There is much talk and concern about increasing interest rates, which will not be good for bond performance. Below are responses to some of the specific questions we have received from clients.

Q: Why have interest rates increased since the election?

A: Many of the ideas put forth by President-elect Trump are perceived to be inflationary. Spending more on infrastructure and defense while cutting taxes would increase the federal deficit and create inflationary pressure.

Q: The Federal Reserve recently increased the federal funds rate and says it will likely do so again in 2017. Is this the beginning of a long-term upward movement in interest rates?

A: Not necessarily. The Fed has limited control over interest rates, particularly longer-term rates. The Fed sets the federal funds rate, which determines the cost for banks to borrow and lend money overnight. Other interest rates are determined by investors in the market. When markets expect higher inflation, there is upward pressure on interest rates, and because markets anticipate the future, the increase in rates can occur well before the deficits or actual inflation appears. The longer-term trend depends on how those expectations change in the future.

Q: What are “normal” interest rates, and when might we see them again?

A: Historically, short-term rates tend toward a level that offsets inflation, so an investor leaving money in a money market account does not earn much, but avoids the loss of purchasing power due to inflation. If inflation is around 2%, normal short-term rates might be 2-3%, which is consistent with Fed expectations. Minutes from the December meeting of the Federal Open Market Committee say members expect “that the appropriate level of the federal funds rate in 2019 would be close to their estimates of its longer-run normal level” and their projections were 2-3%. Investors need an incentive to tie up their funds for longer periods, and they tend to expect 2-3% more than money market returns, so “normal” for ten-year treasury bonds might be 4-6% when inflation is around 2%.

Q: Why have some of my bond funds lost more value than other bond funds?

A: The value of long-term bonds is affected more than the value of short-term bonds when interest rates change. This is a simple economic reflection of opportunity cost – if your money is in cash when rates rise, you can take advantage of higher rates right away, but if your money is tied up in a long-term bond, you have to wait for it to mature. The fact that you will earn less while waiting for the bond to mature is reflected in the immediate change in value. If another investor buys the bond from you at the reduced market price, their return reflects the new higher interest rate. Bond funds reflect the change in market value so investors can get in and out of the fund without harming other shareholders.

Q: Do the recent declines in value reflect a permanent loss in the value of my bond funds?

A: Not really. Like in the example above, the bond fund is just a collection of individual bonds with different maturities. If one of the underlying bonds is held to maturity, it still returns the face value and the interest earned is equal to the amount originally “bargained for.” The lower market value reflects the fact that new investors demand a higher return over the remaining life of the bond because interest rates are now higher. The past year provides an interesting example. On January 1, 2016, the yield on a total bond market index fund was around 2.5%. Rates dropped, and by the end of September, bond funds were reporting year-to-date returns of 6%, because bond prices had increased. Post-election interest rates jumped, bond values dropped, and bond funds ended the year with returns of about 2.5% for the year. For long-term investors the unrealized gains and losses are not permanent – they are just a reflection of the changing opportunity cost of holding bonds rather than cash that can be reinvested immediately.

Q: Given that we don’t know where interest rates are headed, or how soon we might get back to “normal,” how should my fixed income portfolio be structured?

A: The specific answer always depends on your specific situation, but generally we think markets are still the best prediction of the future – sometimes a poor prediction, but the best we have. So we think investing in bonds is important to provide stability to your portfolio, and taking the interest rate risk of the total bond market is likely to provide modest, positive returns, with reasonable levels of volatility.

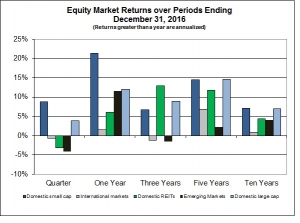

aded in international markets and emerging markets have not fared as well in this period, reflecting a strengthening of the dollar. This means a globally diversified stock portfolio would not have done as well as what might be implied by the media hype.

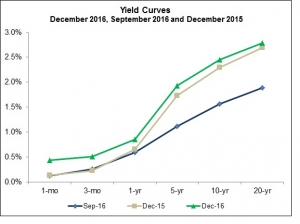

aded in international markets and emerging markets have not fared as well in this period, reflecting a strengthening of the dollar. This means a globally diversified stock portfolio would not have done as well as what might be implied by the media hype. ds at the short end are consistent with the Fed’s recent vote to increase short-term rates; the increases over longer periods have more to do with expectations for economic growth and inflation.

ds at the short end are consistent with the Fed’s recent vote to increase short-term rates; the increases over longer periods have more to do with expectations for economic growth and inflation.