Stock Markets

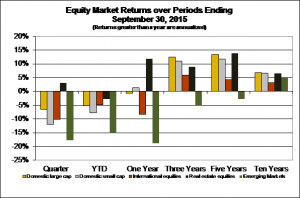

The chart to the right shows what we have had to put up with recently: all but REITs were down for the quarter (all were down since the beginning of the year), and emerging markets were downbig, showing variability over the trailing twelve months. These periods remind us that markets do go down, but this is what it means to accept risk.

Stock markets reflect the uncertainty of today’s economic environment, which includes the slowdown in China’s economy, the short-term impact as well as the longer-term sustainability of the sharp fall-off in the prices of energy and other commodities, and the effects of the Fed unwinding its easy monetary policy of the last seven years. The impact of all of these factors on emerging market economies is especially worrisome and helps explain the sharp fall-off in those markets.

Perhaps the sharp fall-off in markets is a repricing of uncertainty. Yet, all of these things have been pretty well known for some time. The upheaval in just the last couple of months is somewhat a mystery, but is oftentimes how markets work. Diversification has not been helpful in recent periods – most everything is down. All that having commitments to bonds got us was avoiding losses, which, I suspect, is the best we can expect for a while. Yet, I don’t know a better alternative than remaining committed across the board based on established tolerances for risk. It is the best way to deal with market volatility and the unknowable future.

Bond Markets

Bond markets were about flat for the quarter but up a bit year-to-date. While providing some respite from recent losses from stocks, this is about what we can expect.

Interest rate increases – feels like we’re “Waiting for Godot”! The Fed seems to be poised to raise interest rates, which has been the case for a long time now. This is beginning to take on some of the characteristics of the play “Waiting for Godot”, by Samuel Beckett. I can’t help but wonder if “Godot” will ever get here, although I’m sure the Fed will eventually raise rates. While many blame this uncertainty on what’s happening in today’s markets, it’s hard to imagine a 0.25% increase will cause much of an upheaval once it is digested. But, it does reflect a change in policy that could result in dislocations. We’ll see.

Emerging Markets

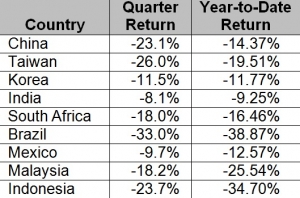

Emerging markets were off more than 17% in the quarter and year-to-date. A diversified emerging market portfolio includes allocations to over fifteen countries ranging from China (16%) to Chile (2%). Using Exchange Traded Funds as proxies, the accompanying table shows the quarter and year-to-date returns in the countries that dominate (86%) the portfolio. Note the evidence of contagion among emerging market economies as all experience a sharp fall-off in the September quarter. And, in most instances, it was these results that dragged the year-to-date returns into negative territory.

It seems clear that investors in stocks of emerging market countries have adjusted to the uncertainty of today’s global economy. We will have to wait and see whether they have gone too far. In the meantime, participation in the risks and returns of this asset class – which makes up about 14% of worldwide stock markets – is important to a well-diversified stock portfolio.

Predictions and Descriptions

At times such as these, everyone seems to be telling us to get ready for tough times ahead. Maybe, but market prices anticipate the future about which uncertainty always abounds. Price changes are driven by surprises. You can’t predict surprises!

While the causes are constantly changing, if we accept that how market participants deal with an unknown future is consistent, then we can use past behavior to describe the future in terms of both what’s expected and, importantly, a well-defined range of possible outcomes. The range for most stock markets is quite large – exceeding an annual rate of plus or minus 16% two-thirds of the time.

Stock market participants always expect positive outcomes. Prices are established from arm’s length transactions by traders satisfied to buy from traders equally satisfied to sell. Neither would trade unless they expected a positive result. Of course, in the short run there will be winners and losers. But, for them to continue to play, the ups and downs will even out and over the long haul markets will produce what traders, on average, expect. How long must we wait for this to happen? It could be a while. But, the alternative is to make moves based on someone’s prediction of a surprise!

Yale Beats Harvard – Again

So trumpeted a recent WSJ headline. Yale’s endowment, managed by David Swenson, earned 11.5% for the year ending June 30th. His acolytes at Bowdoin and MIT earned 14.6% and 13.2%, respectively. This compares to about 1% that benchmark proxies for a well-diversified portfolio would have earned. How do these endowments do it? They hold assets, generally under a category called “Alternatives,” that are not valued from arm’s length transactions – the returns can be whatever they want them to be!

College endowments don’t need to worry about needing cash – when they need money they go to the alumni. So, the ability to readily turn investments into cash (liquidity) isn’t important. Endowments can assume this liquidity risk, which can be large and should provide a significant premium.

Now it just may be that David Swenson has special gifts that allow him to identify assets and managers who will provide extraordinary results through time consistently. And, these gifts can be passed on to whoever will listen. However, the true value of the endowment’s nonmarketable assets will not be known until there is a need for cash, which is apt to be never. In the meantime, they have latitude in reporting values and returns that are based on someone’s estimate. Take with a grain of salt results posted from assets, the values of which are not determined from arm’s length transactions.