Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

April 28, 2021

Retirement

For self-employed business owners, you’re responsible for saving for your own retirement. It’s likely that you got a late start at saving and maybe even had to leverage yourself to get your business up and running.

SEP IRA? SIMPLE? 401k? Solo 401k…I get it, you are busy running your business and the last thing you want to think about is choosing how to save for retirement.

Let’s discuss the advantages of a Solo 401k and why it might be exactly what you need!

1. High Contribution Limits: With a Solo 401k the contribution limit for 2021 is $58,000 ($64,500 for owners over age 50). This includes an employee contribution of $19,500 ($26,000 for those over 50), plus the ability to make a profit sharing contribution up to the limits described above (the profit sharing piece is limited to 20-25% of your business income).

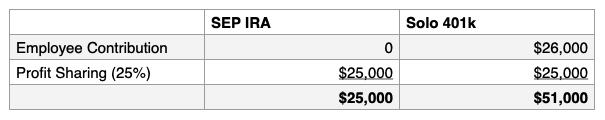

So why a Solo 401k over a SEP? Check out the example below to see the advantage.

John, who is 56 years old, runs a consulting business and earns $100,000/year. He would like to defer as much income as possible for retirement. So let’s see how a SEP and Solo 401k line up:

2. Low Cost to Start: Opening a Solo 401k is easy and can be done at all the major custodians. Feel free to do it yourself or contact a local Fee-only advisor to help you get started.

The nice part about this type of retirement plan is that you get to pick how it’s invested. Once you choose the right mix of low cost ETF’s or index funds to meet your needs, you can leave it alone and get back to running your business.

3. Pre-Tax or Roth: Unlike with the SEP IRA, you have the option to choose to invest your employee contribution ($19,500 or $26,000 if over 50) after-tax (Roth). This is a great option for individuals whose income is too high for contributions to a regular Roth IRA or just want’s to save in a vehicle where distributions will be tax free in retirement!

If a Solo 401k is something you are interested in and have more questions, reach out to a Rockbridge advisor to discuss in more detail.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.