Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

June 1, 2022

Investment Committee

Stock Markets

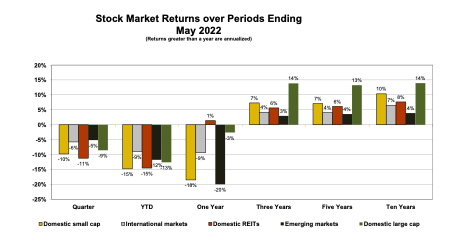

Although rebounding lately, all markets are down year to date. Since December stock markets are off more than 10%. Tech stocks are especially hard hit – an equally weighted portfolio of the largest domestic tech stocks (Apple, Microsoft, Amazon, Google, and Facebook) is off 25%. The premium to value markets, domestic and international, reemerged with year-to-date premiums of 9%.

These results are consistent with a murky future as markets seek to sort out the impact of the ongoing War in Ukraine and the Fed’s ability to thread the needle of tamping down inflation without triggering a recession. While stock prices are established by traders expecting positive results, there is no doubt prices will be volatile throughout this process. Going forward there will be plenty of surprises impacting stock prices one way then another. Yet, the observed price best reflects the news driving these surprises. Consequently, while difficult, it is especially important to maintain established commitments to ensure expected returns are realized.

Inflation is a concern. Over the past twelve months the Consumer Price Index (CPI) is up 7.5% – levels not seen since the early 1980’s. Whether this spike reflects government stimulus spending, or shortages due to disruptions in global supply chains, or some combination is not clear. The Fed has been increasing interest rates in response. Its success at bringing down inflation without triggering a recession remains uncertain.

Over longer periods, domestic market returns stand out, especially in large cap markets which reflect the extraordinary results of large tech stocks. Ten years is not a long time in markets. While these relative returns are useful to understanding short-term results in diversified portfolios, historical results are not useful for predicting the future. Periods of significant volatility oftentimes brings short-term regrets, which is OK if it doesn’t affect long-term decisions.

Bond Markets

Today’s pattern of bond yields versus those at the beginning of the year shows a marked increase at all maturities. Bond prices and returns move inversely with yield changes. The longer the period to maturity, the greater the move. This year-to-date upward shift helps to explain recent negative bond returns.

Yields are driven by interest rates, risk premiums and expected inflation. These factors shift through time resulting in changing yields and volatile bond market returns. If we isolate the effect of interest rates and risk by looking at nominal versus real Treasury yields of like maturities, then we have a view of expected inflation implied in today’s yields. This analysis produces expected inflation over the next five years of 3.0% and 2.6% over the next ten-years – not only different from what we have been observing, but also closer to the Fed’s objectives.

Uncertainties associated with activities of the Fed include (1) how fast and by how much it will increase interest rates to contain inflation and (2) how it will deal with the massive amount of Government securities on its balance sheet. At its recent meeting the Fed increased interest rates ¼%, announcing several more increases going forward. Its goal is to bring down inflation without triggering a recession. Expectations of the Fed’s success in achieving this goal will be reflected in both stock and bond markets going forward.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.