The holiday season is a great time to see friends of old who are back in town and catch up with family you don’t get to see as often as you would like. While getting caught up on each other’s lives, and amidst the small talk, most people these days bring up their dissatisfaction with the stock market. I even hear, from time to time, that some people feel that they would have been better off if they had just stored their savings underneath their mattress rather than dealing with the ups and downs of the recent market.

Over the last decade investors have been faced with a tremendous amount of volatility in the financial markets. The “technology bubble” was the first obstacle investors ran into and unfortunately had to bear with for over two years before the markets began to recover in late 2002. That recovery lasted for around five years and culminated in late 2007 when the Dow Jones hit its all time high. Unfortunately, this high was short lived and in 2008 investors saw one of the worst market corrections of their lifetimes! So has this decade been a waste for investors? Are their depictions of the market over the last ten years correct? Hardly, as long as you were properly diversified.

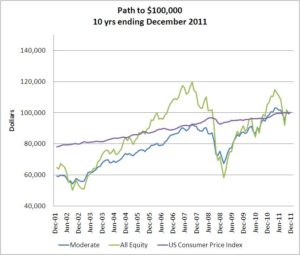

The graph below shows the performance of various benchmark portfolios and how they have fared over the past ten years. The green line tracks a well-diversified all stock portfolio. What this graph shows is that if you wanted $100,000 today, you would have needed to invest $64,500 ten years ago to achieve that. The blue line shows the returns of a moderate portfolio (50% stocks, 50% bonds), which is a more realistic holding for most investors. With a moderate risk portfolio, an investor could meet his $100,000 demand today with an investment of only $59,200 ten years ago! I know these are double digit annualized returns we are looking at, but to see this kind of growth in supposedly a “lost decade” seems pretty good to me.

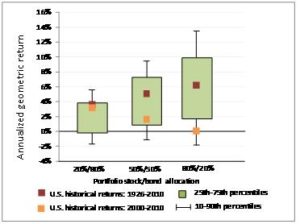

Now, let’s take a look at how your investments would have done over a longer period of time. The graph below shows the path of those same benchmark portfolios over a time period of 32 years; a time horizon more indicative of what many investors face during their years of saving. In this case, a mere $4,500 was needed back in 1979 to reach our goal of $100,000 today. That equates to over a 10% annualized return!

The “investment rollercoaster” of the past decade has played with many investors’ emotions and has been hard to handle. However, for those who have stayed the course and were properly diversified, you are better off for it.

It is times like these that we need to step back and look at the bigger picture and realize that the recent volatility is nothing more than a few potholes on the road to your financial success!

Related Articles: