Rockbridge

April 23, 2018

AllInvestingNews

Market commentary – april 2018

Stock Markets

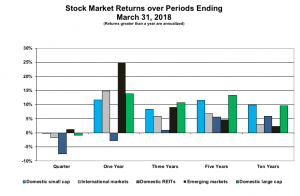

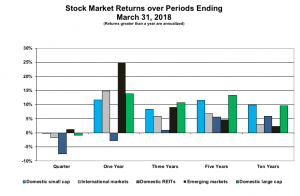

Returns from various stock market indices over several periods ending March 31, 2018 are shown to the right. Here are a few highlights:

- While not observed in these graphs, volatility seems to have come back, which is normally how stock markets work.

- Except for emerging markets, stocks were down over the past quarter – REITs continue to lag.

- Even with the off quarter (with the exception of REITs), stocks were up nicely over the past twelve months.

- Note that over the past five and ten years, returns from stocks traded in domestic markets were well above those in non-domestic markets. However, don’t let these results fool you. Diversification to non-domestic markets is still important to long-term success.

Bond Markets

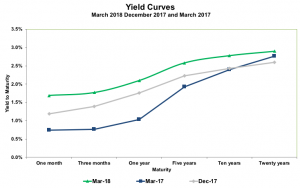

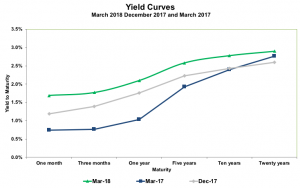

The Yield Curves to the right show the yield to maturity of U.S. Treasury securities over several maturities, from the short term (one month) to the long term (twenty years).

- Look at how the curve has moved since the beginning of the year. It is essentially showing a parallel shift upward. As yields move up, prices and returns go down. Consequently, we realized negative bond returns this past quarter – the longer the maturity, the greater the loss.

- Now look at the changes since a year ago. Yields for longer maturities did not change much over the past year and, in fact, fell between March and December. Not

ice how yields on shorter-term Treasury securities moved up. These shifts explain the negative annual returns on bonds of shorter maturities and positive returns on bonds of longer maturities.

ice how yields on shorter-term Treasury securities moved up. These shifts explain the negative annual returns on bonds of shorter maturities and positive returns on bonds of longer maturities.

- The Yield Curve got flatter over the past year. The Fed’s activities have increased short-term yields without much effect on longer-term bond yields. Generally, longer yields are driven by the expectation of future short-term interest rates and inflation. Today’s Yield Curve implies lower interest rates in the future – quite different from both the announced goal of the Fed and what is usually experienced in a robust economy.

ice how yields on shorter-term Treasury securities moved up. These shifts explain the negative annual returns on bonds of shorter maturities and positive returns on bonds of longer maturities.

ice how yields on shorter-term Treasury securities moved up. These shifts explain the negative annual returns on bonds of shorter maturities and positive returns on bonds of longer maturities.