Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

November 22, 2022

Investing

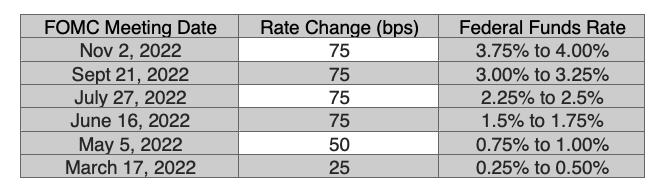

In early November, the Fed raised interest rates by 75 bps, marking the sixth rate hike since March 17th, 2022, and four consecutive .75 bps increases. This puts the Fed Funds rate (the short-term rate guiding overnight lending) up to a range of 3.75% to 4.00%, pushing borrowing costs to a new high since 2008. The Fed hasn’t increased rates in six straight meetings since 2005 and hasn’t increased rates by 3.75% in a single year since the 1980’s.

Is the strategy working?

We are seeing early signs of the cumulative effects of tightening the monetary policy. The annual inflation rate in the US slowed to 7.7% in October, down from 8.2% in September, yielding the fourth straight month of declining inflation. Investors saw markets react very favorably last week as inflation numbers arrived below the 8% forecast.

Slowdowns are showing up in key leading areas, with Energy costs up 17.6% in October vs 19.8% in September. Used cars also slowed in October as compared to the prior month (2% vs 7.2%). Food also slowed by 0.3%, down to 10.9%. While we are seeing some leading indicators trending in the right direction, there are lagging pockets of the market that have yet to peak. For example, shelter increased to 6.9% from 6.6% and fuel oil rose to 68.5% from 58.1%.

While consumers have benefited from recent supply chain improvements, strong inflationary pressures persist. The Fed is sticking with their plan to tame inflation and claiming additional increases rate hikes are necessary; projecting rates to top out at 4.5 to 4.75% in 2023.

What does this mean for investors?

While YTD bond returns are historically bad, the silver lining is that fixed income portfolios are now earning nearly 5% as a result of rising rates. Last week’s strong performance may be the market’s signal that smaller-than-planned future rate increases may be possible. How the Fed weighs the wide variety of economic indicators will ultimately determine how soft our landing will be.

In the meantime, we suggest staying invested in a diversified portfolio and take advantage of any financial and/or tax planning opportunities that current market conditions may provide.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.