Stock Markets

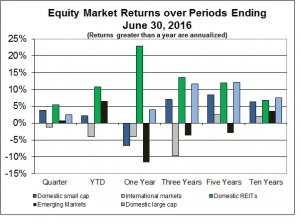

Just look at the short-term variability in the various equity indices shown in the accompanying chart. It shows how markets behave through time – some markets are up substantially while others are down. Of course, this variability is reduced by holding a commitment to each, but it means periodically enduring down markets while appreciating the positive results of others.

Look at the ten-year period where all equity indices are positive. Even in this relatively long period, proxies for international developed markets and emerging markets stand out as below average. While we have had to deal with an extended down period in these markets, it is not indicative of what the future holds.

markets and emerging markets stand out as below average. While we have had to deal with an extended down period in these markets, it is not indicative of what the future holds.

Financial markets continue to deal with the turmoil from Britain voting to exit the European Union. First lurching down on the news, then, except for British markets, back up to where it now seems that financial markets have generally incorporated the initial shock in a reasonable fashion. Domestic stocks ended the quarter up about 3%; stocks traded in developed international markets down 1%; emerging markets up nearly 2%. Year to date a globally diversified stock portfolio would not have fared too badly either – gains in emerging markets generally offset losses in international developed markets. This time around diversification to emerging markets, REITs and bonds cushioned the immediate impact of today’s uncertainties.

Bond Markets

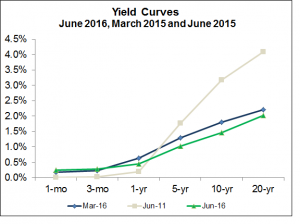

The bond market story is told in the yield curves chart. Look at how short-term yields have generally increased, while yields of longer maturities have dropped. The change in short-term yields reflects the Fed’s beginning to increase interest rates, and longer-term yields are consistent with the so-called “flight to safety” in the face of global uncertainties and negative interest rates. (U.S. Treasuries are still providing a positive return, increasing their demand.)

Once again, the Fed announced that they would delay their program to increase interest rates – too much uncertainty in global markets they say. I wonder when global uncertainty will dissipate – there will always be something.

Credit spreads – the difference in yield between corporate bonds and Treasury securities – narrowed over the quarter explaining a premium for bearing the credit risk of corporate bonds versus Treasury securities. While narrowing credit spreads is contrary to the reduced appetite for risk, it is consistent with market participants searching for yield in today’s low (negative) interest rate environment.

Brexit

On June 23rd, 52% of British voters thumbed their nose at the European Union to say: “We’re out of here!” This action is going to usher in change. Of course, anytime the status quo is upended, get ready for a lot of uncertainty as things get sorted out. As always, the best strategy to deal with this turmoil is to periodically rebalance allocations back to an established risk profile – taking advantage of “buying low and selling high.”

The British vote surprised many. Now we start the process of “putting as much of the toothpaste as possible back into the tube.” This will produce more surprises – some positive, others negative – all independent of the Brexit vote. So far, financial markets seem to have handled the uncertainty reasonably well.

While Brexit didn’t seem to have much of an impact on financial markets, the vote is important nonetheless. Brexit is a first cousin to the Trump phenomenon here. Both reflect a repudiation of the ideas and programs of the so-called “Establishment.” The data is reasonably clear that not everyone has shared the benefits of globalization, technological change, immigration, etc. A lesson of the Brexit vote as well as the success of Donald Trump and Bernie Sanders is that there is an underlying discontent with economic and cultural changes that better not be ignored