Each month, the Federal Open Market Committee (FOMC) issues its position on the current economic conditions and outlook on future forecasts and projections. The main areas of focus are inflation, unemployment and interest rates. Here are a few takeaways from Chairman Jerome Powell’s press conference:

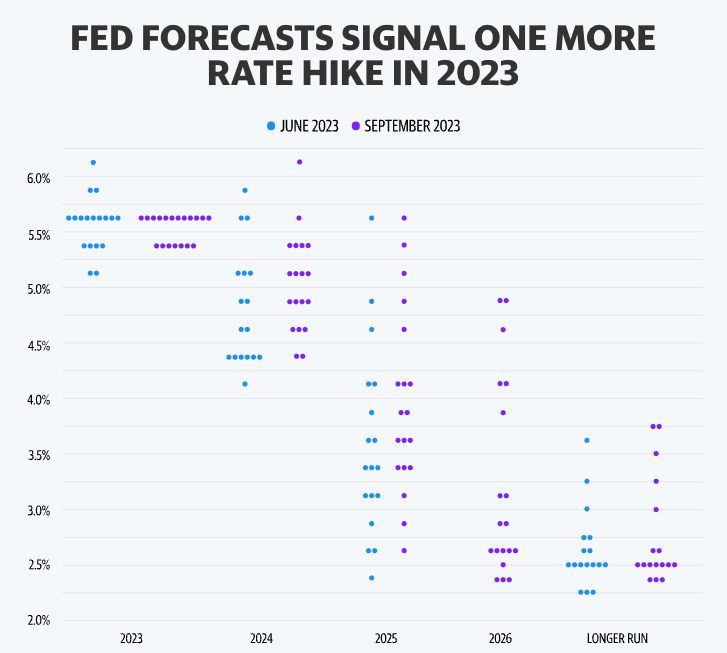

- As predicted, the FOMC voted to hold the federal benchmark overnight interest rate at its current range (5.25% – 5.5%). They are anticipating rate decreases in 2024 and 2025. However, the Fed “dot plot” (below) shows an expectation of slower decreases than originally discussed at previous meetings (chart from Yahoo Finance).

- Rate predictors anticipate one more hike by the end of this year. However, this is not a unanimous decision, with seven out of nineteen committee members opting to keep rates steady to finish out the year. Ultimately this decision will be driven by how the economy performs between now and the end of 2023.

- Some of the risks affecting the outlook of the economy noted by Powell were the United Auto Workers strike, a potential government shutdown, the beginning of student loan repayment, high energy and oil prices, and increase in long-term borrowing costs. All of these factors will play an important role in the Fed’s future decision making.

- Powell also addressed the growing frustration with inflation. Some current inflation measures remain more than twice the Fed’s optimal level of 2%. The Fed’s commitment to decreasing inflation is one of the primary reasons that interest rates currently remain steady.

- Although most people were predicting a recession, the incoming data shows a resilient economy. Economic growth remains strong and unemployment is still close to record lows. One of the key reasons for this is demand across the US economy remains solid and consumer spending is up.

- The updated economic projections seem to indicate a “soft landing,” even though Powell emphasizes there is still uncertainty about making it their baseline. A soft landing means the FOMC’s goal is to bring inflation down while maintaining maximum employment and ultimately avoid a recession.

Overall, the Federal Reserve is attempting to “proceed carefully” with future policy moves while attempting to combat inflation without impacting jobs. The next FOMC meeting will be held October 30 – November 1. Contact your Rockbridge advisor if you have any questions or concerns.