The utility of living consists not in the length of days, but in the use of time.

For better or worse, many of us have had more time than usual to engage in new or different pursuits in 2020. Even if you’re as busy as ever, you may well be revisiting routines you have long taken for granted. Let’s cover eight of the most and least effective ways to spend your time shoring up your financial well-being in the time of the coronavirus.

- A Best Practice: Stay the Course

Your best investment habits remain the same ones we’ve been advising all along. Build a low-cost, globally diversified investment portfolio with the money you’ve got earmarked for future spending. Structure it to represent your best shot at achieving your financial goals by maintaining an appropriate balance between risks and expected returns. Stick with it, in good times and bad.

- A Top Time-Waster: Market-Timing and Stock-Picking

Why have stock markets been ratcheting upward during socioeconomic turmoil? Market theory provides several rational explanations. Mostly, market prices continuously reset according to “What’s next?” expectations, while the economy is all about “What’s now?” realities. If you’re trying to keep up with the market’s manic moves … stop doing that. You’re wasting your time.

- A Best Practice: Revisit Your Rainy-Day Fund

How is your rainy-day fund doing? Right now, you may be realizing how helpful it’s been to have one, and/or how unnerving it is to not have enough. Use this top-of-mind time to establish a disciplined process for replenishing or adding to your rainy-day fund. Set up an “auto-payment” to yourself, such as a monthly direct deposit from your paycheck into your cash reserves.

- A Top Time-Waster: Stretching for Yield

Instead of focusing on establishing adequate cash reserves, some investors try to shift their “safety net” positions to holdings that promise higher yields for similar levels of risk. Unfortunately, this strategy ignores the overwhelming evidence that risk and expected return are closely related. Stretching for extra yield out of your stable holdings inevitably renders them riskier than intended for their role. As personal finance columnist Jason Zweig observes in a recent exposé about one such yield-stretching fund, “Whenever you hear an investment pitch that talks up returns and downplays risks, just say no.”

- A Best Practice: Evidence-Based Portfolio Management

When it comes to investing, we suggest reserving your energy for harnessing the evidence-based strategies most likely to deliver the returns you seek, while minimizing the risks involved. This includes: Creating a mix of stock and bond asset classes that makes sense for you; periodically rebalancing your prescribed mix (or “asset allocation”) to keep it on target; and/or adjusting your allocations if your personal goals have changed. It also includes structuring your portfolio for tax efficiency, and identifying ideal holdings for achieving all of the above.

- A Top Time-Waster: Playing the Market

Some individuals have instead been pursuing “get rich quick” schemes with active bets and speculative ventures. The Wall Street Journal has reported on young, do-it-yourself investors exhibiting increased interest in opportunistic day-trading, and alternatives such as stock options and volatility markets. Evidence suggests you’re better off patiently participating in efficient markets as described above, rather than trying to “beat” them through risky, concentrated bets. Over time, playing the market is expected to be a losing strategy for the core of your wealth.

- A Best Practice: Plenty of Personalized Financial Planning

There is never a bad time to tend to your personal wealth, but it can be especially important – and comforting – when life has thrown you for a loop. Focus on strengthening your own financial well-being rather than fixating on the greater uncontrollable world around us. To name a few possibilities, we’ve continued to proactively assist clients this year with their portfolio management, retirement planning, tax-planning, stock options, business successions, estate plans and beneficiary designations, insurance coverage, college savings plans, and more.

- A Top Time-Waster: Fleeing the Market

On the flip side of younger investors “playing” the market, retirees may be tempted to abandon it altogether. This move carries its own risks. If you’ve planned to augment your retirement income with inflation-busting market returns, the best way to expect to earn them is to stick to your plan. What about getting out until the coast seems clear? Unfortunately, many of the market’s best returns come when we’re least expecting them. This year’s strong rallies amidst gloomy economic news illustrates the point well. Plus, selling stock positions early in retirement adds an extra sequence risk drag on your future expected returns.

Could you use even more insights on how to effectively invest any extra time you may have these days? Please reach out to us any time. We’d be delighted to suggest additional best financial practices tailored to your particular circumstances.

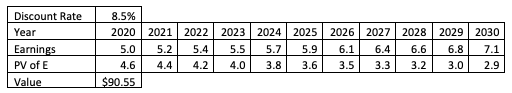

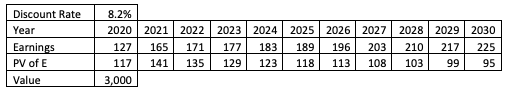

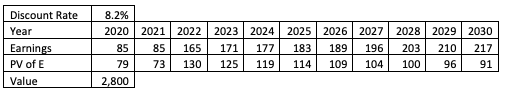

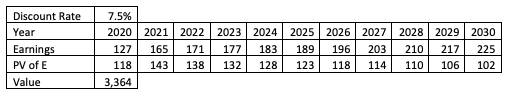

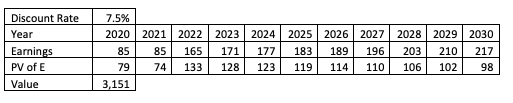

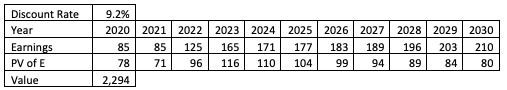

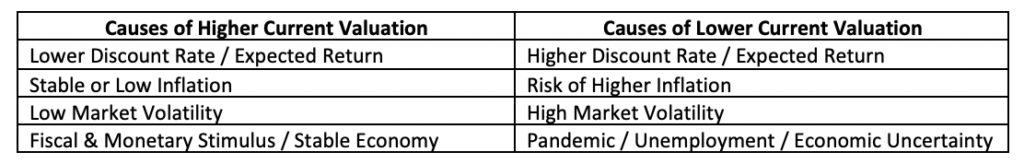

In the appendix of this article we run through several scenarios adjusting corporate earnings and discount rates to assess their impact on S&P 500 fair value. Some interesting observations:

In the appendix of this article we run through several scenarios adjusting corporate earnings and discount rates to assess their impact on S&P 500 fair value. Some interesting observations: