This past weekend, the New England Patriots did it again. Down 10 in the 4th, star quarterback Tom Brady orchestrated two scoring drives to pull off another comeback victory. In two weekends, the Pats will try to win their 3rd Super Bowl in 4 years – headlining a host of impressive statistics dating back to 2001.

But as loyal CNYers, we know this run will come to an end. Brady, already 40 years old, will age, coach Belichik will retire, and the Bills and Giants will once again meet in the Super Bowl.

We’ve seen it in other sports: The UCLA Bruins under Wooden, the Celtics with Bill Russell, and the Yankees in the 1950s. Teams have great runs, but sooner or later they have losing records. This pattern transcends most facets of life. When we perceive something to be at a peak, we say it’s only a matter of time before it’s worse than it is today.

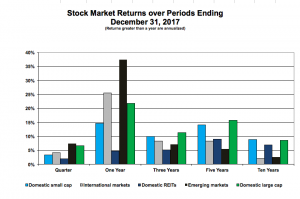

The stock market doesn’t play by these rules. It’s normal to think because the market is at an all-time high it must go down, but it mustn’t. The stock market and the Patriots have enjoyed similar recent success, but they will have different futures.

Markets go up over time. Since 1978, we’ve had 40 “year-ends.” Money invested in the S&P 500 has hit a new end-of-year-high in 27 of those 40 years. Having the stock market trading at or near an all-time high isn’t cause for panic; it’s common!

We just hit our sixth consecutive year of a new high. This is a great stretch, but in the 80s and 90s we saw runs of eight and nine years respectively. The current run could last for 12 years, or it could end this next year.

No one knows for sure what the market will do, but cash is a poor long-term investment and the stock market has rewarded those who stuck with it through the ups and downs. $1 invested 40 years ago is worth $80 today.

While markets go up over time, they do have temporary periods of declines. As investors, we need to determine the right diversified mix of stocks and bonds that allows us to benefit from being invested while protecting us when times are bad.

And when the stock market inevitably performs poorly, Tom Brady will be jealous. For unlike Mr. Brady, the stock market’s best days are still to come, but Brady is better now than he will be at 45. Well it’s Tom Brady, let’s say 50 to be safe.