Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

November 7, 2024

Institutional BlogNews

Here’s a snapshot of recent returns for indices representing various stock and bond markets:

| Market | Trailing 3 Months | Year to Date | Trailing 12 Months | Trailing 5 Years |

| US Large Cap (S&P 500) | 7% | 21% | 37% | 15% |

| US Small Cap (Russell 2000) | 4% | 10% | 33% | 8% |

| Int’l Developed (EAFE) | 2% | 7% | 22% | 6% |

| Emerging Markets (MSCI Index) | 6% | 12% | 25% | 4% |

| Short-term Bonds (Treasury 1-3 yr) | 0% | 4% | 6% | 1% |

| Intermediate-Term Bonds (Treasury 3-5 yr) | -1% | 2% | 6% | 0% |

| Long-term Bonds (Treasury 5-7 yr) | -3% | 1% | 8% | -1% |

| Inflation (CPI) | 0% | 2% | 2% | 4% |

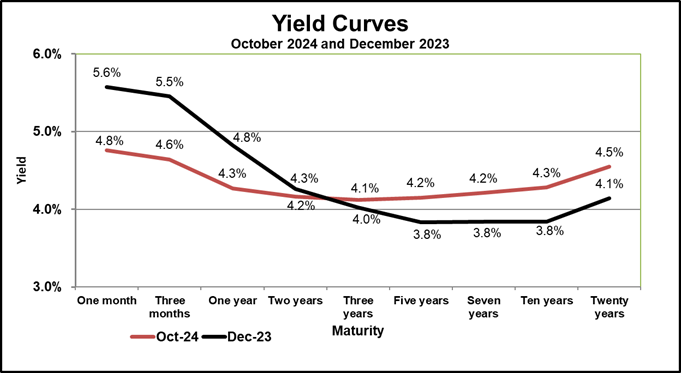

The change in the pattern of yields (Yield Curve) for several maturities are shown here – notice the twists – yields at the shorter term falling and longer-term yields rising. Since returns and prices behave inversely with changing yields, these twists explain recent bond markets. Also, the Yield Curve is generally upward sloping for bonds maturing beyond two years, which is more typical.

Yields jumped over 0.5% this month, signaling increases in the cost of capital (interest rates) as inflation expectations did not move. A rising cost of capital can have a negative impact on economic growth.

The robust stock returns of recent periods, especially in the tech-ladened S&P 500, have led some to suggest a “correction” is ahead. There is considerable uncertainty in today’s investment landscape due to our closely contested election, wars in Ukraine and the Middle East, the impact of AI, and rising interest rates. Yet today’s prices are established in a well-functioning market and reflect what is known – the future is, of course, unknown.

In a well-functioning market prices incorporate available information. Stock prices and returns are based on continuous trading by informed buyers and sellers, both of whom make decisions on their best assessment of the future. New information drives price changes as it becomes apparent, assessments of the impact are evaluated and prices change. However, the impact could be either positive or negative.

While we may experience a correction, it will be due to unpredictable surprises. Consequently, to deal with uncertainty it’s best to maintain established commitments to a well-diversified portfolio and periodically rebalance in response to future volatility.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.