Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

April 10, 2023

Institutional BlogNews

Stocks

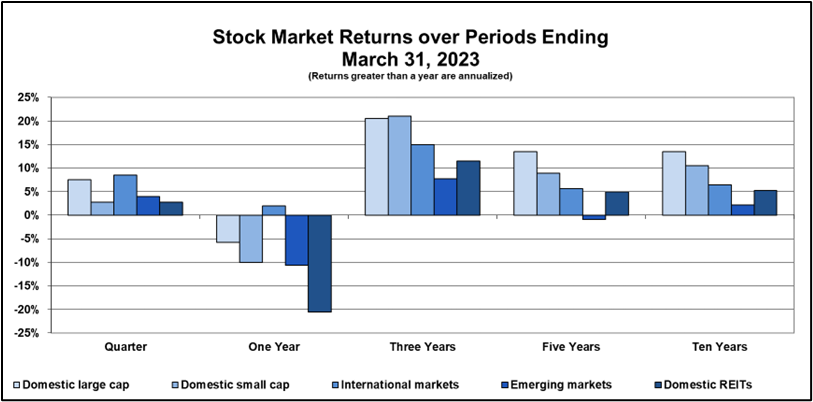

After enduring ups and downs due to the uncertainty in the financial system and the Fed’s response triggered by the collapse of Silicon Valley and Signature banks, stocks ended the first quarter in positive territory. Domestic large cap stocks, International developed markets and emerging markets were up between 4% and 8%, small cap stocks and REITs up just under 3%. Over the trailing twelve months, on the other hand, except for International developed markets, stocks were down significantly because of rising interest rates and inflation uncertainty.

While the past year was not kind to stocks, the story has been mostly positive over longer periods. The past three years saw a portfolio diversified among several markets earning about 15%. Although with considerable variability among individual markets, a diversified stock portfolio earned about 4% and 7% over the last five and ten years, respectively.

Bonds

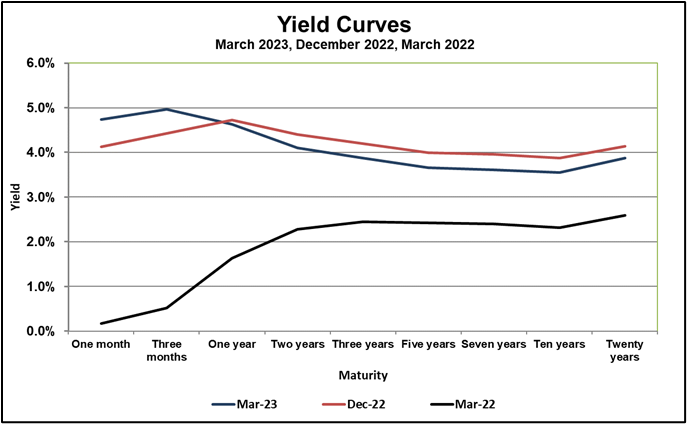

Recent turmoil in the banking system drove bond yields down, especially for longer maturities. Since prices move inversely to yields, this downward trajectory in yields pushed first quarter bond returns up between 1.5% and 2.8% depending on maturity. The Yield Curves below show the extent to which yields have climbed since March 2022. The primary culprit is the Fed increasing its Federal Funds rate to dampen inflation. While yields fell back a little this quarter, with the recent 0.25% increase in the Federal Funds rate, the Fed seems committed to keeping rates high for the immediate future.

The spread between nominal- and inflation-adjusted five- and ten-year yields, which is a reasonable measure of the market’s expectation for inflation over these periods, is close to the Fed’s inflation target. The shape of the yield curve can be a harbinger of future interest rates – today’s downward sloping shape implies reduced rates ahead. These signals are positive for future inflation.

Failure of Silicon Valley and Signature Banks

The turmoil in banking brought on by the collapse of Silicon Valley and Signature Banks has not only unsettled markets, but also increased uncertainty in the financial system associated with rapidly rising interest rates and the fight to dampen inflation. These two banks failed because after being accustomed to low interest rates, management lost track of the impact of rising interest rates on bond values. It was surprised by the prices at which its bonds had to be liquidated to meet unanticipated depositor withdrawals, causing sharp losses and eventual failure.

Further exacerbating this interest rate risk, these banks had a concentrated base of large depositors. In response, the Fed has stepped in to protect all depositors. While this intervention has lessened the impact of this crisis, the extent to which it creates a moral hazard that distorts future economic decisions is a downside.

While the implications of the failure of these two banks appear to be well-known and somewhat manageable, it brings heightened uncertainty, not only in the banking system, but also with the Fed’s continued resolve to squeeze out inflation, the availability of credit and economic activity going forward. While the market has absorbed this uncertainty reasonably well so far, we can anticipate continued market volatility.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.