Given the volatility in the financial markets beginning the week of February 20th, it’s helpful to

review the state of the U.S. economy entering into this stressful period, what’s happened since,

and some of the potential economic impacts. Here is my take on those topics.

At the beginning of 2020, the U.S. economy was in very strong shape, with

unemployment falling and the labour force participation rate and wages rising.

Compared to 2008-09, this is not a financial crisis but rather a health crisis, which

tends to be much shorter in duration (typically several months) and which should

lessen in magnitude as the Northern Hemisphere approaches spring and

summer. Banks are in the strongest capital positions ever, and strong banks with

the ability to lend are obviously important to the sustainability and health of the

economy during times of crisis. Further, the ratio of consumer debt to gross

domestic product (GDP) is about 75 percent, its lowest since 2002, down from

almost 100 percent in 2008.

Lower interest rates will help governments, consumers and corporations

refinance debt, leading to lower debt burdens within those sectors of the

economy. However, lower interest rates, along with lower stock prices, will put

further stress on state and local pension plans, many of which are already

severely underfunded. In order to minimise risk, we have been avoiding buying

bonds from a significant number of these states. A sustained period of low rates

will also impact savers, increasing the need for other parts of the portfolio to

generate the returns needed to fund retirement and other goals. We also expect

that we will see yields on short-term fixed income, such as money market funds,

drop substantially as well, increasing the “cost” of cash.

While bad for energy companies, their stockholders and potentially their

bondholders, collapsing energy prices are effectively a big “tax cut” for

consumers. Also, companies that are heavy energy users (e.g., airlines) will

benefit, to some degree offsetting the losses associated with lower energy prices

in other sectors of the economy. However, there is significant risk to the high-

yield corporate bond market, as there is $85 billion of high-yield debt issued by

energy companies, and with oil prices below $40 a barrel, many of these

companies will struggle to generate profits. Much of that debt matures in the next

four years. In this type of environment, one can expect the high-yield corporate

bond market to be highly correlated with the stock market, which is one of the

reasons we generally do not recommend high-yield bonds as part of client fixed-

income portfolios. High-yield bonds do not provide effective diversification within

a portfolio that already owns stocks.

The U.S. has the lowest percentage of trade relative to GDP, at about 12 percent

(country trade-to-GDP ratios). In comparison, most of Europe varies from around

50 percent (Germany) to the high 80s (Belgium, Netherlands). Japan is about 16

percent and the UK is about 30 percent. So, if there is a prolonged deterioration

in trade, the U.S. should be less impacted than most countries.

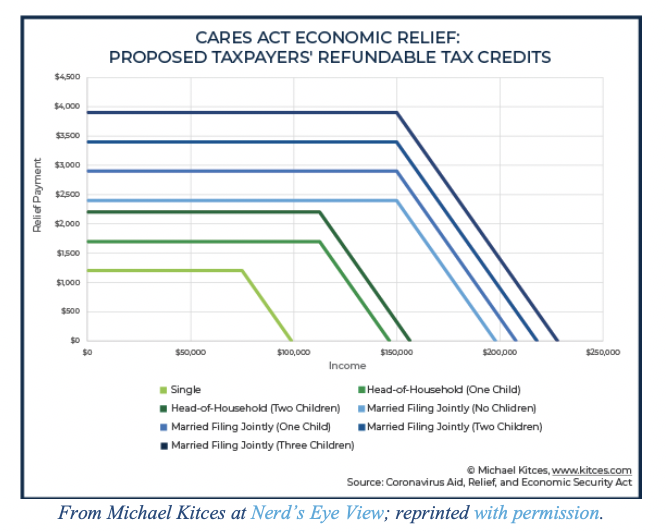

If the economic disruption associated with the coronavirus worsens, governments

are likely to take action to address issues, such as coming out with loan

programs to bail out specific industries (as the government did during the 2008-

09 crisis for General Motors and the banking industry) and enact fiscal stimulus

(tax cuts or other programs to more directly help those financially impacted by

the coronavirus) [1] . Given possibilities like this, one must also keep in mind that

markets are forward-looking, recovering well before the economy does, just as

they tend to fall before the economy is materially disrupted.

Markets generally do a good job of incorporating both good and bad news and

anticipating potential impacts on the economy. When we see markets change, it

is almost always because of new information that couldn’t have been reliably

forecast in advance. However, markets can also fall for noneconomic reasons

due to a cascade of sellers who reach their get-me-out point, have margin calls,

or are covering short put options positions that are held by sellers of volatility

insurance and sellers of structured notes (which limit downside equity risks); or

market participants who are trading with the trend. In addition, banks and

investment firms using value at risk (VaR) metrics to assess possible losses on

their books for any single day may have to sell off risks as volatility

increases. Market participants can sometimes exacerbate downward trends in

markets, but we still believe it’s best not to try to predict these occurrences but

rather to be aware they are possible. Further, if you sell, you have no way of

knowing when to get back in or when trends like the above could reverse.

While stocks and risky fixed-income assets or pseudo fixed-income strategies,

such as dividend paying stocks, REITs (real estate investment trusts), etc., are

falling in value, safe bonds are rising in value, demonstrating their value as

dampeners of portfolio volatility, which is why we include them in portfolios.

Some “true” alternative strategies, such as marketplace lending, reinsurance and

trend-following, have held up very well and have generally generated positive

returns on a year-to-date basis.

Finally, remember that bear markets are periods when stocks are transferred

from weak to strong hands, as does wealth when recoveries occur. We have

recovered from every past crisis, which we tend to experience with great

frequency, about every two or three years. Further, we recovered quickly in the

past from the health crises of SARS, MERS and Ebola.

Footnotes

[1] On Sunday night, March 15 th , the Federal Reserve announced that it cut the Fed funds rate to

effectively zero, a drop of a full 1 percent. In addition, it announced a massive $700 billion

bond-buying program. These actions will provide cover for other central banks to cut rates

without fear of their currencies collapsing. Congress is also working on a massive stimulus bill,

on top of the $8.3 billion approved last week by the Senate. Governments around the world are

certain to follow with packages of their own.