Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

January 21, 2022

Investment Committee

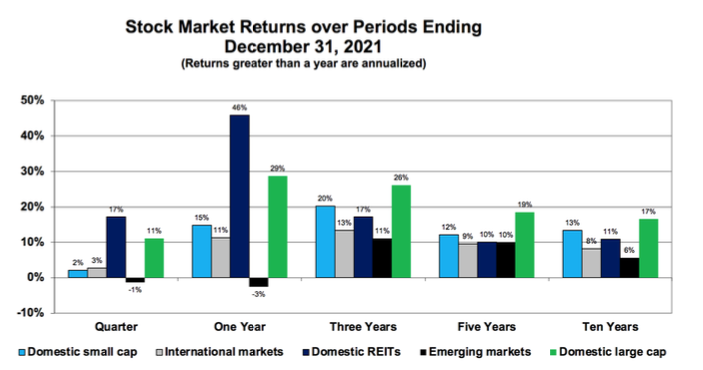

2021 was a good year for domestic stocks, with large-cap stocks (S&P500) up 29%. Returns in this market segment continue to be driven by the largest tech stocks, which had been the case for the last ten years. Results in other markets are mixed.REITs produced extraordinary returns bouncing back from last year’s sharp fall-off. Emerging markets, on the other hand, were down, primarily reflecting a slow down in China. A longer view, which includes the Coronavirus pandemic, shows that stock markets have rewarded investors. This consistent performance among most asset classes demonstrates that the best way to deal with short-term volatility is to remain committed and diversified across all market segments.

Inflation reared its ugly head in 2021. The Consumer Price Index (CPI) grew 6.6%, well above predictions and long-term averages. Supply chain bottlenecks and government stimulus payments are among the key factors blamed for the increased inflation.

Bond Markets

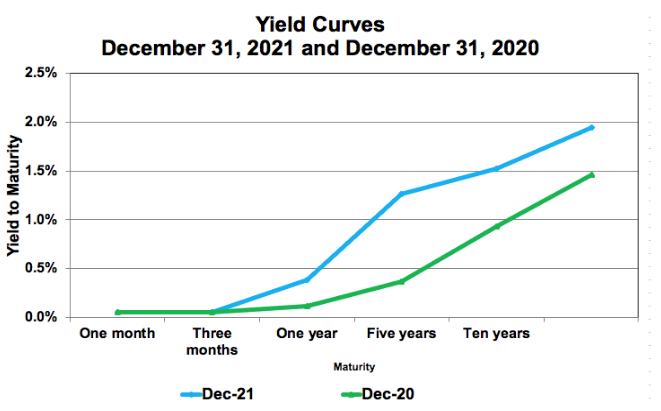

A Yield Curve shows the pattern of observed yields from holding bonds to term across several maturities. The graph at right shows today’s yields from essentially zero to 2% across a twenty-year maturity spectrum. Yields at these levels are consistent with the Fed’s commitment to keeping interest rates low.

Returns to bond investors in 2021 were negative, explained by the upward shift in the Yield Curve over the past year. The longer the maturity, the greater a given shift has on returns, which is the primary reason short-term bond returns were down a little less than 1% while longer-term returns are down between 2% and 3%. Note the “kink” in the curve at around five years. To resume its more normal shape either yields in the five-year range must come down (driving returns up) or yields on longer maturities must increase (pushing returns down).

The Year Ahead

Uncertainties in the year ahead include current stock valuations, inflation, and Fed activities. While there are plenty of forecasts in the popular press of what’s ahead, expectations for how these issues will affect markets are baked into today’s prices reflecting the best guesses of both buyers and sellers.

The S&P 500, which many view as the “Stock Market” (it is not) has had a great run. Historical pricing models and the idea of regression to the mean signal caution for the S&P 500. However, historical models can become obsolete and moving back to long-term averages can take a while confirming the futility of short-term predictions. Recent returns in other markets are closer to long-term averages, which, absent surprises, provide a reasonable expectation for 2022. One safe prediction is for continued volatility.

Inflation presents another uncertainty for 2022. Its effects will depend primarily on whether it’s “transitory” or not. Will the resolution of the current supply chain problems settle inflation? Or is inflation embedded in today’s economy due to excess cash from stimulus payments chasing too few goods coupled with an accommodative monetary policy? Perhaps inflation is more directly tied to a cost/push from labor market disruptions? Yet, markets seem to be signaling inflation at more typical long-term averages as today’s difference between nominal yields and yields on comparable inflation protected securities (TIPs) is a little more than 2%.

The Fed’s accommodative monetary policy over the past few years in response to the 2008 financial crisis and the Covid 19 Pandemic may have produced a moral hazard altering stock market risks but has also resulted in a massive amount of Treasury securities on the Fed’s balance sheet. The Fed is continuing to purchase Treasury securities, although at a reduced pace. There’s little history to help predict how these distortions will be resolved and the impact they will have on markets in 2022. This is uncharted territory, which is apt to produce surprises in 2022 and beyond.

The issues of stock market valuation, inflation and Fed policy are well-known. Their expected impact in 2022 is reflected in today’s prices – betting against these market signals usually does not produce good outcomes. Only time will tell.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.