Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

October 21, 2020

Market Volatility

With the general election approaching, many investors are worried about heightened volatility in the stock market. We have had several people reach out with three types of concerns: concern around an election without a clear winner (or a candidate not admitting defeat), concern around an election result different than their preference, and concern around general volatility.

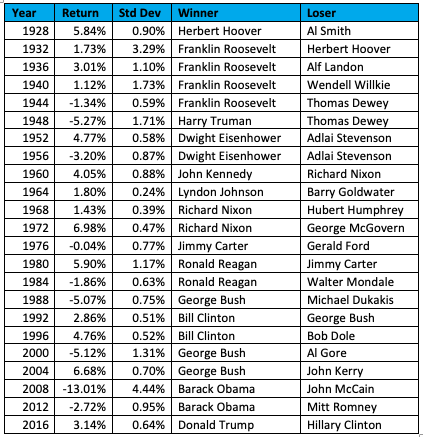

This election is unique, but so is every election. That’s what makes it “news” and news moves markets. While the news is always different, the way markets react to news is fairly steady over time. In this piece, we analyzed market behavior in the 30-day period around each election over the last 96 years.

Starting 15 days before the election (a Monday in late October) and ending 15 days after the election (Wednesday in November) we looked at returns of the S&P 500 and the standard deviation of daily moves during that time.

In the 23 elections listed above, the average return over the month is 0.72%, which is slightly behind the 0.83% we’ve seen on a monthly basis over the last 95 years. The volatility (standard deviation of daily returns) during these 505 trading days was also slightly elevated, at 1.44% per day compared to an average of 1.20% (23,310 trading days since 1926).

The volatility is 20% higher, which isn’t a meaningful difference for a month. The return averages 0.11% less but is still rather positive and the difference is far from being statistically significant.

That message probably won’t allay the fears of those who feel this particular election is too unique to be captured by historical data. Still, it should provide a degree of comfort that returns around elections have historically been positive and close to average market returns.

Two things are worth remembering. First, markets move on events that differ from expectations. The stock market didn’t drop in 1984 because Reagan was reelected or in 2008 because Obama was elected, both of those outcomes were expected. The market dropped for other reasons. Second, a company is worth the present value of all future profits. Perhaps the market will be volatile around this election, but for stocks to drop, and stay down, the market must decide expected future corporate profits are worth less.

At Rockbridge, we believe the best course is to stay invested through the election, we are recommending that to all clients and doing it with our own investments. However, if you can’t sleep at night you should reach out and have a conversation with your advisor.

Departing thoughts: I recently overheard someone intending to get out of the market now and buy back in at a lower price. They said they were hoping to “make” a little money from the trade. They should have said “win” a little money. Timing the market is a zero-sum game, and a game of chance, it’s not earned money and if the market doesn’t behave as desired money will be lost.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.