With much of the country in self-isolation, perhaps you’ve got time to read the entire H.R. 748 Coronavirus Aid, Relief, and Economic Security Act, or CARES Act. If you’d prefer, here is a summary of many of the key provisions we expect to be discussing with you in person (virtually), depending on which ones apply to you. Questions? Please be in touch!

In General

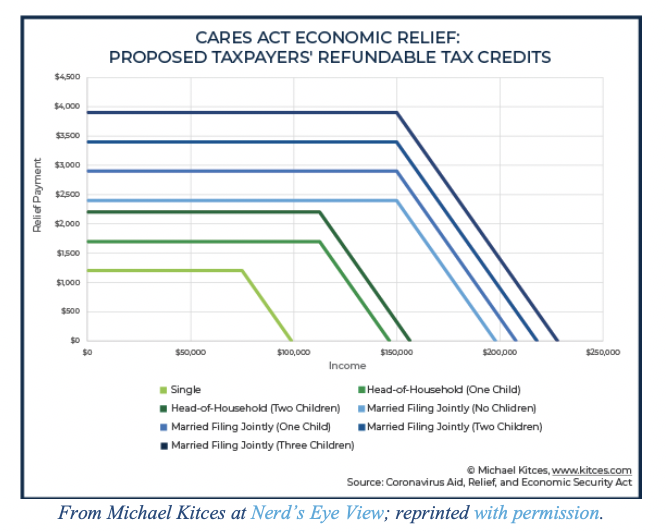

- Direct payments/recovery rebates: Most Americans can expect to receive rebates from Uncle Sam. Depending on your household income, expect up to $1,200 per adult and $500 per dependent child. To calculate your payment, the Federal government will look at your 2019 Adjusted Gross Income (AGI) if it’s available, or your 2018 AGI if it’s not. However, you’ll receive an extra 2020 tax credit if your 2020 AGI ends up lower than the figure used to calculate your rebate. This Nerd’s Eye View illustration offers a great overview:

- Retirement account distributions for coronavirus-related needs: You can tap into your retirement account ahead of time in 2020 for a coronavirus-related distribution of up to $100,000, without incurring the usual 10% penalty or mandatory 20% Federal withholding. You’ll still owe income tax on the distributions, but you can prorate the payment across 3 years. You also can repay distributions to your account within 3 years to avoid paying income taxes, or to claim a refund on taxes paid.

- Various healthcare-related incentives: For example, certain over-the-counter medical expenses previously disallowed under some healthcare plans now qualify for coverage. Also, Medicare restrictions have been relaxed for covering tele-health and other services (such as COVID-19 vaccinations, once they’re available). Other details apply.

For Retirees (and Retirement Account Beneficiaries)

- RMD relief: Required Minimum Distributions (RMDs) go on a holiday in 2020 for retirees, as well as beneficiaries with inherited retirement accounts. If you’ve not yet taken your 2020 RMD, don’t! If you have, please be in touch with us to explore potential remedies.

For Charitable Donors

- “Above-the-line” charitable deductions: Deduct up to $300 in 2020 qualified charitable contributions (excluding Donor Advised Funds), even if you are taking a standard deduction.

- Donate all of your 2020 AGI: You can effectively eliminate 2020 taxes owed, and then some, by donating up to, or beyond your AGI. If you donate more than your AGI, you can carry forward the excess up to 5 years. Donor Advised Fund contributions are excluded.

For Business Owners (and Certain Not-for-Profits)

- Paycheck Protection Program loans (potentially forgivable): The Small Business Administration (SBA) Paycheck Protection Program (PPP) is making loans available for qualified businesses and not-for-profits (typically under 500 employees), sole proprietors, and independent contractors. Loans for up to 2.5x monthly payroll, up to $10 million, 2-year maturity, interest rate 1%. Payments are deferred and, if certain employment retention and other requirements are met, the loan may be forgiven.

- Economic Injury Disaster Loans (with forgivable advance): In coordination with your state, SBA disaster assistance also offers Economic Injury Disaster Loans (EIDLs) of up to $2 million to qualified small businesses and non-profits, “to help overcome the temporary loss of revenue they are experiencing.” Interest rates are under 4%, with potential repayment terms of up to 30 years. Applicants also are eligible for an advance on the loan of up to $10,000. The advance will not need to be repaid, even if the loan is denied.

- Payroll tax credits and deferrals: For qualified businesses who are not taking a loan.

- Employee retention credit: An additional employee retention credit (as a payroll tax credit), “equal to 50 percent of the qualified wages with respect to each employee of such employer for such calendar quarter.” Excludes businesses receiving PPP loans, and may exclude those who have taken the EIDL loans

- Net Operating Loss rules relaxed: Carry back 2018–2020losses up to five years, on up to 100% of taxable income from these same years.

- Immediate expensing for qualified improvements: Section 168 of the Internal Revenue Code of 1986 is amended to allow immediate expensing rather than multi-year depreciation.

- Dollars set aside for industry-specific relief: Please be in touch for a more detailed discussion if your entity may be eligible for industry-specific relief (e.g., airlines, hospitals and state/local governments).

For Employees/Plan Participants

- Retirement plan loans and distributions: Maximum amount increased to $100,000 on up to the entire vested amount for coronavirus-related loans. Delay repayment up to a year for loans taken from March 27–year-end 2020. Distributions described above in In General.

- Paid sick leave: Paid sick leave benefits for COVID-19 victims are described in the separate, March 18 R. 6201 Families First Coronavirus Response Act, and are above and beyond any benefits received through the CARES Act. Whether in your role as an employer or an employee, we’re happy to discuss the details with you upon request.

For Employers/Plan Sponsors

- Relief for funding defined benefit plans: Due date for 2020 funding is extended to Jan. 1, 2021. Also, the funding percentage (AFTAP) can be calculated based on your 2019 status.

- Relief for facilitating pre-retirement plan distributions and expanded loans: As described above for Employees/Plan Participants, employers “may rely on an employee’s certification that the employee satisfies the conditions” to be eligible for relief. The participant is required to self-certify in writing that they or a direct dependent have been diagnosed, or they have been financially impacted by the pandemic. No additional evidence (such as a doctor’s release) is required.

- Potential extension for filing Form 5500: While the Dept. of Labor (DOL) has not yet granted an extension, the CARES Act permits the DOL to postpone this filing deadline.

- Exclude student loan pay-down compensation: Through year-end, employers can help employees pay off current educational expenses and/or student loan balances, and exclude up to $5,250 of either kind of payment from their income.

For Unemployed/Laid Off Americans

- Increased unemployment compensation: Federal funding increases standard unemployment compensation by $600/week, and coverage is extended 13 weeks.

- Federal funding covers first week of unemployment: The one-week waiting period to start collecting benefits is waived.

- Pandemic unemployment assistance: Unemployment coverage is extended to self-employed individuals for up to 39 weeks. Plus, the Act offers incentives for states to establish “short-time compensation programs” for semi-employed individuals.

For Students

- Student loan payments deferred to Sept. 30, 2020: No interest will accrue either. Important: Voluntary payments will continue unless you explicitly pause them. Plus, the deferral period will still count toward any loan forgiveness program you’re in. So, be sure to pause payments if this applies to you, lest you pay on debt that will ultimately be forgiven.

- Delinquent debt collection suspended through Sept. 30, 2020: Including wage, tax refund, and other Federal benefit garnishments.

- Employer-paid student loan repayments excluded from 2020 income: From the date of the CARES Act enactment through year-end, your employer can pay up to $5,250 toward your student debt or your current education without it counting as taxable income to you.

- Pell Grant relief: There are several clauses that ease Pell Grant limits, while not eliminating them. It would be best if we go over these with you in person if they may apply to you.

For Estates/Beneficiaries

- A break for “non-designated” beneficiaries: 2020 can be ignored when applying the 5-year rule for “non-designated” beneficiaries with inherited retirement accounts. The 5-Year Rule effectively ends up becoming a 6-Year Rule for current non-designated beneficiaries.

There. You’re now familiar with much of the critical content of the CARES Act! That said, given the complexities involved and unprecedented current conditions, there will undoubtedly be updates, clarifications, additions, system glitches, and other adjustments to these summary points. The results could leave a wide gap between intention and reality.

As such, before proceeding, please consult with us and other appropriate professionals, such as your accountant, and/or estate planning attorney on any details specific to you. Please don’t hesitate to reach out to us with your questions and comments. It’s what we’re here for.

Reference Materials:

- DWC News Update, The CARES Act: Federal Coronavirus Relief. March 30, 2020.

- Financial Planning, “Major changes in RMDs and retirement contributions in $2T stimulus plan,” Ed Slott, March 27, 2020.

- H2R CPA, “Cares Act will provide billions of dollars of relief,” March 27, 2020.

- R. 748: Coronavirus Aid, Relief, and Economic Security (CARES) Act.

- Nerd’s Eye View, “Analyzing The CARES Act: From Rebate Checks To Small Business Relief For The Coronavirus Pandemic,” Jeffrey Levine, March 27, 2020.

- The Wall Street Journal, “How the Coronavirus Paid Leave Rules Apply to You,” Charity L. Scott, March 27, 2020.

- ThinkAdvisor, “3 Stimulus Bill Provisions Advisors Should Act On Now: Jeff Levine,” Jeff Berman, March 30, 2020.

- S. Chamber of Commerce, “Coronavirus Emergency Loans Small Business Guide and Checklist.”

U.S. Small Business Administration, Paycheck Protection Program and Disaster Assistance