Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

October 22, 2020

Investing

Stock Markets

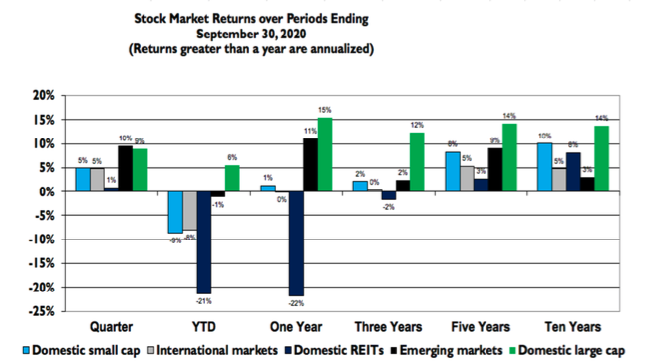

Stocks continued to come back from their sharp declines earlier in the year. Over the September quarter, stocks are up across the board – Domestic Large-Cap stocks and Emerging Markets are up 9%. Since December 31st, a diversified global portfolio is off 8% year-to-date excluding the Domestic Large- Cap market, which is driven by the largest tech companies. Returns from domestic stocks continue to exceed those of non-domestic stocks.

Value stocks are priced based on expected earnings from assets in place while growth stocks reflect expected earnings mainly from future investments.

Research shows that markets tend to overprice these future earnings. Yet, there has been a significant discount to value stocks in recent periods, which is especially pronounced in the year-to-date numbers.

Looking back over a long history the average difference in five-year returns between a blended index and a value index is close to zero. The historical variability is such that a discount to value stocks of more than5%, such as we experienced over the most recent five-year period, is clearly an outlier.

Results over the past quarter show the stock market continuing to shrug off the economic and political uncertainties of today. The well-worn observation that the stock market is not the economy continues to resonate as stocks are based on expectations well into the future.

Bond Markets

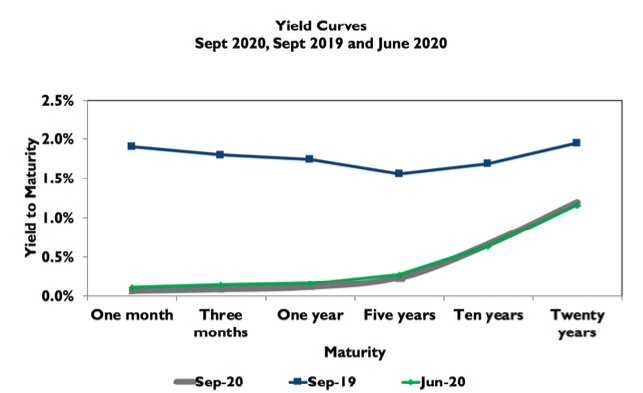

The Yield Curve below shows the pattern of observed returns from holding bonds to term across several maturities. Today, these Treasury yields go from essentially zero to a little above 1% across a twenty-year spectrum – little change from last quarter which explains the essentially flat bond returns regardless of maturity over the period. On the other hand, look how yields have fallen over the past twelve months in response to the Fed providing the market with liquidity. This change explains bond returns over the past year that run from 4% to 11% – the longer the time to maturity, the greater the return.

In response to ongoing economic uncertainties the Fed is keeping interest rates low and doing all it can to ensure liquidity. These activities result in a yield on 10-year inflation adjusted Treasuries of a negative 1%, which means investors are essentially paying the Treasury to hold their money. While these negative yields have been the case since February, it does not seem sustainable over a long period.

Dealing with Today’s Unconventional Markets

It is difficult to reconcile today’s investment landscape with established expectations – negative real interest rates; massive government spending with little impact on inflation; some stocks trading at PE ratios well above 30 times trailing twelve-month earnings; sharp discount to value stocks; large variances in returns among several markets. Today’s conditions reflect the external shock of the Coronavirus pandemic; we have fewer clues as how things might look on the other side.

Massive government spending without inflation is inconsistent with conventional wisdom. Inflation did not happen with the 2008 financial crisis and is not happening now. The view from the Fed is that interest rates and bond yields will remain low. The only way to do better is to take risk – either credit risk, interest rate risk, or liquidity risk, which oftentimes is difficult to access. Yet, because bond results remain uncorrelated with stocks, they are important to managing a portfolio’s risk. While fulfilling that role, we need to accept an essentially zero return for the time being.

The Fed’s actions mean bonds are not attractive causing investors to turn to the stock market for expected positive returns thereby increasing the demand for these assets. Today’s stock market is driven by the largest tech companies. While other markets have come back to some extent from the sharp fall-off in March, it is just these tech companies that explain much of the results of the S&P 500 Index.

With some stocks beginning to look pricey and anemic bond returns assured, there is a strong urge to take profits in stocks and move to the sidelines until the investment environment improves. History has shown this is not a good idea. Moving away from established allocations due to a worry of the investment environment is “market timing,” which everyone acknowledges rarely works out.

There is no reason to think this time is different. Yet, just like a hot fudge sundae, market timing is something you know you should avoid but it is hard to do. History tells us to establish commitments based on long-term risk objectives, rebalance regularly, but expect a bumpy ride. u

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.