A Commitment To Our Investment Philosophy And Your Goals

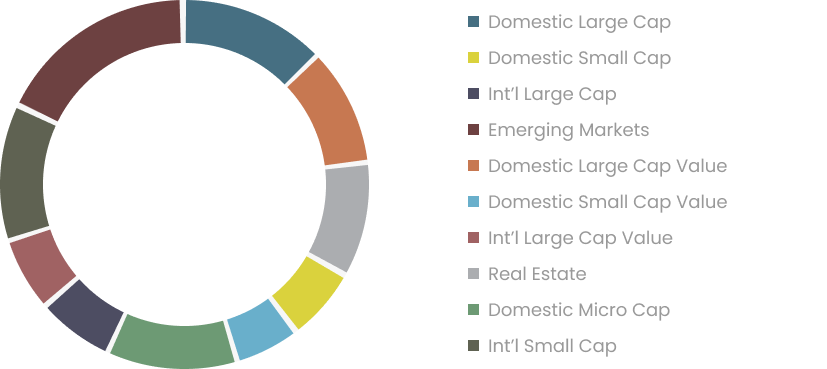

Asset Allocation

We believe that our primary role as an investment advisor is to connect your goals to a portfolio that has the best probability of achieving them at a level of risk that you can tolerate.

Asset allocation, then, becomes the most important decision. Because studies show that asset allocation is the primary factor in determining the portfolio’s results over time, we work closely with your organization to determine your goals and risk tolerance. Since risk and return are two sides of the same coin, we can approach the conversation from either perspective. Our conversation can focus on your goals and result in the amount of risk you must be willing to take to achieve them; or, we can focus on the risk you’re comfortable taking and explaining the returns that level of risk implies.

Either way, our job is to provide a portfolio asset allocation that has the greatest likelihood of matching your stated goals. Then we manage that portfolio to always be consistent with those instructions.

Investment Policy Statement

All of these elements of discussion, responsibility, expectation, and instructions should be enshrined in a robust, detailed investment policy statement. We take a very active role in helping draft a document that will reflect both your objectives and what we will do to help you achieve them.

Investment Committee Meetings

We are always available to meet with you to discuss your goals, portfolio, and progress. Whether in person, via conference call, or video link, these conversations allow us to learn more about your organization, challenges, goals, and strategy. We can even share some perspectives from our decades of experience in serving other institutions.

Expenses Matter

Small differences in fees can compound over time and limit your ability to fund programs. We understand that every dollar you retain is potential spending on a program that makes our community a better place to live. Our below-average fees recognize that success in your mission is a significant component in our total compensation.

Commitment

We are specifically designed to help you fulfill your responsibilities. Our commitments are central tenets of our purpose: first, to a disciplined and proven investment philosophy; and second, to aiding your responsible stewardship of the resources that have been entrusted to you.

Disciplined.

Since 1991, we’ve been consistent in the application of an investment philosophy based in Nobel Prize-winning research on capital markets.

Proven.

Decades of real-world market results and academic studies reinforce the value of an efficient-markets based philosophy.

Responsible.

The combination of a clear and transparent philosophy with a process of careful consideration of risk means that our focused approach provides the highest fulfillment of a Board’s fiduciary obligation to its assets.