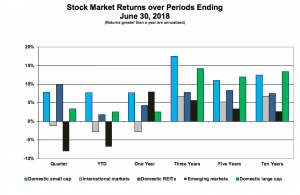

Stock Markets

Returns from various stock market indices over several periods ending June 30, 2018 are shown to the right. Here are a few highlights:

- Domestic stocks continue to lead the way. REITs were up nicely for the quarter, but non-domestic stocks were down. Due to political turmoil and the specter of a trade war, stocks traded in developed international markets are reflecting uncertainty.

- Emerging markets gave back much of their positive result of recent periods. This is driven by increasing interest rates and the strength of the dollar.

- Returns from domestic small-cap stocks have done well over these periods.

- Look at the variability among the different markets over the shorter periods and how it tends to even out over longer periods. Keep in mind: ten years in capital markets is a short period over which there can be plenty of anomalies.

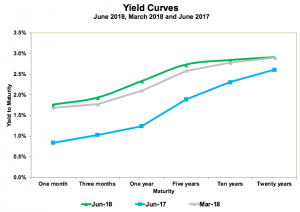

Bond Markets

The Yield Curves graph to the right shows the yield to maturity of U.S. Treasury securities, from short-term (one month) to the long-term (twenty years). Recent changes in these curves are presented below. Note:

- Look how short-term yields have climbed over the past year with little change in longer-term yields. As yields move up, prices and returns go down.

- There is not much change over the quarter. Notice the flatness of today’s yield curve – hardly any difference between 5-year and 10-year yields. A flat yield curve is generally an indicator of a difficult economic environment ahead.

- While there is no sign of it yet, it seems reasonable to expect increasing inflation due to the introduction of tariffs, plus today’s robust economy and low unemployment. Expectations of increasing inflation should produce higher yields for longer-term bonds.