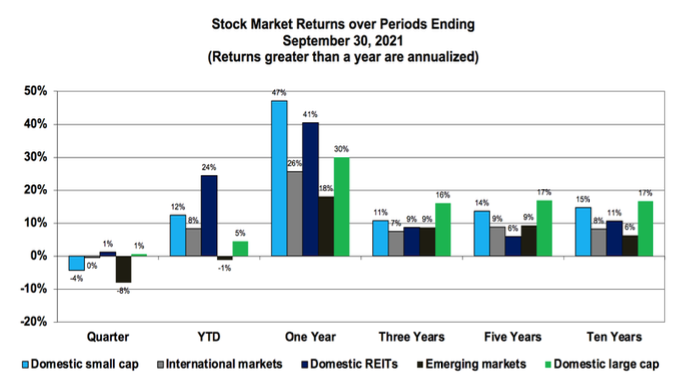

Stock market returns were mixed in the third quarter. Microsoft, Google and Apple led returns in the domestic large-cap stock market; stocks traded in international developed markets and REITs were also positive. The riskier domestic small-cap and emerging market stocks posted negative results, which dragged a portfolio diversified among all these markets down over 2% this quarter.

On the other hand, over the past year, we saw results that were well-above long-term averages. One-year returns from emerging markets range from 18% to nearly 50% in domestic small-cap markets. While clearly a great period and necessary to offset the sharp fall off in the first quarter of 2020, these one-year returns are not sustainable.

Equity investors with a sustained allocation were rewarded over longer periods as each of these markets earned a consistent return of about 11% in each of the three-, five- and ten-year periods. All in all, it was a good period for stocks, which includes the impact of a 100-year pandemic.

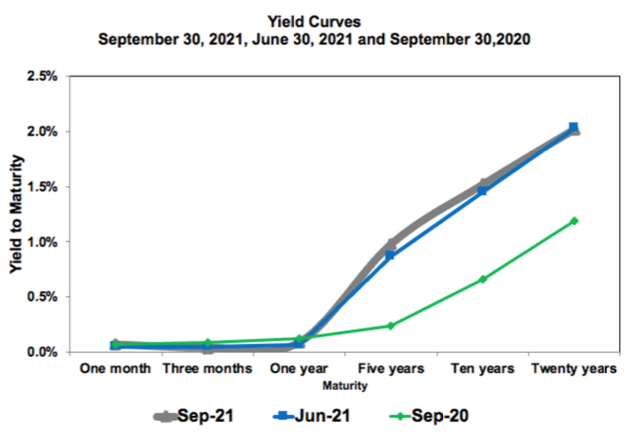

Bond Markets

The Yield Curve to the right illustrates the pattern of observed returns from holding bonds to term across several maturities. Today these yields go from essentially zero to about 2% across a twenty-year spectrum. Yields remained low and didn’t change much over the most recent quarter, reflecting the Fed’s desire to continue to stimulate the economy by keeping rates low. Over the past year yields at the longer end increased, which had a negative impact on bond returns – an index of longer-term Treasury securities maturing between 7 and 10 years lost 4.3% over the last twelve months.

Capital Market Signals

A steadily rising stock market and negative real bond yields are not the signals we expect from capital markets. Models of stock behavior tell us that prices reflect available information about cash flows over an uncertain future, which as new information unfolds will cause them to move up and down randomly. Additionally, we have always thought that people must be paid with a positive expected return to give up consumption to invest. A consistently increasing stock market and negative bond yields are inconsistent with these models of capital market behavior.

One thing that is different this time around is that the Fed has become a major player in capital markets. Through its Quantitative Easing programs in response to the financial meltdown in 2008 and the Covid-19 pandemic in 2020, it has purchased massive amounts of U.S Treasury and mortgage-backed securities – it holds over $8.0 trillion of these assets on its balance sheet today. This activity not only reduces the downside risk to stockholders, but also has driven nominal interest rates to zero. Knowing the Fed stands ready to provide liquidity to lessen the impact of economic shocks creates a willingness for investors to take on risk. The moral hazard from the Fed’s activities helps to explain the steady rise in stock prices. Additionally, negative bond returns mean stocks are relatively more attractive.

The Fed continues to signal the continuation of the current monetary policy, although it may soon begin to “taper” its monthly bond buying program. It is not clear what will result in the Fed being less involved in capital markets and what penalties will be paid from either continuing to be a major player in markets or moving away from its dominance.