Market Review

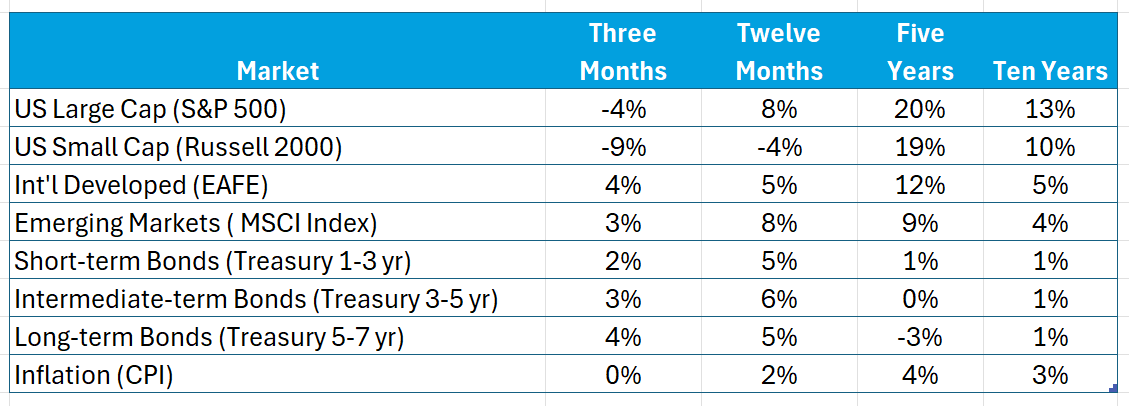

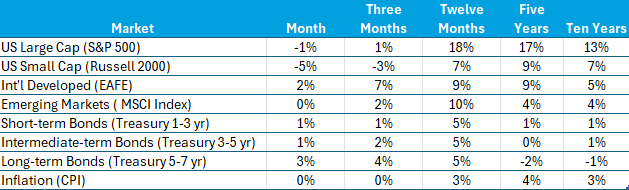

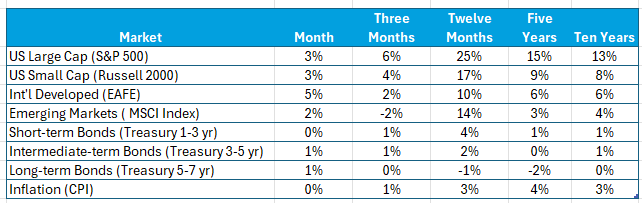

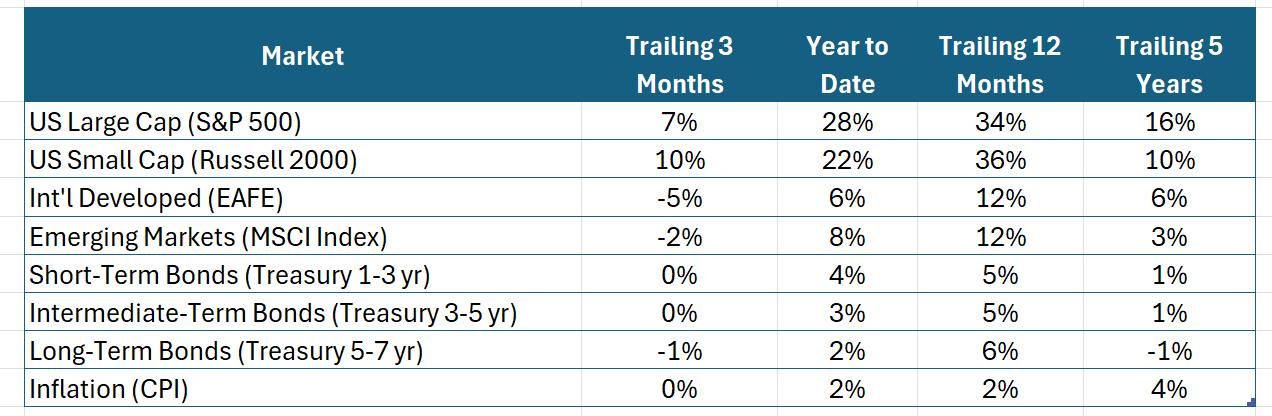

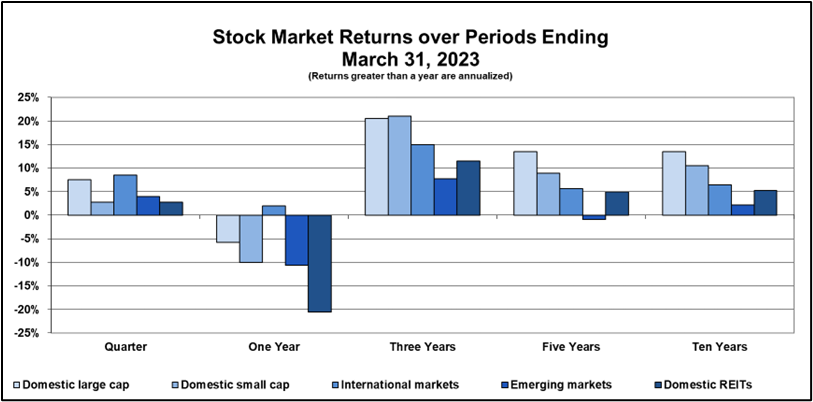

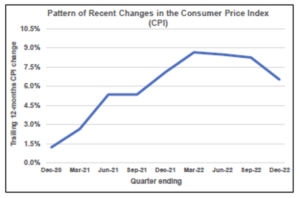

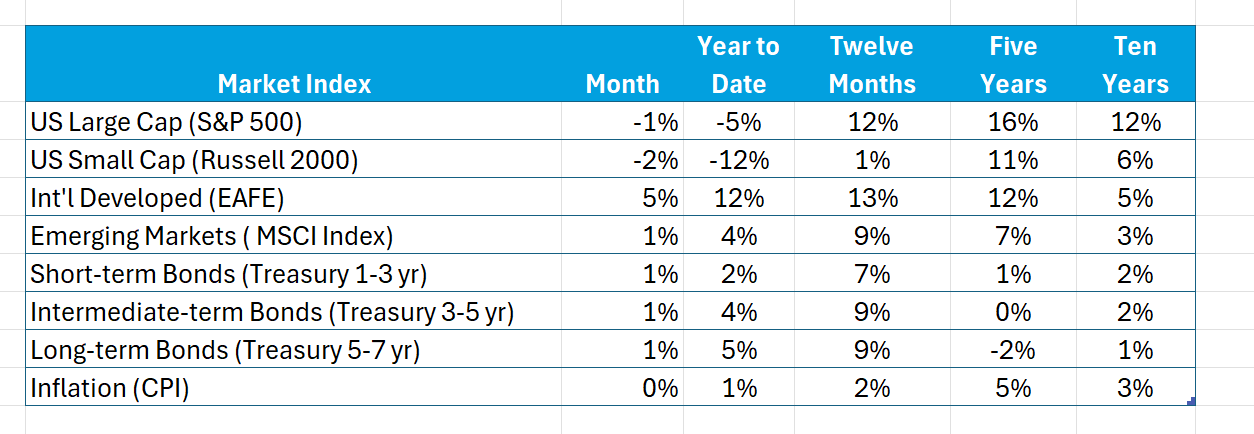

Here are recent returns from several market indices: Note especially the difference in returns among the various indices this past month and year to date. Also, note the generally positive results over longer periods.

Stocks

Domestic stock prices were volatile throughout April. After starting the month down significantly, stocks have bounced back recently to nearly flat for the S&P 500. These ups and downs primarily reflect the whims of tariff implementation.

Year-to-date domestic stock markets were down – Large Cap (S&P 500) off 5% and Small Cap (Russell 2000) down 12%. The S&P 500 results reflect that the Magnificent Stocks continue to give back much of their past extraordinary results. Year-to-date, an equally weighted portfolio of these stocks (Amazon, Apple, Google, Meta, Microsoft, Nvidia and Tesla) shed nearly 13% of their value. On the other hand, stocks traded in International Developed markets (EAFE) earned 12% from the beginning of the year, demonstrating the benefits of commitments to this market.

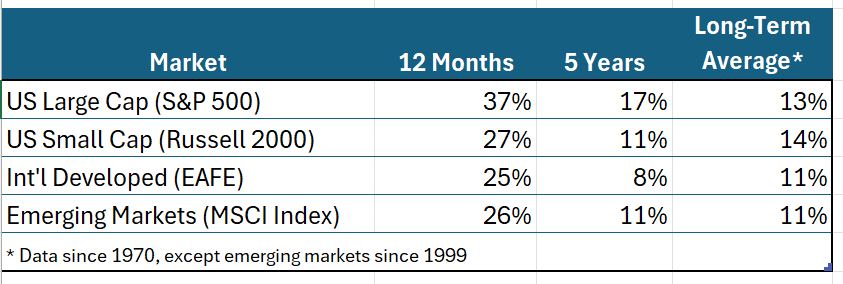

While domestic stock markets have been uncomfortable recently, we can take some consolation in the numbers over longer periods. While not sustainable, the level of five- and ten-year returns in the US Large Cap market stand out.

Bonds

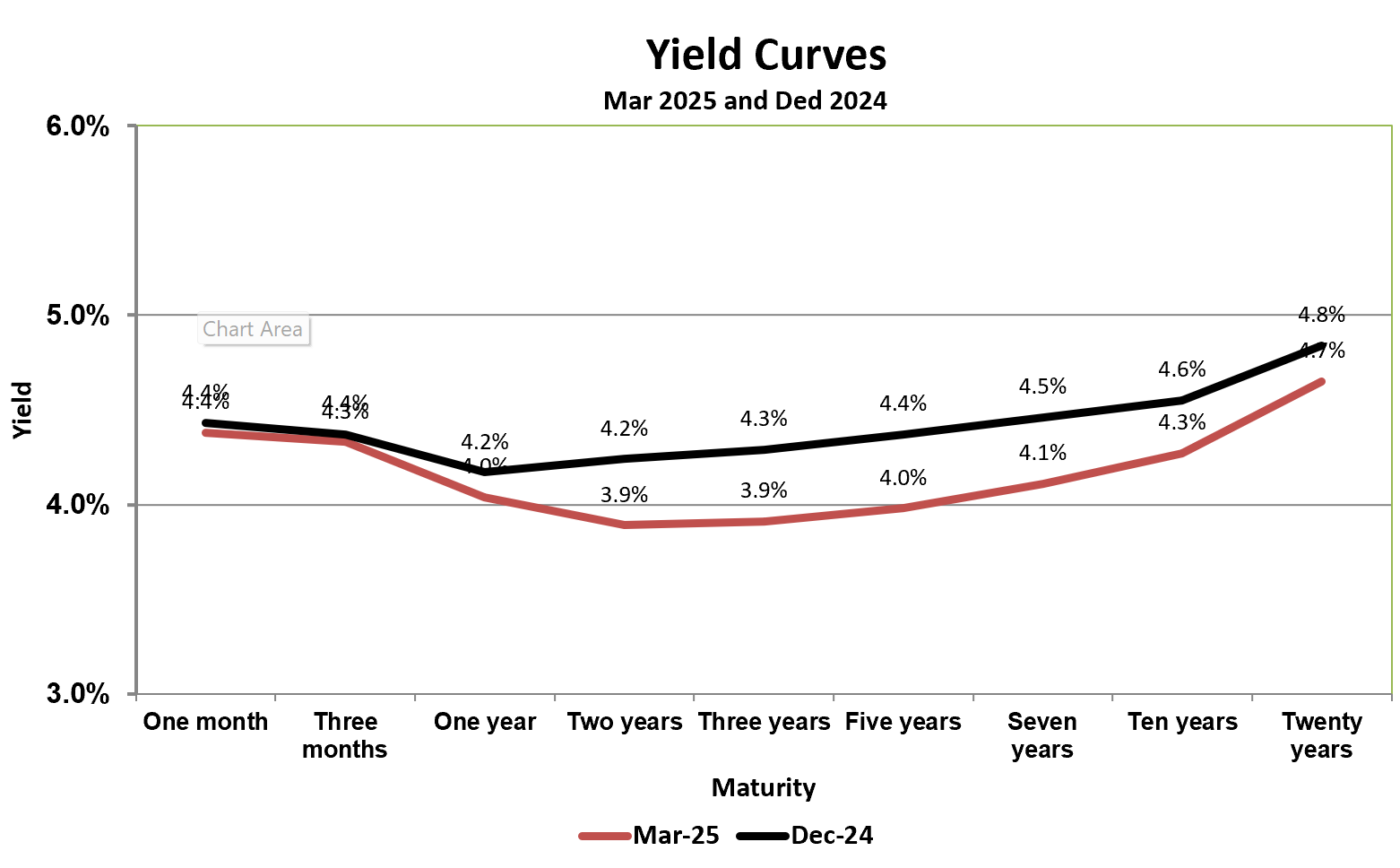

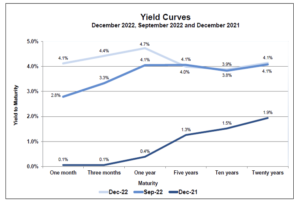

Bond markets are unsettled reflecting today’s uncertainties. Real interest rates shot up 0.4% at the beginning of the month. Although falling back recently, this behavior is worrisome as it’s indicative of increased risk in the market for US Treasury securities, making it more difficult, as well as costly, to finance growing deficits. The term premium (10-yr yield minus 2-yr yield) jumped to 0.5%.

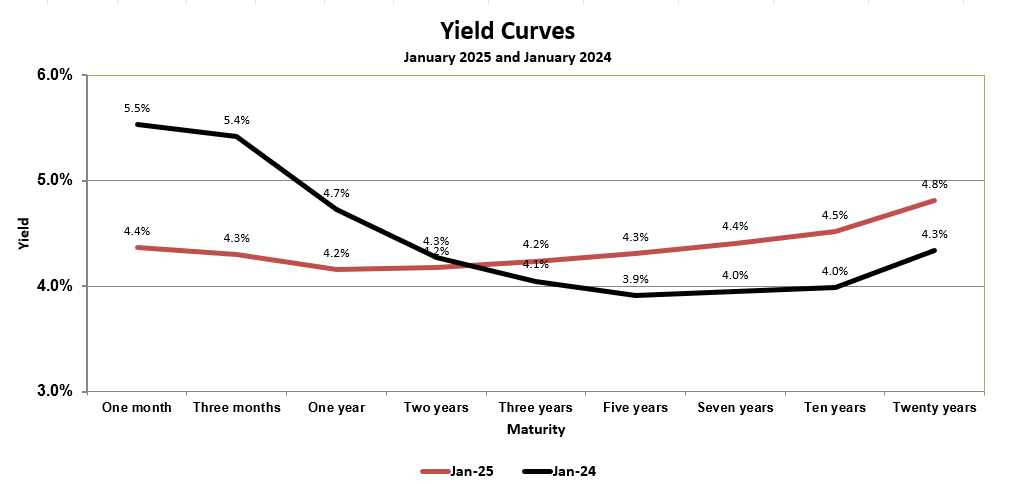

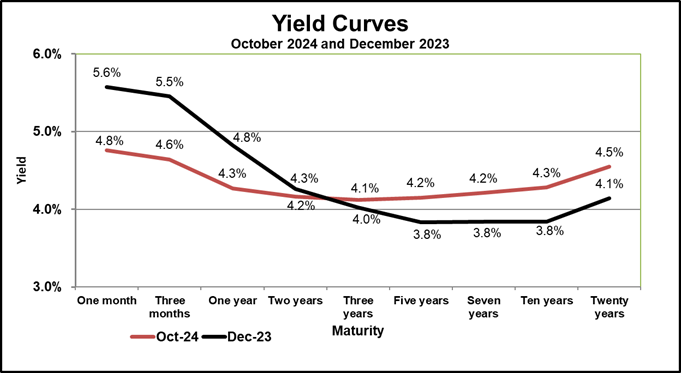

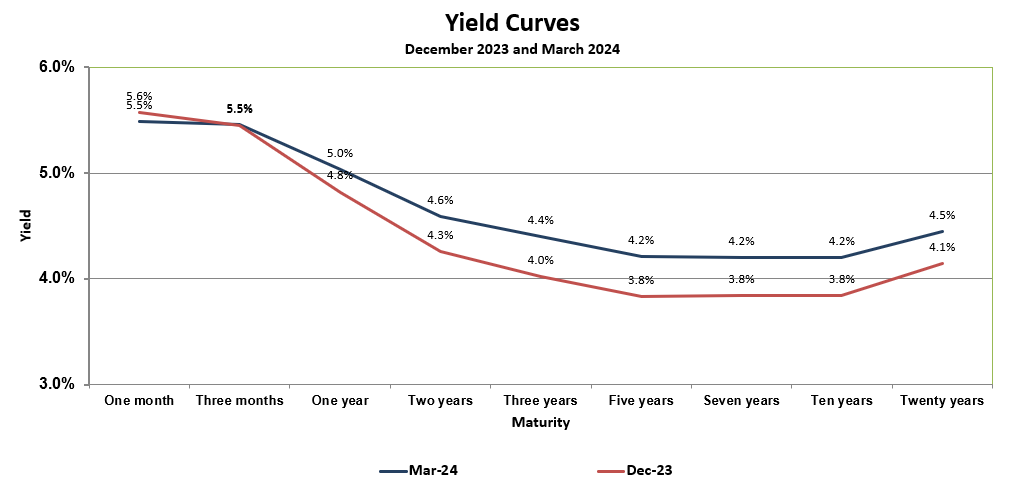

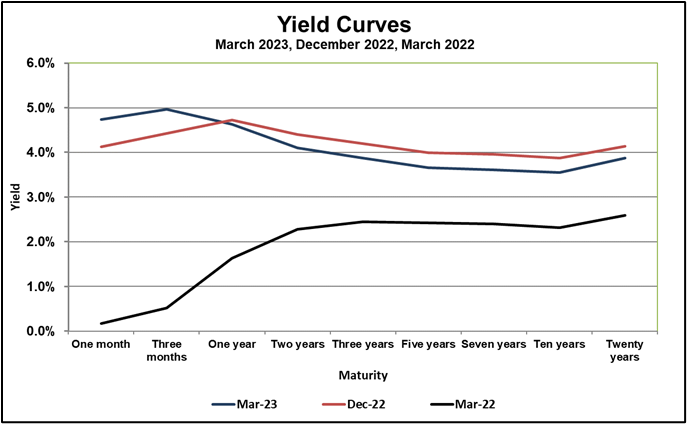

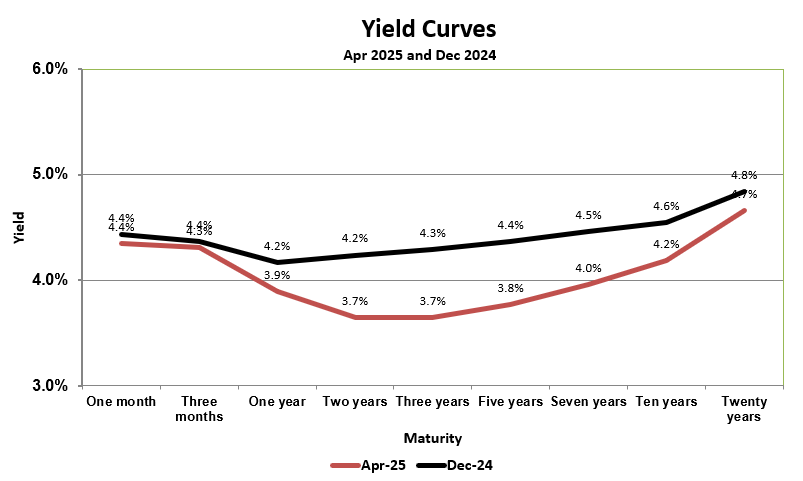

Note from the accompanying Yield Curves that while remaining generally constant in April, intermediate-term bond yields are down year-to-date, resulting in positive bond returns.

Risk and Uncertainties

Markets are forward looking. As the future becomes murky, stock prices are increasingly volatile. Among the negative clouds are the implementation and economic impact of tariffs; the threat of politicizing the Fed; the impact of budget negotiations on the deficit; and an economic slowdown (recession).

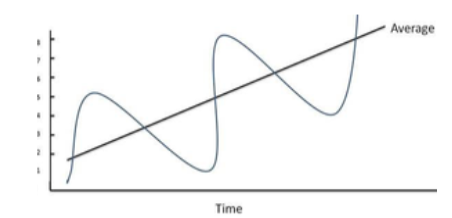

Risk and uncertainty are different concepts – risk can be measured, uncertainty cannot. Risk is the possibility that the future will be different from what’s expected. This chance can be measured with probabilities and statistics. Uncertainty, on the other hand, is a description of the state of the world. Not only is this situation constantly changing, but it can’t be measured precisely.

Markets have weathered uncertain periods before. Risk profiles (average returns and standard deviation) of stock returns reflect how markets deal with uncertainty. While the events that trigger volatility are forever changing, these profiles have remained generally constant and are a reasonable description of the future.

If we look around us there are always things about which we are uncertain. Today it is tariffs. We are uncertain not only about the economic effects of tariffs, but also how future tariff regimes will unfold. Of course, it’s this uncertainty of where tariffs are going that drives market volatility, which will continue until some of the uncertainty is resolved; however, others will take their place.