Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

March 6, 2025

Institutional BlogNews

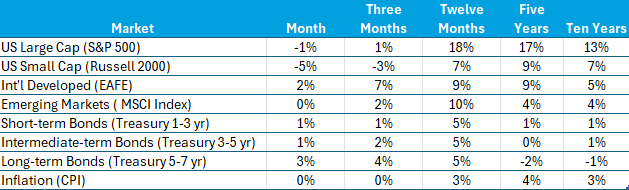

Here are the recent returns from various market indices:

Stocks are volatile this month. Returns of the six AI companies that have driven the S&P 500 recently are not as dominant. Note in the above chart that domestic stocks are down while international stocks have picked up the slack. The returns in developed international markets (EAFE) and emerging markets (MSCI Index) stand out. While certainly not a trend, it is heartening to those who have argued for a long time that an allocation to non-domestic markets is important to a well-diversified portfolio. Diversification paid off this month and quarter.

Not only volatile, but stock returns have been more dispersed recently. Returns of the six AI firms reacted differently to the introduction of the competition from DeepSeek. While Nvidia, Microsoft, and Apple were off, Amazon, Google, and Meta were up over the same period, providing evidence of some independence among these market drivers. Recent measures of dispersion are lower for stock indices than for individual stocks in the index, which is indicative of less correlation among returns in today’s stock markets.

With declining yields in recent periods, bond returns are up. Bond returns are evidence of a mostly stable interest rate environment. The pattern of yields across several maturities (Yield Curve) remained at its more normal upward-sloping shape.

The yield on 10-year Treasuries reflects inflationary expectations and prospects for an economic downturn. This yield came down nearly 0.25% this month. Stripping away implied inflationary expectations, this drop in yield is consistent with an expected falloff in economic activity, as the inflation- adjusted yield was down 0.3%.

While the spread between the inflation-adjusted yield and nominal 10-yr. yields ticked up a bit, it is still a rather benign 2.4%, and inflation is becoming worrisome once again. No doubt this concern reflects cost-conscious consumers changing their food buying habits, especially fewer eggs, in response to years of rising prices and an uncertain inflationary future. Tariffs, tax cuts, and deficits add to the worry of future inflation.

Serious long-term investors know it is best to avoid making changes to established strategic allocations in response to market ups and downs – yet, maintaining this discipline is hard. There will be many periods, some quite long, when one particular asset class does better, sometimes dramatically, while others do not keep up. The urge to tilt towards outperforming markets and away from those that have underperformed (market timing) is difficult to resist.

However, giving in to this urge can be costly in the long run. A simple decision model may be helpful to understand this cost: I compare a timing strategy in the S&P 500 Index consisting of forgoing the subsequent quarter’s return if the current return is below the trailing five-year average. At the end of twenty years, this strategy results in a portfolio of about one-half the size of that from doing nothing and letting the wonder of compounding do its work. While admittedly a simple decision model, adding more realistic complexity doesn’t change the conclusion – market timing rarely pays in the long run.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.