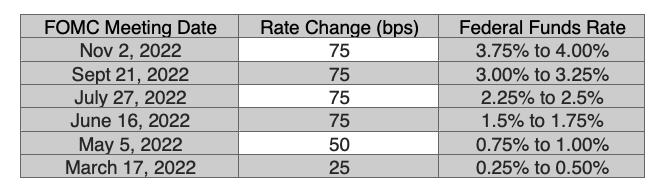

To say the least, there’s been plenty of political, financial, and economic activity this year—from rising interest rates to elevated inflation, to ongoing market turmoil.

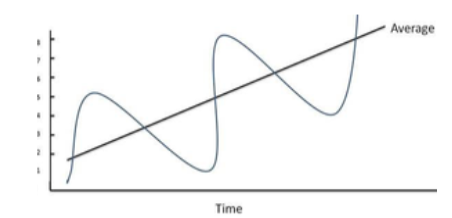

How will all the excitement translate into annual performance in our investment portfolios? Markets often deliver their best returns just when we’re most discouraged. So, who knows! While we wait to find out, here are six action items worth tending to before 2022 is a wrap.

- Revisit Your Cash Reserves

Where is your cash stashed these days? After years of offering essentially zero interest in money markets, savings accounts, and similar platforms, some banks are now offering higher interest rates to savers. Others are not. Plus, some money market funds may have quietly resumed charging underlying management fees they had waived during low-rate times. It might pay to …

Shop around: If you have significant cash reserves, now may be a good time to compare rates and fees among local institutions, virtual banks, and/or online services that shift your money around depending on the best available offers (for a fee). Double check fees; make sure your money remains FDIC-insured; and remember, if it sounds too amazing to be true, it probably is.

- Put Your Money to Work

If you’re sitting on excess cash, you may be able to put it to even better use under current conditions. Here are three possibilities:

Rebalance: You can use cash reserves to top off investments that may be underweight in your portfolio. Many stock market prices have been depressed as well, so this may be an opportunity to “buy low,” if it makes sense within your investment plans.

Lighten your debt load: Carrying high-interest debt is a threat to your financial well-being, especially in times of rising rates. Consider paying off credit card balances, or at least avoid adding to them during the holiday season.

Buy some I bonds: For cash, you won’t need for a year or more, Treasury Series I bonds may still be a good deal, as described in this Humble Dollar post. Until April 2023, the current yield is 6.89%.

- Replenish Your Cash Reserves

Not everybody has extra money sitting around in their savings accounts. Here are a couple of ways to rebuild your reserves.

Earning more? Save more: To offset inflation, Social Security recipients are set to receive among the biggest Cost-of-Living Adjustments (COLAs) ever. Or, if you’re still employed, you may have received a raise or bonus at work for similar reasons. Rather than simply spending these or other new-found assets, consider channeling a prescribed percentage of them to saving or investing activities, as described above. If you repurpose extra money as soon as it comes in, you’re less likely to miss it.

Tap Required Minimum Distributions (RMDs): If you need to take required minimum distributions (RMDs) from your own or inherited retirement accounts, that’s a must-do before year-end. Set aside enough to cover the taxes, but the rest could be used for any of the aforementioned activities. Another option during down markets is to make “in-kind” distributions: Instead of converting to cash, you simply distribute holdings as is from a tax-sheltered to a taxable account.

- Make Some Smooth Tax-Planning Moves

Another way to save more money is to pay less tax. Here are a couple of year-end ideas for that.

It’s still harvesting season: Market downturns often present opportunities to engage in tax-loss harvesting by selling taxable shares at a loss, and promptly reinvesting the proceeds in a similar (but not identical) fund. You can then use the losses to offset taxable gains, without significantly altering your investment mix. When appropriate, we’ve been helping Rockbridge clients harvest tax losses throughout 2022. There still may be opportunities before year-end, especially if you’ve not yet harvested losses year to date. We encourage you to consult with a tax professional first; tax-loss harvesting isn’t for everyone and must be carefully managed.

Watch out for dividend distributions: Whether a fund’s share price has gone up, down, or sideways, its managers typically make capital gain distributions in early December, based on the fund’s underlying year-to-date trading activities through October. In your taxable accounts, if you don’t have compelling reasons to buy into a fund just before its distribution date, you may want to wait until afterward. On the flip side, if you are planning to sell a taxable fund anyway—or you were planning to donate a highly appreciated fund to a charity—doing so prior to its distribution date might spare you some taxable gains.

Donate to your favorite charity from your IRA: Instead of writing a check or giving cash to your local church or favorite non-profit organization, you also could donate the assets through a Qualified Charitable Distribution. All you do is work with your Advisor to have a check sent from your IRA to a qualified charity of your choice and you’ll avoid paying taxes to the government and help out the community in the process.

Convert some of your IRA funds to your Roth IRA: At the end of every year, sit down with your tax professional and see if it makes sense to convert some of your pre-tax dollars for tax-free growth. You’ll pay taxes on the amount converted, but it’s possible you can save on taxes long-term by being proactive. Now, you’ve created a tax-free bucket to use down the road with flexibility.

- Check Up on Your Healthcare Coverage

As year-end approaches, make sure you and your family have made the most of your healthcare coverage.

Examine all your benefits: For example, if you have a Health Savings Account (HSA), have you funded it for the year? If you have a Flexible Spending Account (FSA), have you spent any balance you cannot carry forward? If you’ve already met your annual deductible, are there additional covered expenses worth incurring before 2023 re-sets the meter? If you’re eligible for free annual wellness exams or other benefits, have you used them?

- Get Set for 2023

Why wait for 2023 to start anew? Year-end can be an ideal time to take stock of where you stand, and what you’d like to achieve in the year ahead.

Audit your household interests: What’s changed, and what hasn’t? Have you welcomed new family members or bid others farewell? Changed careers or decided to retire? Received financial windfalls or incurred capital losses? Added new hobbies or encountered personal setbacks? How might these and other significant life events alter your ideal investment allocations, cash-flow requirements, insurance coverage, estate plans, and more? Take an hour or so to list key updates in your life, so you can hit the ground running in 2023.

How Can We Help?

How else can we help you wrap 2022, and position you and your loved ones for the year ahead? Whether it’s helping you manage your investment portfolio, optimize your tax planning, consider your cash reserves, weigh insurance offerings, or assess any other components that contribute to your financial well-being, we stand ready to assist—today, and throughout the year