2018 was a woeful year for investing. All major stock market indexes were down, bonds enjoyed a year-end rally to finish flat, and commodities such as gold and oil fell. Seeing all asset classes drop in unison is unusual and unlikely to continue.

Stocks

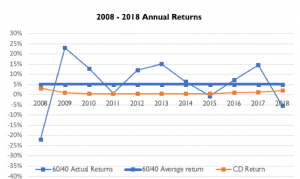

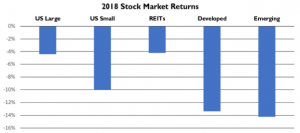

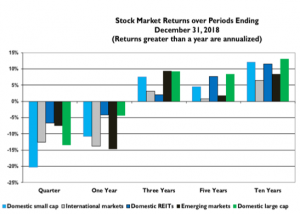

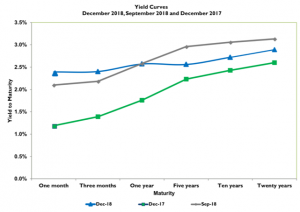

Stocks began the year on solid footing, but fortunes quickly changed as early February saw a 10% drop in equities. Markets steadied over the spring and summer, with domestic stocks reaching new highs in the early fall. And then the 4th quarter happened. All equities suffered substantial losses. In aggregate, U.S. Large Caps and REITs were the best performers of 2018, followed by U.S. Small Caps, and then International Stocks.

2018 was a poor year for International Stocks, but Emerging Markets are still the best performer over the last two years (after being up 38% in 2017). December was a reminder of why we stay diversified. While U.S Stocks were down 10%, International Developed lost 4.8% and Emerging Markets lost 2.6%. Again, we see diversification help to dampen volatility.

Bonds

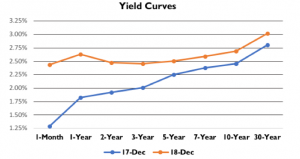

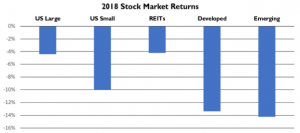

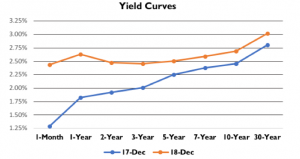

Yields rose in 2018 and the curve flattened substantially. The Federal Reserve hiked rates four times last year as they viewed a strong economy and a tightening labor market reason enough to aggressively unwind their accommodative monetary policy. The U.S. 5-Year Treasury, a good proxy for our Bond holdings, began the year with a yield of 2.25%, before selling off to reach a high of 3.09% in early November. At that point, the aggregate bond market was down 3% for the year and it looked certain we’d finish the year negative for the 4th time in the index’s 43-year history. But a 58 basis point rally in the final two months spared Bonds, allowing them to finish 2018 with a positive return of 0.01%.

The yield curve is now the flattest it’s been in a decade. The 1-Year Treasury Bill is yielding more than the notes maturing in 2-7 years. It appears the market is pricing in one more hike in interest rates, followed by a few cuts from the Federal Reserve. These cuts could come as a result of a recession or simply because global growth slows (but doesn’t contract) and inflation softens below the Fed’s goal of 2%.

Near Bear Market

On Christmas Eve, the S&P 500 closed down 2.7%, ending a 7-day stretch where stocks lost 11.3% of their value. That selloff put us on the cusp of a “bear market” meaning a drop-in price of 20% or greater from a previous high.

The causes of the selloff are numerous. America and China are involved in a growing trade war, the Fed is raising interest rates, analysts lowered global GDP growth estimates, manufacturing activity is below expectations and our government is in a shutdown with no end in sight.

On top of that, we’ve had a record long 10-year run of strong stock market performance and economic expansion that is the second longest in history. It seems there is plenty to be fearful of. Our cognitive biases aren’t helping. Some of us may be experiencing recency bias. In the last 30 years, the only two times the market has dropped more than 20% were because of the dot-com bubble and the financial crisis. In those instances, we saw the market sell-off 49% and 57% respectively. Being 20% off the highs investors think, “I know what happens next.” The next logical question is– shouldn’t we sell out of stocks now, wait until the market falls 50% and buy back in? But just because that’s how the last two drops have happened doesn’t mean this one will be the same. It’s possible the bottom of the market will be a 21% selloff, or 23%, or 27%, or 32%. Or it’s possible that the bottom was the 19.78% we saw on December 24th.

Some of us also suffer from negativity bias; we remember the things that ended poorly but forget instances where things turned out well. In 2011, the market was in the middle of its recovery from the financial crisis when cracks began to appear. Greece was heading towards bankruptcy and there were concerns the Eurozone would break apart. Bank of America was experiencing extreme volatility, and some feared they may be insolvent. High-profile investors such as Ray Dalio, who predicted the 2008 crash, were warning of a “double-dip” recession, pushing markets back to levels in 2008 & 2009. In the five months from May until October, the market sold off 17%. But the crash never came. Greece and the rest of the EU didn’t implode, Bank of America got a $5 billion investment from Warren Buffet, and the economy kept chugging along.

The same fear investors feel about the market today they could have felt in 2011. But we forget 2011 and remember 2008, though there is no reason to think that 2019 will be like 2008 and not 2011 (throughout history there have been a lot more 20l1’s than 2008’s).

2019 and Beyond

We do not know what the stock market will do in 2019, and neither does anyone else. Despite the pessimism in the markets and in the media, there are plenty of reasons to feel good about stocks. America’s economy is expected to grow at 2.3% and the broader world is expected to grow at 3.0%. 2018 ended with a very strong jobs report as wages and hiring continues to be robust. Perhaps most promising of all was an increase in the labor force as those who had previously not been looking for jobs re-entered the market.

Every Wall Street Bank that puts out a price target for the S&P 500 is predicting a positive year in 2019. The average earnings for the S&P 500 are expected to be $173. With a 2018 close of $2,507, that works out to a forward P/E of 14.5, which is low by historical standards meaning stocks are currently a good value. This puts equities on par with where they were at the start of 2013 – that year the market rallied 34%.

We don’t know what next year and beyond have in store for stocks, but we do know over time it pays to be invested. Investing in the market isn’t easy which is why it pays so well in the long-run. Volatility like we saw in the last quarter causes people to sell out of stocks. This is beneficial to the disciplined investor as there are fewer people with whom he or she has to share corporate profits.

The best thing a person can do is find the right mix of stocks and bonds that fits their individual needs and then stay the course. And lastly, if the market closes next year right where it started at $2,507, your return won’t be 0, you’ll have made 2.2% because companies pay dividends!