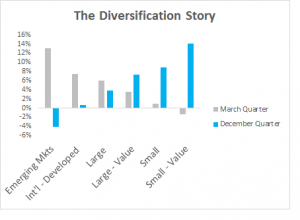

The accompanying chart illustrates the diversification story. It shows returns in several markets over both the March and December quarters. The upward sloping blue columns of the December 2016 quarter show an increase from the low (4% loss) in emerging markets to the high (14%) for the market of small-cap value stocks. Note the variability of returns in these different markets. Now, look at the gray columns of the March quarter and how they decrease across the same markets from a high (13%) for emerging markets to a low (1% loss) for small-cap value stocks. Just the opposite is happening. If you couldn’t predict how these different markets would fare, then to achieve the positive returns stock markets provided over the last two quarters, you had to have commitments to each. This is the diversification story.

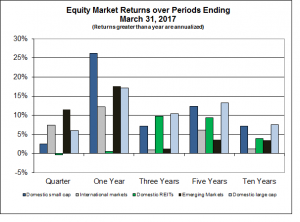

A longer perspective is provided in the accompanying Equity Market Returns chart. As you can see, the variability among the different markets tends to lessen over longer periods. Yet, even over the ten years, variability remains. Generally speaking, ten years is a short period in capital markets, and it takes courage to rema in committed to markets that have produced below average returns for ten years. The fact that international developed markets have languished over the past ten years tells us very little about the future in this market sector.

in committed to markets that have produced below average returns for ten years. The fact that international developed markets have languished over the past ten years tells us very little about the future in this market sector.

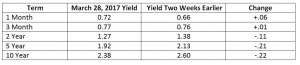

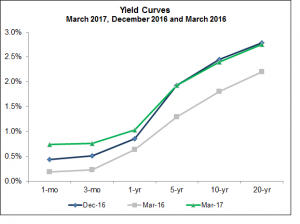

Bond Markets

A Yield Curve shows bond yields across a spectrum of time to maturity. These curves can be useful for both providing some sense of what is expected for future interest rates and understanding recent changes. One thing we see this time is a persistent increase in yields across shorter maturities over the three periods. These changes reflect what the Fed has been doing to increase rates. While yields of longer-term bonds have increased since March 2016, primarily in response to the Election, there is little change over the last quarter even in the face of increasing short-term rates. Changing expectations for future inflation helps to explain this lack of movement in longer-term yields.