With the general election one week away, many Americans and capital markets are awaiting the results. In this piece, we will go over expectations heading into the election and possible market reactions based off those outcomes.

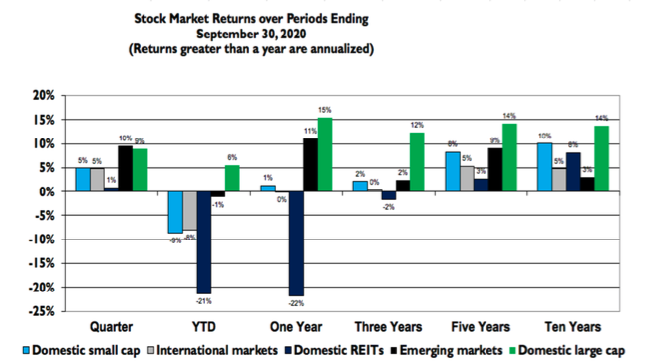

Before we dive in, it’s important to remember current market prices reflect all known information and expectations. And while we don’t know the outcome of the election or how the market will react, we do know it pays to be invested over the long run which is what we are recommending for all clients. Stick with your plan, take a personally appropriate level of market risk, and enjoy the long-term appreciation we’ve observed over the last 90 years and will observe over the next 90.

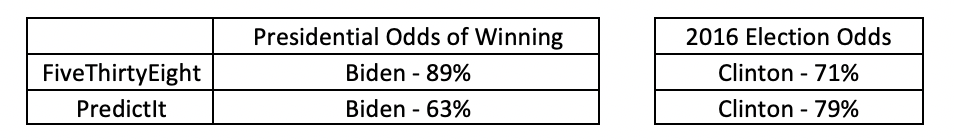

In the election forecasting world, two of the best sources are FiveThirtyEight.com and online betting markets (we’ll look at PredictIt). Between the two, we feel FiveThirtyEight is more reliable but it’s worth showing both.

Both sources show Biden as the expected winner with FiveThirtyEight showing very high likelihood. The betting website has Biden at 63% which indicates its users are less certain of a Biden victory. Though there are limitations around betting market regulations which make the true likelihood of a Biden victory larger. On the FiveThirtyEight side, Trump’s 11% chance of winning reelection is quite a bit lower than the forecasting website showed in 2016. While things with odds of 11% do happen 1 in 9 times, it is reasonable to say the market has priced in a Biden victory and will be surprised if Trump is the winner.

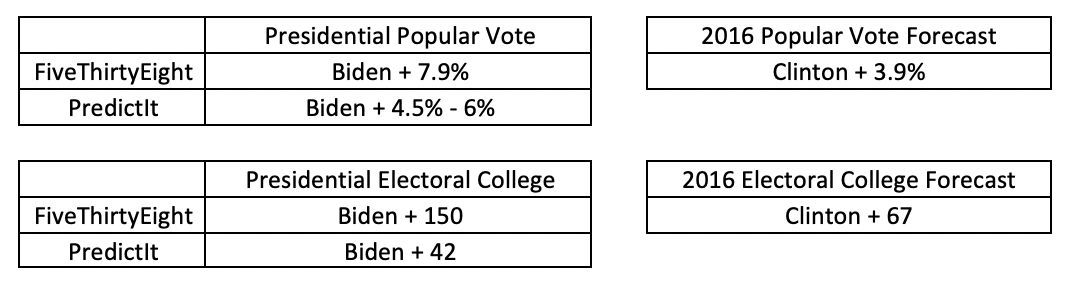

The following tables show a few other ways of looking at expectations of the upcoming presidential election.

We don’t have data for the expected PredictIt margin in 2016, but in 2020 we again are seeing a Biden victory, with a narrower margin among online betters than the forecasting website FiveThirtyEight. Again, it’s worth noting how much more decisive FiveThirtyEight is predicting the 2020 election than the 2016 election – reiterating that markets expect a Biden victory.

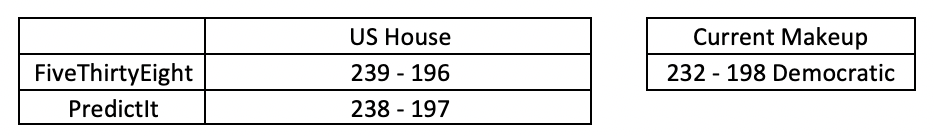

The House of Representatives is relatively boring. Democrats have a sizable advantage and that is expected to stay the same. The current makeup is about 54% Democratic and it’s expected to slightly rise to 55% Democratic.

It’s interesting that the online betting market and FiveThirtyEight are more or less saying the same thing when it comes to the House of Representatives, but not the Presidency.

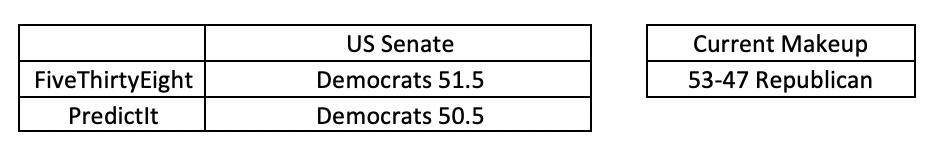

What will likely be the most interesting part of the election is what happens in the Senate. At the moment, Republicans hold a 53-47 advantage. It is expected that Democrats will pick up seats, but how many is not known.

Republicans are expected to gain a seat in Alabama, where Democrat Doug Jones is up for reelection. Democrats are expected to gain a seat in Colorado as former Democratic Governor John Hickenlooper has a large polling lead over incumbent Republican Cory Gardner. Democratic candidates also have narrow(er) leads over incumbent Republicans in Arizona, Maine, North Carolina, and Iowa. If the polls hold in all those, that will give Democrats 51 seats in the Senate. If Republicans hold on to one of those, but Biden wins the Presidency, Democrats will have the ability to control the Senate because the Vice President (Kamala Harris) serves as the deciding vote in the event of a tie. In a dream scenario for Democrats, they could pick up additional seats in Georgia (2), South Carolina, Montana, and even Kansas. Republicans have an outside chance at picking up seats in Michigan and Minnesota.

A narrow Democratic majority isn’t expected to be overly liberal. Democrat Joe Manchin of West Virginia has a fairly conservative voting record, as does Jon Tester of Montana. Angus King of Maine is fairly moderate and it’s reasonable to expect a new Democratic Senator from a purple state like Iowa, Arizona, or North Carolina will want to strike a moderate tone in their first term. From a markets perspective, the expectation is for a fairly moderate Senate that doesn’t pass any policies overly different from the status quo (like Government run healthcare, or a Green New Deal).

If Democrats got 53-55 seats, this would be different from expectations, but it’s not clear how the market would react. Some might be concerned that a more liberal senate would pass policies unfriendly to businesses and a strong democratic showing might encourage liberals to push for more business regulation through the executive branch. Those would be seen as bad for future corporate profits and harmful to stocks. However, others might see a more democratic senate as better on getting COVID under control and more likely to pass a large and generous infrastructure / general spending bill. That would be positive for expected corporate profits and stocks.

Remember, under current Senate Rules most legislation needs 60 votes to avoid a filibuster. The exception is one budgetary bill per year that just needs a majority and passes by the “reconciliation” process. This is how Republicans passed their tax cut three years ago. While it’s only one bill a year, it can be a large bill with broad provisions/impact. It’s possible the next Senate could change the rules but that isn’t likely.

To conclude, the current expectations are for Democrats to maintain a similar majority in the House, Biden to win the presidency, and Democrats to narrowly gain control of the Senate. If all this happens you would not expect the market to react in a meaningful way over a longer period of time. There may be high volume that causes some choppiness in the immediate aftermath of the election, but the overall direction of the market should not move much from this outcome. It could move from other news – like COVID, or issues abroad.

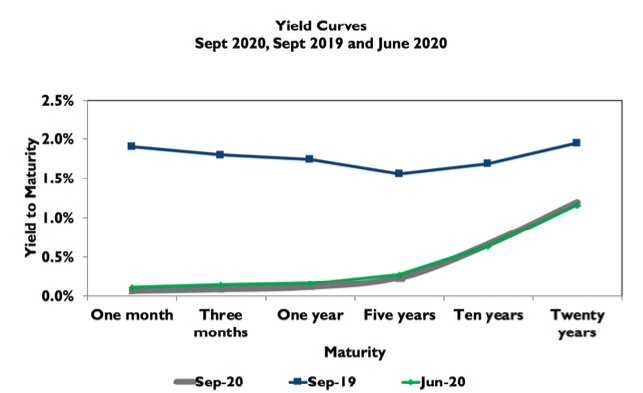

We are quick to concede “experts,” forecasts, and predictions are wrong all the time. We saw it in 2016 with the election, we saw it with economists and interest rates in 2019, and we saw it with the American hockey team at the winter Olympics in 1980. That said they are often right. Despite poor performance in 2016, FiveThirtyEight was spot on in 2008 and 2012. They also called the House in 2018 almost exactly and were a seat off in the senate.

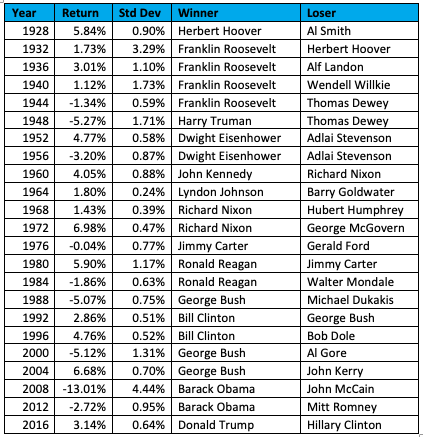

If we see an election outcome different than what’s expected that could lead to volatility, but like we saw in 2016, it’s hard to predict how the market will react. On the night of the 2016 election, stock futures were down 5% at midnight after it was clear Trump would win, however they regained all their losses by the market open and finished up 1% on the day.