It’s common for investors to feel nervous when looking at investments by themselves. Are you saving enough? Are you saving in the right place? Are you holding the right mix of investments? Should you own individual stocks or funds? Are you paying too much in fees? What are you actually paying in fees? For the average investor, this is enough uncertainty to make someone feel uncomfortable, and this isn’t even the whole picture.

Dealing with a pension can seem daunting too. How does my retirement date affect my payout? When should I claim my benefit? Should I take the lump sum or the annuity? What, if any, survivorship benefit should I select? The same goes for Social Security: When should I collect? When should my spouse collect? Will I get the full amount promised to me once I retire?

Any of these items, in a silo, is enough to make an investor nervous. Add them together and you get anxiety. When investors are nervous, they are more likely to make mistakes. That’s where Rockbridge comes in. We can help you answer these questions by framing your financial decisions in a comprehensive financial plan.

Numerous studies have shown investors harm themselves when they act impulsively. This boils down to investors holding cash because they are afraid of the market declining. This may be when the market is at an all-time high and they’re afraid of a correction, or when the market is rapidly falling and the person is worried it will go to 0.

In reality, neither is certain and no one knows what the next day will entail. However, we do know markets go up over time, and every day you hold cash is a day you’re missing out on the next incremental gain.

As advisors, we’ve found investors are less likely to make mistakes or act impulsively when they see their investments as part of a larger plan. Knowing the role each piece of the puzzle plays is helpful in reducing the stresses of personal finance, and makes one more likely to adhere to a course of action that is in the person’s best interest. It can be hard to forego income when you’re middle aged, but understanding the benefit of saving in your 401(k) makes this more doable.

Perhaps a family has a large fixed pension that, combined with Social Security, covers all their living expenses right as they retire. Their investment savings will become important over time as inflation erodes the value of the fixed pension. Knowing this helps a family stay the course when the stock market is volatile.

Alternatively, a person might need to rely heavily on their portfolio in their early 60s while they wait to take Social Security and receive a small inheritance. This investor will want a less risky allocation to protect against large declines in the stock market. They should also stick with their plan and not pursue a riskier allocation because they think the market is about to shoot up. This person’s portfolio plays a much different role than the portfolio of the family in the previous paragraph, despite being close in age.

This is all not to say plans can’t change. For example: Someone is 68 and delaying their Social Security to claim a larger benefit; if the stock market drops 50%, the course of action giving them the highest probability of success might be to claim Social Security now and not draw down on an investment account while stocks are at depressed levels. These decisions shouldn’t be done impulsively. They should be well thought out and analyzed with mathematical probabilities to ensure that an unemotional, best course of action is being pursued.

No commentary or article you read is going to be perfectly relevant to you because every situation is unique. Investors are best served when they have a plan they buy into that addresses all facets of their financial life. This improves mental well-being and helps families avoid mistakes that can be costly. Rockbridge can help you look at the whole picture and guide you in making the important financial decisions.

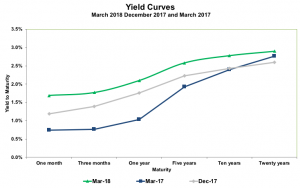

ice how yields on shorter-term Treasury securities moved up. These shifts explain the negative annual returns on bonds of shorter maturities and positive returns on bonds of longer maturities.

ice how yields on shorter-term Treasury securities moved up. These shifts explain the negative annual returns on bonds of shorter maturities and positive returns on bonds of longer maturities.