Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

July 6, 2023

Institutional BlogNews

Predicting Future Prices

If we could predict future prices for financial assets, then investing would present no problems. As Will Rogers tells us: “Don’t gamble; take all your savings and buy some good stock and hold it till it goes up, then sell it. If it don’t go up, don’t buy it.” Unfortunately, it doesn’t work that way.

The observed market price, which consolidates the predictions of all participants from available information, is usually the best price. Because new information comes randomly, prices will fluctuate unpredictably – investors need confidence to make decisions using only observed market prices.

Instead of predicting the future, we can use past data to construct an average and, importantly, a range. Using this description of the future allows us to consider investment alternatives objectively. Relying on predictions to make these decisions, while it can be comforting, rarely pays off.

Market Review

Stocks

Stocks were up this quarter and six months, helped by significant advances in a few large tech companies. The S&P 500, which is over-weighted by these stocks, was up almost 9% for the quarter. Other market indices were up between 1% and 5%. The story is much the same for the year-to-date numbers. While over this period international developed markets (EAFE), domestic small cap stocks (Russell 2000) and emerging markets (MSCI emerging markets) were up a comfortable12%, 8% and 5%, respectively – they were well below the 15% return of the S&P 500. The equally weighted portfolio of the six largest tech stocks (Apple, Microsoft, Google, Amazon, Nivida and Facebook) was up 27% over the quarter and 83% year-to-date. Nvidia, a software company engaged in the manufacture and distribution of chips for AI (Artificial Intelligence) headquartered in Santa Clara, CA, is new to this group. It was up over 50% for the quarter, and has nearly doubled in value since the first of the year. These numbers tell us the market’s enthusiasm for AI. We’ll see whether it is misplaced.

The Consumer Price Index (CPI) is up 2.7% over the trailing twelve months, close to the Fed’s long-term objective. While the Fed has paused its drive to increase interest rates, inflation remains a concern and there are no declarations of victory, only discussions of the difficulty of interpreting the data. Regardless, we are in a better place than a year ago, which helps to explain the positive stock market.

Bonds – Yields Versus Returns

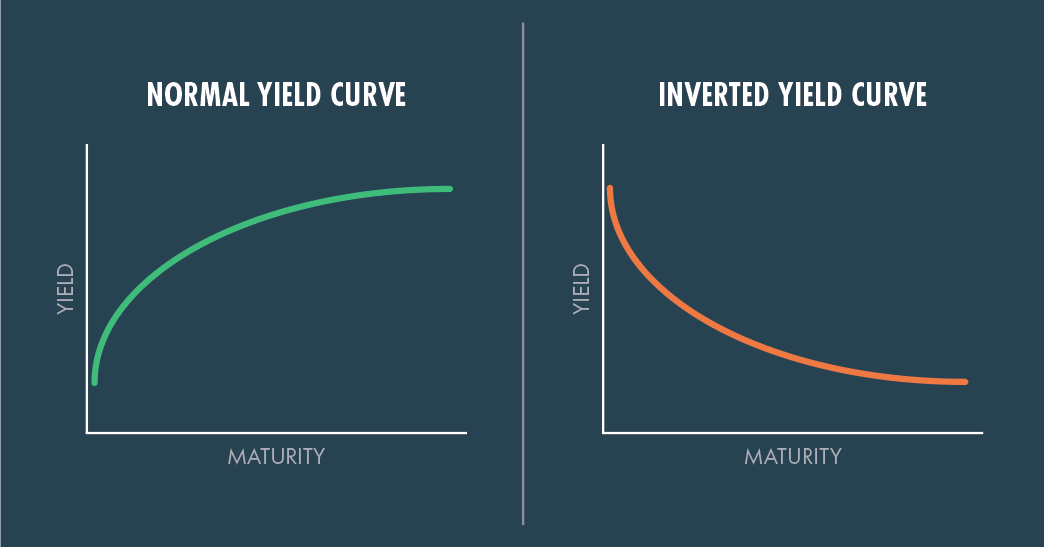

Over the June quarter, bond returns are negative, reflecting rising yields. The Yield Curve (pattern of bond yields for various maturities) shows a parallel shift upward of about 0.5%, which is consistent with the increase in the Fed’s Target Federal Funds rate. Bond prices (returns) move inversely to yields – yields up, prices down.

Today’s Yield Curve is unusual. The typical curve slopes upward, showing yields increasing with maturity. The downward sloping curve we see today anticipates falling interest rates. We earn 5.4% annualized, investing for 3 months versus 4.3% for three years.

However, taking advantage of today’s short-term interest rates is not without risk, as proceeds from short-term bonds must be reinvested at an unknown rate at maturity. Today’s Yield Curve tells us this rate will be lower and in fact, one explanation (Expectations Hypothesis) of the observed shape of the Yield Curve is that you will end up at the same place by taking advantage of the higher short-term rates and “rolling over” the proceeds over three years as you would by earning the three-year rate. Market predictions of future yields are embedded in the observed Yield Curve.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.