Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

February 2, 2022

Investment Committee

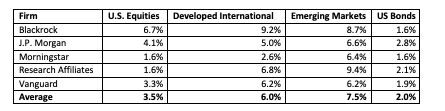

Every year large Wall Street firms publish their forecast of expected returns for the coming decade. The following table shows what each firm expects from capital markets in the coming 10-years.

The first thing that jumps out is the poor expected performance by U.S. equities. Despite averaging nearly 10% over the last 100 years, forecasters have returns in a range from 1.6% to 6.7% which an average of 3.5%.

It’s also worth noting how much better forecasters expect international stocks to perform compared to U.S. stocks. Every forecaster has international stocks outperforming U.S. stocks, the average difference being 2.5% with developed countries and 4% with emerging countries.

It stands to reason international stocks will outperform U.S. stocks by a bit as they are more volatile, but if the difference in returns is as large as these forecasters expect, portfolios heavy in international stocks will have greater risk-adjusted returns.

Expected returns for bonds have much less variability, with their 2% average coming in just above what the aggregate bond market is currently yielding.

These forecasters have been predicting international outperformance for several years now, but U.S. stocks keep stealing the show. Will the experts finally be right, or will domestic stocks continue to be the best? It’s anyone’s guess but these forecasts reinforce the importance of maintaining a globally diversified portfolio, with a meaningful allocation to international stocks.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.