Many of our clients have been asking why the stock market has recovered so much in the last two months while the economy is shrinking, and unemployment is hitting record highs. Implied in the question is whether the stock market is “overvalued” and will drop in the near future. The stock market may drop in the future because of new information and events that have yet to happen, no different than any other day. Here we will try to put the market’s actions into perspective and provide an explanation for current share price.

The best way to look at market valuation is through fundamentals. The price of a stock, or the market as a whole, is the value of all future earnings, from now until the end of time, discounted back to today. If you’re retired and think “But I don’t have forever”, worry not because the market does and that’s what prices stocks.

Our valuation equation consists of earnings (numerator) divided by a discount rate (denominator). Earnings will be less this year, though the degree of the drop and its longer-term impact are open to debate. According to FactSet Market Aggregates, analysts are expecting a 22% decline in earnings for 2020 (still positive just smaller than 2019), with 2021 reverting to just shy of what 2020 was supposed to be. If this were to hold, and using a 12/31/2019 valuation baseline, the S&P 500 should be around 3,000 – a 2.7% discount from where it stands today. A larger decrease in earnings or a prolonged reduction in earnings growth would harm stocks further.

Earnings are only half the equation. Even a slight change to the discount rate can meaningfully alter equity valuations. Were the discount rate to drop from 8.2% to 7.7% equities would increase 9.1% in value. The most indisputable thing affecting discount rates at the moment is the drop in inflation expectations and bond yields. If inflation is lower and you’re getting a lower return from a safe investment like a treasury bond, it stands to reason the market will demand a lower return from the stock market, meaning a lower discount rate and higher stock prices.

Many think of stock market returns as an “equity risk premium” or the extra return you get by bearing the extra risk associated with the stock market. Since 1926, the S&P 500 has returned an annualized 7.3% more than inflation and 5.1% more than five-year treasury notes. At the start of the year, the 5-year treasury note was yielding 1.67%, which was about the same as 5-year inflation expectations. Now the five-year note is at 0.33% and five-year inflation expectations are 1.06%. If real bond returns are lower, you’d expect real stock returns to be lower which is manifested through a lower discount rate and higher valuations.

Some argue the market’s increased volatility should mean a higher discount and lower stock prices. This argument has merit and may be partially responsible for lower equity prices. However, others argue the recent fiscal policy of the legislature and monetary policy of the federal reserve has been faster and more accommodating than previously expected. With the government quick to intervene to protect corporate profits and prevent bankruptcies perhaps stocks are less risky than previously thought and the discount rate again should be lower.

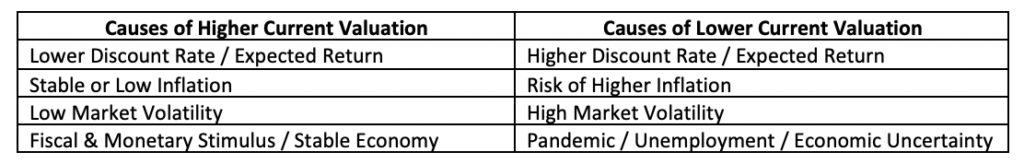

Things that decrease future risk, lead to a lower discount rate, and lower expected returns.

In the appendix of this article we run through several scenarios adjusting corporate earnings and discount rates to assess their impact on S&P 500 fair value. Some interesting observations:

In the appendix of this article we run through several scenarios adjusting corporate earnings and discount rates to assess their impact on S&P 500 fair value. Some interesting observations:

- At the end of 2019, the price of the S&P 500 Index, projected earnings (analyst expectations in the near term and historical real growth in the long-term), implied a discount rate/expected return of 8.2% over a 50-year window.

- A temporary reduction in earnings, and a slight decrease in the discount rate can explain current market valuations.

No one knows what the market will do in the coming months, but it’s wrong to think the market must go down. Things like future earnings and discount rates are impossible to know and subjective to each persons’ point of view, but it is not difficult to get to current equity values under reasonable assumptions. The following are key takeaways:

- Markets are forward-looking and move when events transpire differently than expected.

- Earnings drive prices but one bad year will not make an enormous impact as long as future years return get back close to expectations.

- The rate at which future earnings are discounted is very important. A lowering of the discount rate will cause market prices to increase substantially and there is good reason to believe the market’s discount rate is lower today than it was six months ago.

Appendix

Key Terms

Discount Rate: The interest rate used to calculate the present value of cash flows in the future.

Earnings: Corporate earnings, either of a single stock or a weighted earnings of a whole index. For all examples below, we assumed a long-term growth rate of 3.5% which represents the 2% real earnings growth rate we’ve seen over the last 140 years, plus the 1.5% current long-term inflation expectation.

PV of E: The present value of earnings are the future earnings that have been discounted back to today’s dollars by the discount rate.

Value: This is the sum of the “Present Value of Earnings.”

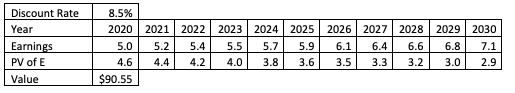

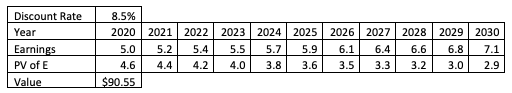

The following table shows the value of a fictitious stock that will earn $5 next year, those earnings will grow 3.5% a year, and the discount rate applied to the stock is 8.5%.

If you sum the “PV of E” (present value of earnings) for the next 50 years you get $90.55. We cut the chart after 11 years to make it fit on one page. The most sensitive variable is how much larger the discount rate is than the growth rate. In this case it was 5%. If we lowered that to 3% (say a 4.5% growth and a 7.5% discount rate) the value jumps to $126/share. If we widen it to 7% it drops to $69/share. What makes valuing stocks difficult is that no one knows future growth, or the market assigned discount rate. A critical thing to note, the discount rate is the expected return.

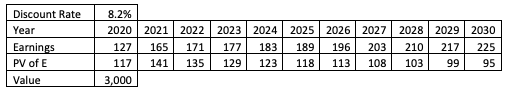

We can put this formula to practice with the S&P 500 looking back to the end of 2019. At the time, the S&P 500 was trading at 3,231 with expected 2020 earnings of 170.

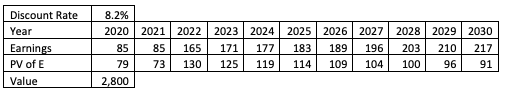

Using the same method of summing the next 50 years, we get an index value of 3,231 (the index’s close on 12/31/2019) from a discount rate of 8.2%.

With this premise in place, we can explore different scenarios. First let’s look at the consensus estimates by Wall Street analysts. They are forecasting the S&P 500 to make 127/share in 2020, with 2021 being close to 2020’s original forecast or 165/share in earnings.

Were that to happen we should see an S&P 500 valuation of about 3,000 or 1.7% below today’s prices. This is assuming no change in the discount rate. This may be what the market is expecting and how it’s currently priced.

But what if the effects of the Coronavirus are substantially greater than the market is expecting. The following scenario assumes earnings are 50% below expectations in 2020, stay at the same level in 2021, and then revert to expectations in 2022 and beyond.

We now get a fair value that is 8.2% below where the market is currently trading. To get a market valuation down in the 2,300s like we saw near the bottom in March, earnings would have to come in substantially below expectations and would need to have a lasting impact through the rest of the decade, and likely we’d need an increase in the discount rate (we revisit this later).

The prior scenarios are all assuming a change in earnings but not a change in the discount rate. If the discount rate is altered, even slightly, then equity valuations would be meaningfully changed.

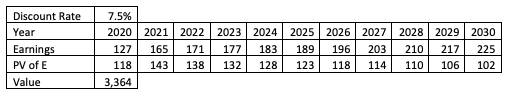

If earnings forecast came in on top of expectations, but the discount rate was lowered by 0.70% to match the decrease in the real yield of treasury bonds, we’d actually see a valuation near the record highs we saw in February.

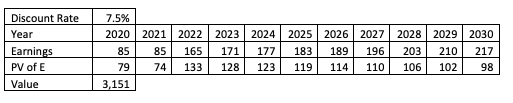

The next table incorporates a more severe earnings decrease combined with a reduction of the discount rate. The result is an equity valuation about 3.2% above what we see today.

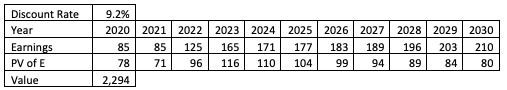

If you’re pining for an equity valuation around the lows we saw at the end of March, the following table is one way to get you there.

We’d need very depressed (50%) earnings for the next two years, followed by a year that gets us halfway back to what analysts are currently expecting for 2021. Furthermore, the discount rate would have to increase to 9.2% which would happen if investors became more nervous because of stock market volatility or if inflation were to increase substantially over expectations.

It is important to remember the relationship between discount rates, valuation, and expected returns. Most people’s Intuition would say to root for a lower discount rate in order to increase equity valuations. However, a lower discount rate means lower expected returns in the future. On the flip side, a larger discount rate would cause the market to drop, but you’d be compensated in the long run by greater expected returns going forward. For the market to do well in the long-run companies need to create wealth and make money.