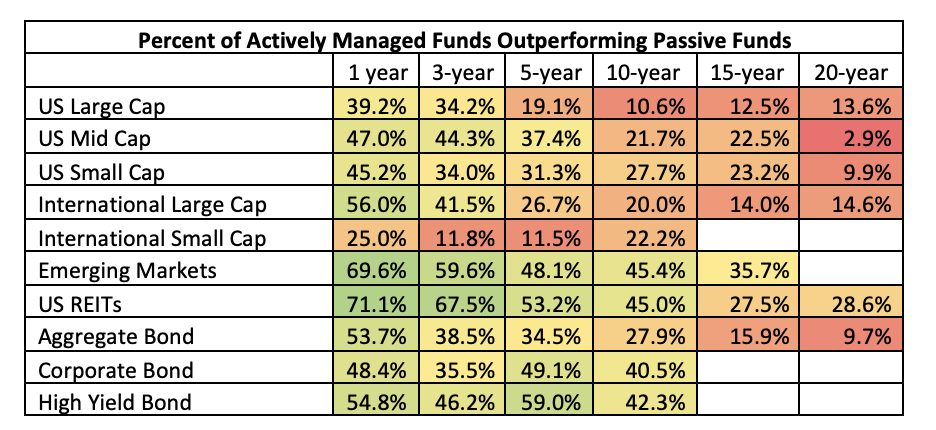

Speculative, or active investors try to predict what’s going to happen next in markets or to individual securities, and place clever trades ahead of the curve. Be they individual traders or well-heeled analysts, the competition is so fierce and price-setting is so instantaneous, their efforts aren’t expected to add persistent value, especially after costs. They may work hard to decipher financial conditions and economic indicators. They may even be correct. But that “curve” they’re trying to trade ahead of is always blind to the next price-altering news. Over the long run, this makes it nearly impossible to consistently surpass the prices and long-term expected returns already available in highly efficient markets.

Step Two: Identify the Best of the Best

After we eliminate the speculative product providers, we’re left with a much smaller, but still sizeable pool of credible selections. This is a nice “problem” to have. But it means we must narrow the field further by identifying the best of the best. We also must periodically revisit our selections, as new or existing providers offer potential enhancements over time.

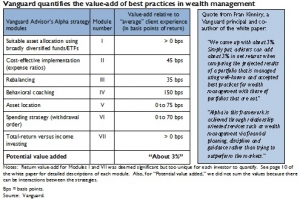

As your advisor, we believe we add considerable value through out upfront and ongoing due diligence. We aim for providers who offer a prudent balance between incorporating important innovations, without creating chaos. This involves identifying the most robust factors, or expected sources of return, and understanding how they interact with one another across various market conditions.

To build toward desirable investment outcomes, we favor fund managers who are:

Evidence-based: They harness the same, growing body of evidence we use to create a more reliable investment experience across the market’s “random walk.”

Persistent: They are deliberate, patient, and thrifty, with an eye toward offering more than just a menu of popular products and short-term “pops.”

Visionary: They’ve been around for a while, with a strong track record for capturing known and newly identified dimensions of expected returns.

Collaborative: They specialize in providing sensible, low-cost building blocks for creating and managing solid investment portfolios to facilitate investors’ greater financial goals.

Step Three: Inspect the Product Packaging

Beyond the investments themselves, there are the “containers” in which investment opportunities are delivered. These days, there’s nearly no end to the shiny packaging in which product providers can wrap their offerings. There are traditional mutual funds and ETFs. There are hedge funds, target-date funds, annuities, separately managed and/or direct indexing accounts, private partnerships, robo-advisors, and more. Do-it-yourself investors can also go directly to cryptocurrency exchanges and trading platforms like Robinhood to manage their own money.

Regardless of the wrapper, the initial hurdle remains unchanged: Is the product provider managing your money in an appropriate, evidence-based manner, as described above? After ruling out any speculative action, we also want to review each product’s prospectus or similarly detailed disclosures to avoid packaging that is overly complicated, suspiciously opaque, and/or needlessly expensive. (If there are no details to inspect, that’s a big, red flag in itself.)

Step Four: Incorporate Your “You” Into Your Investments

Who are you, and what is your money about? As our next step, we need to get to know you very well, so we can identify where you are planning to go. Even world-class investments won’t do, if they don’t align with your personal tastes and unique financial circumstances. For example:

Personal Circumstances: There are any number of details that might influence the specific selections we’d recommend for your evidence-based portfolio. How long do you have to invest toward your various goals? What are your cash flow wants and needs? Are you a business owner? What are your legacy plans? These and other fundamentals can influence not only how we structure your investment accounts, but which specific holdings to tilt toward or away from.

Risk Tolerances: Are you comfortable taking big risks in pursuit of greater rewards? Maybe you even thrive on the bleeding edge of the latest investment innovations—such as potential new investment factors, alternative markets beyond stocks and bonds, cryptocurrency, and other blockchain-related investment vehicles. Conversely, you may prefer only the most tried-and-true solutions, with decades of dependable performance data on record. Your portfolio can be tailored in either direction, while maintaining an evidence-based approach either way.

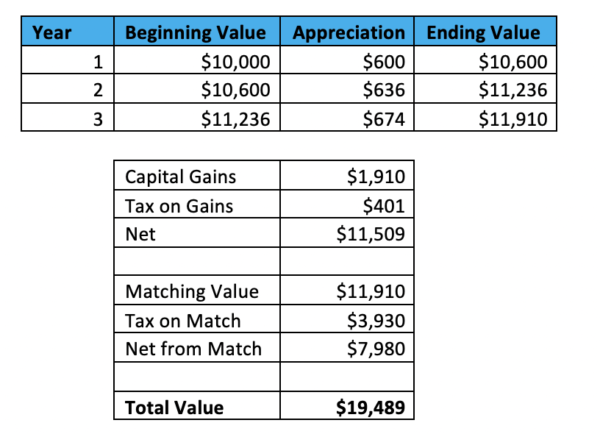

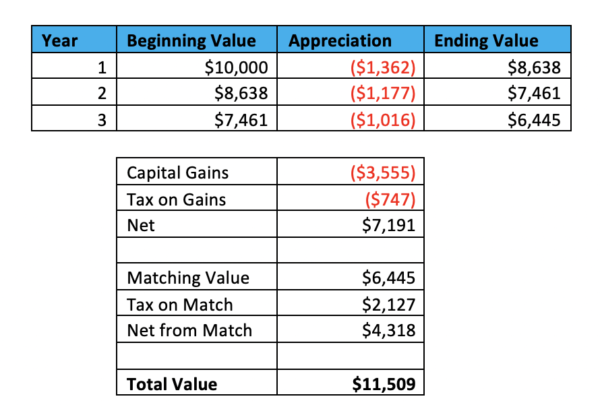

Taxable Tradeoffs for Existing Wealth: Most investors arrive with existing investments—good, bad, and ugly. In pursuit of perfection, we must carefully account for the costs of transitioning toward a more cohesive portfolio. This includes accounting for the “space” in your existing, tax-sheltered accounts, as well as the tax ramifications of selling less desirable taxable positions. Upfront and ongoing, we perform cost/benefit analyses to identify when our preferred investment selections should be in your best interest, and when tradeoffs may have to do.

Ideal Application for Your Income Streams: Different selections also may make more or less sense for assets you’re adding to your investment portfolio. For example, even if your company retirement plan doesn’t offer ideal selections, it may still be among your best, most tax-wise investment vehicles—especially if your employer is matching your contributions. After all, free money is hard to beat. For the income you’re directing to your retirement plan, we’ll make appropriate recommendations based on what’s available in the plan.

Sustainable Investing: Do you want to incorporate an “ESG” (Environmental, Social, Governance) or similar values-based element in your investing? The right solutions for you depend on where your priorities fall.

Step Five: Manage the Modifications

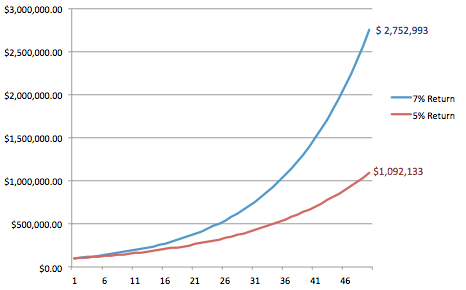

You may have noticed, the world never stops spinning. The same can be said for evidence-based investing. Even an evidence-based portfolio is expected to evolve over time.

For example, Harry Markowitz and William Sharpe introduced Modern Portfolio Theory in the 1950s, and Capital Asset Pricing Model in the 1970s, respectively. Their insights set the stage for moving from individual stock speculation to diversified portfolio construction. In the 1990s, the Fama/French three-factor pricing model helped us understand the importance of capturing global returns from multiple sources. Since then, we’ve explored ways to incorporate other, potentially persistent factors—such as profitability, investment, and momentum. Most recently, we’ve also started applying factor investing in additional markets, such as alternative lending and reinsurance, which may offer discrete sources of expected returns.

In short, new studies can change or add to our existing assumptions, with portfolio construction models evolving accordingly. Benchmarks and indexes improve over time as well, sharpening our ability to track and compare relative performance. Enhanced technologies can eliminate inefficiencies, making it possible to pursue expected sources of return that simply weren’t accessible to us in the past.

Reputable product providers heed such updates—or sometimes develop them themselves—and build them into new or existing solutions. We, in turn, must weigh the advantages and disadvantages of incorporating them into your portfolio.

Even if a new and improved fund hits the market, what are the tax ramifications of your investing in it? Even if it is a solid solution, does it fit into your greater financial goals? How can investment management (such as adding new assets or rebalancing your portfolio back to plan) help us incorporate the latest, greatest opportunities, without incurring excessive costs? These are a few of the many questions that factor into your optimal investment selections.

Fund Selection Built to Last

So, how do we choose the funds we use? The answer depends on how to best extract the most dependable returns out of highly efficient markets. It depends on heeding practical improvements as they arise. It depends on determining how these forces are expected to impact you, and your one and only investment experience.

One thing fund selection should not depend on is reacting to the daily news. The world’s financial, economic, and geopolitical events do influence your returns. But just as the weather is one thing and climate is another, our focus remains on harvesting seasons of bounties, while standing firm against the inclement days that come and go. We favor investment product providers who do the same, and build their evidence-based solutions accordingly.

How else can we help you invest toward the personal financial goals that will add the most meaning to your life? Let us know!

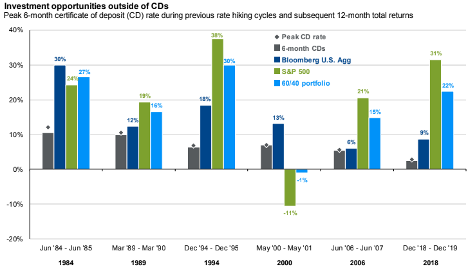

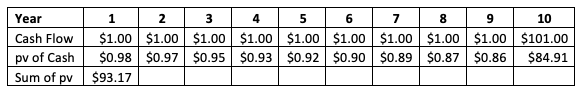

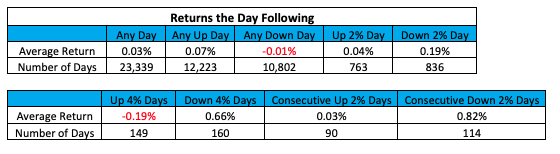

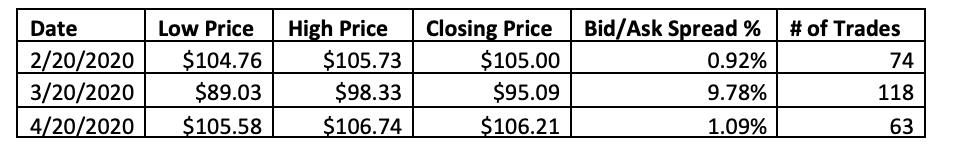

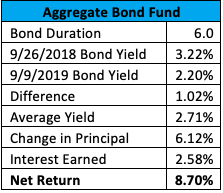

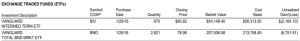

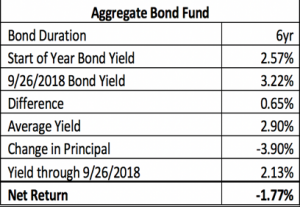

In February and April, trading volume was average, and spreads were reasonable. But March! As views of the world diverge, profits explode. There are desperate sellers who only know they want out and are willing to sell at $89/share, a 15% discount from recent levels. Meanwhile, buyers view $98 as an easy way to get a safe, investment-grade bond maturing in three years, at a 7% discount. The colossal difference between $89 and $98 is profit for the banks – Wall Street loves volatility.

In February and April, trading volume was average, and spreads were reasonable. But March! As views of the world diverge, profits explode. There are desperate sellers who only know they want out and are willing to sell at $89/share, a 15% discount from recent levels. Meanwhile, buyers view $98 as an easy way to get a safe, investment-grade bond maturing in three years, at a 7% discount. The colossal difference between $89 and $98 is profit for the banks – Wall Street loves volatility.

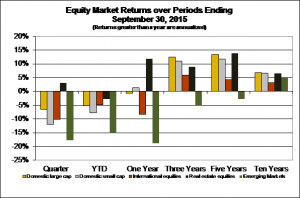

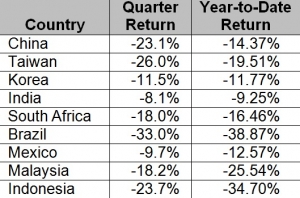

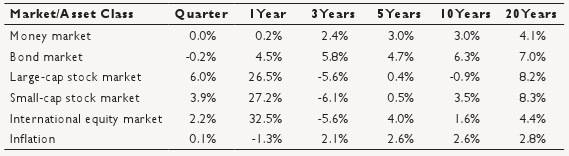

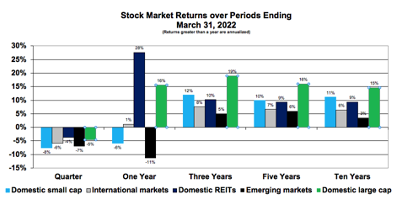

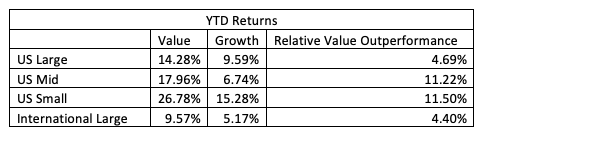

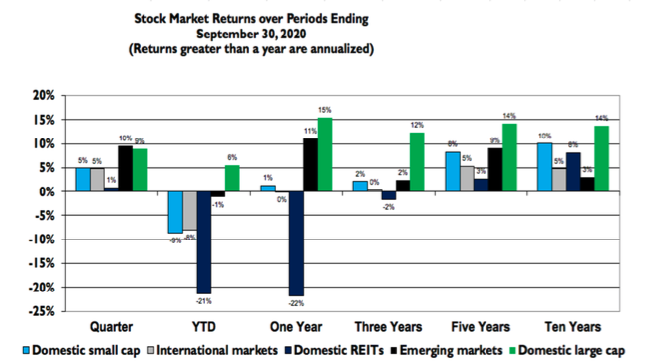

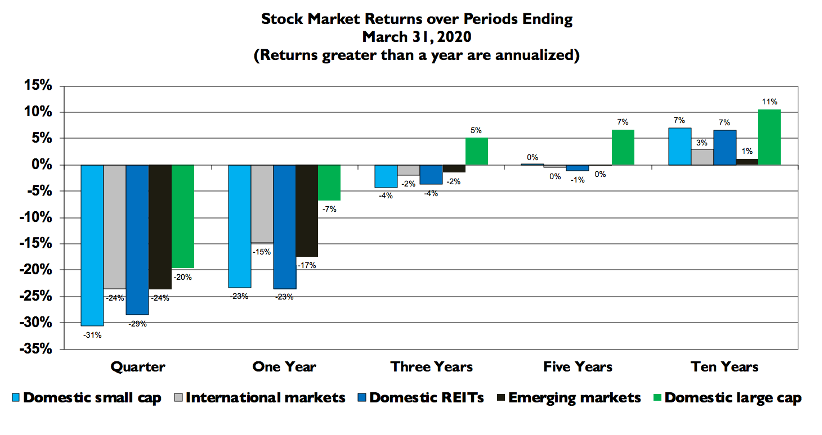

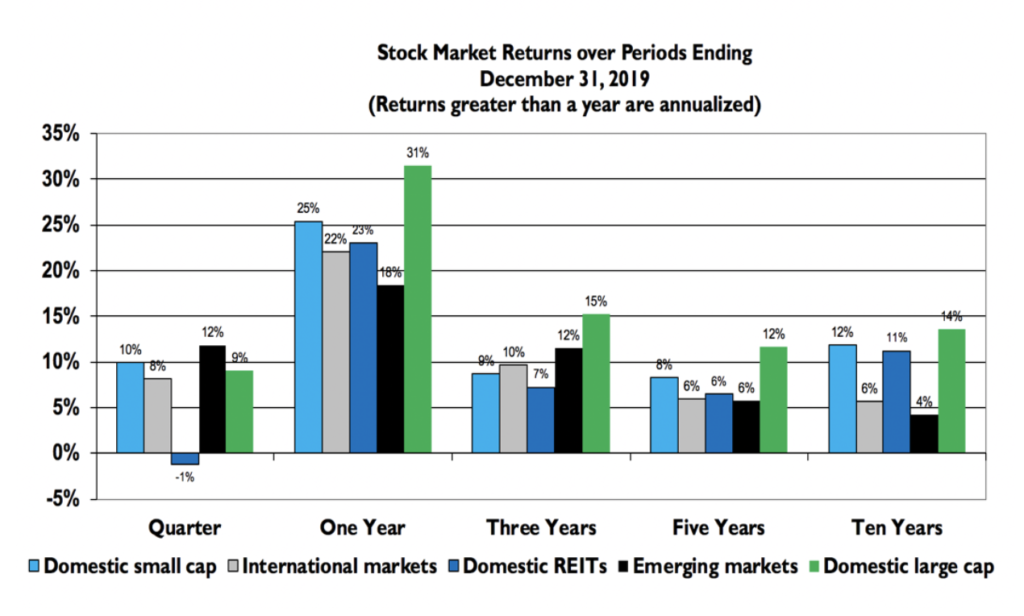

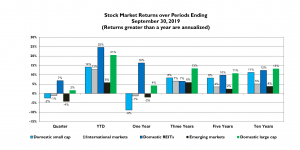

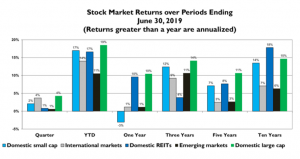

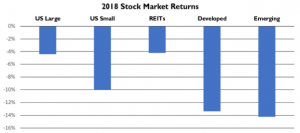

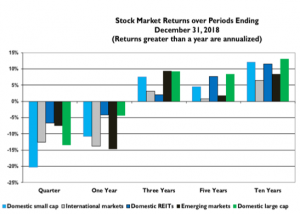

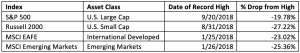

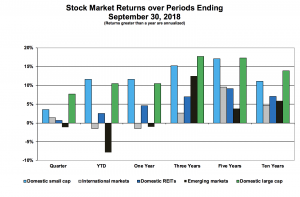

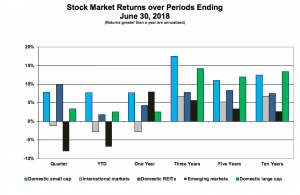

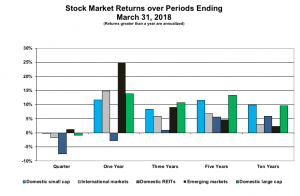

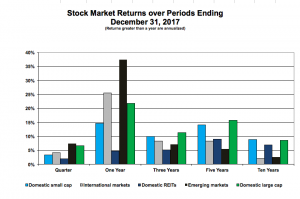

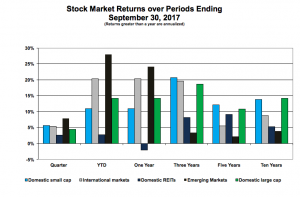

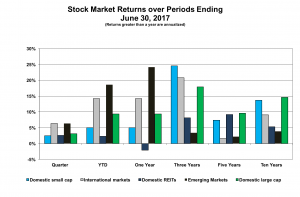

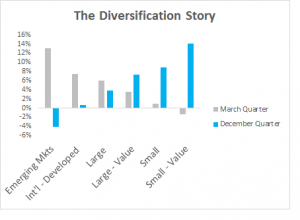

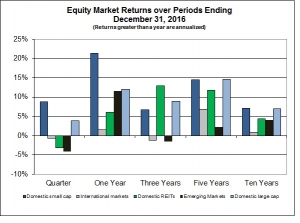

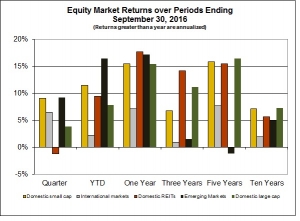

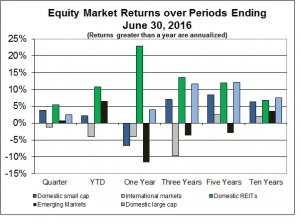

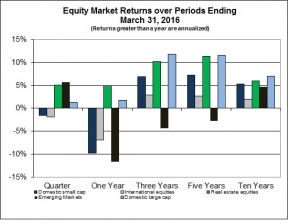

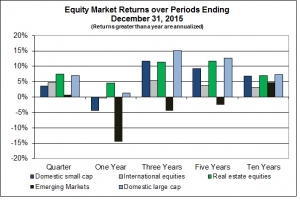

markets and emerging markets stand out as below average. While we have had to deal with an extended down period in these markets, it is not indicative of what the future holds.

markets and emerging markets stand out as below average. While we have had to deal with an extended down period in these markets, it is not indicative of what the future holds.

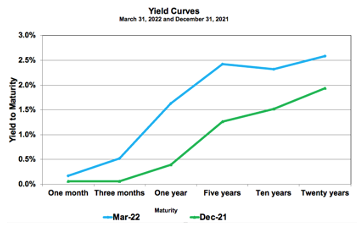

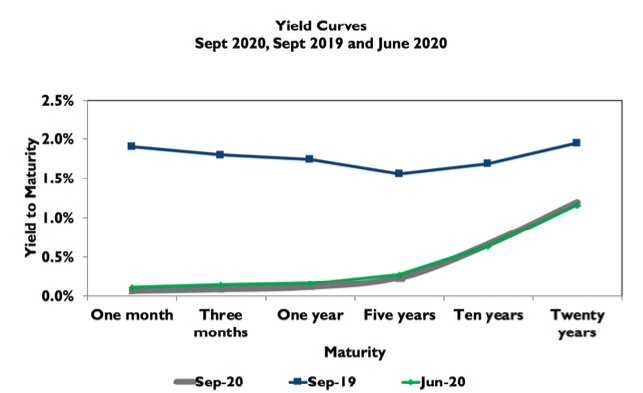

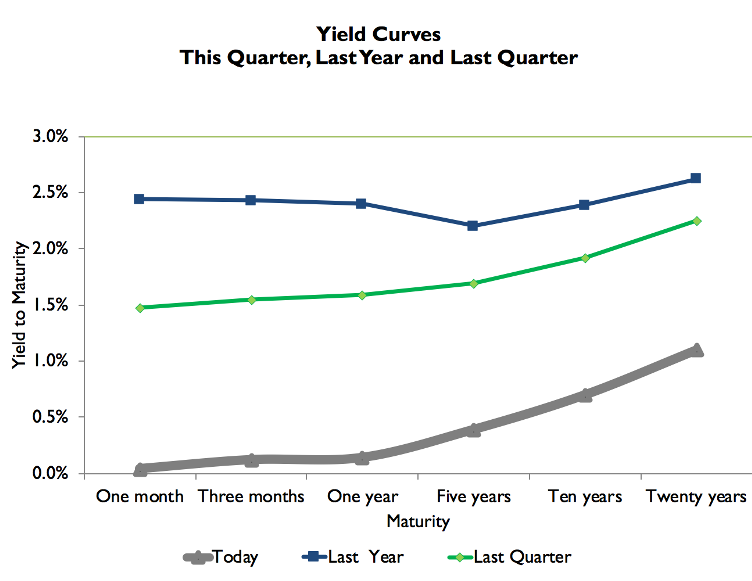

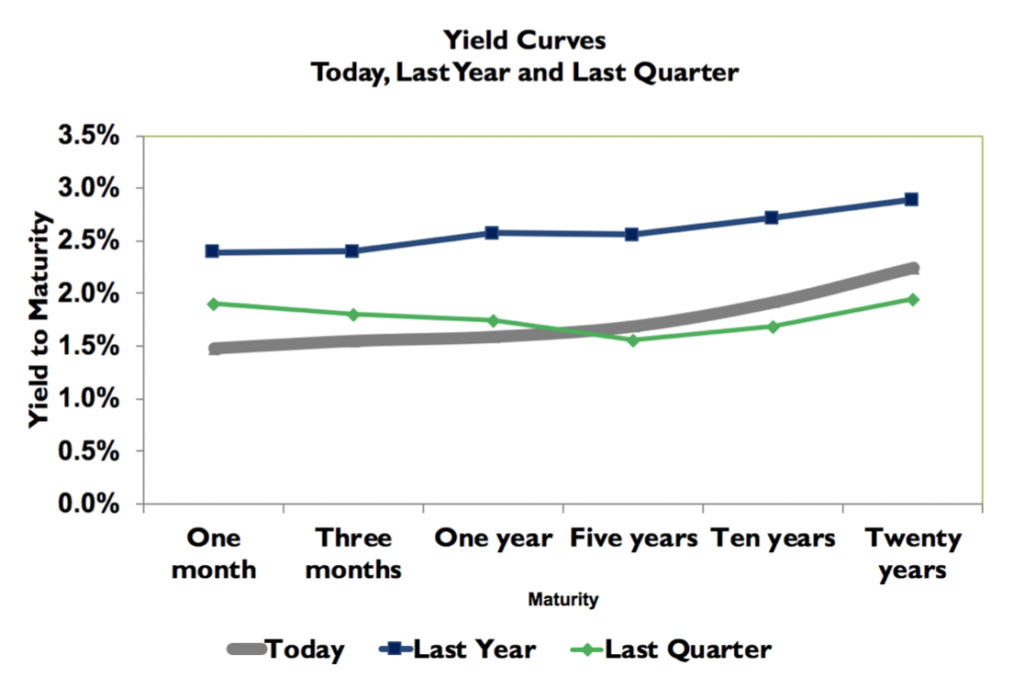

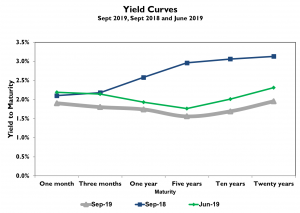

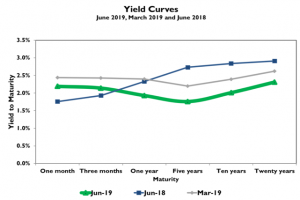

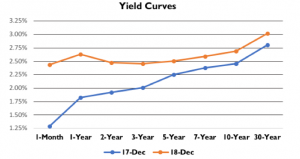

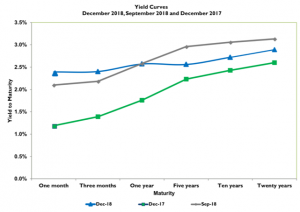

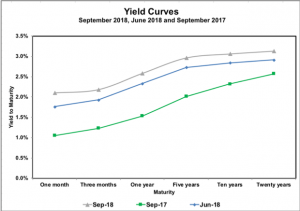

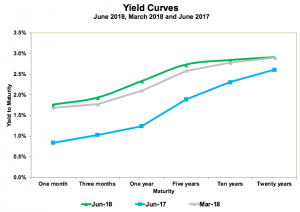

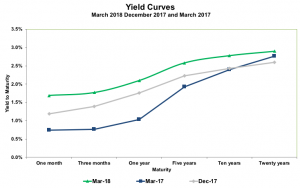

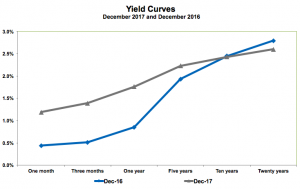

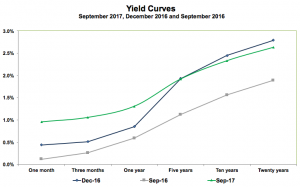

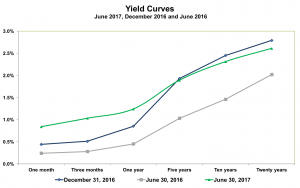

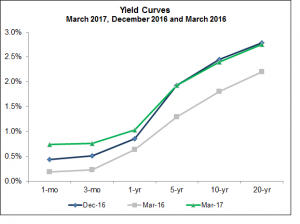

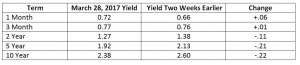

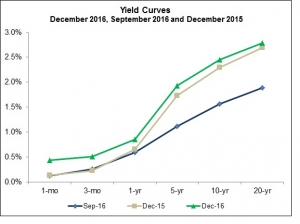

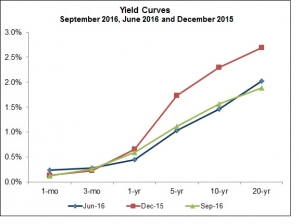

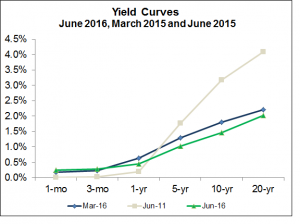

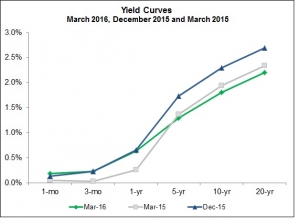

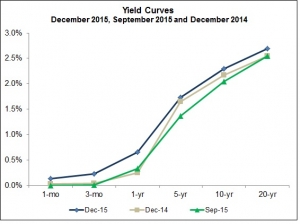

of different maturities, depicts increases at the short end with slight increases at longer maturities. Yet, not much of a change overall.

of different maturities, depicts increases at the short end with slight increases at longer maturities. Yet, not much of a change overall.