Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

April 27, 2021

Investing

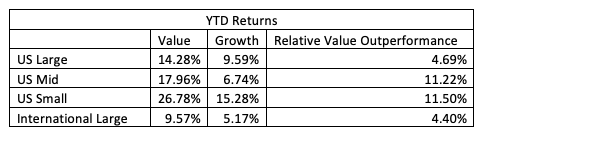

Year to date returns for Value stocks have exceeded that from Growth stocks across all market caps, both domestically and abroad.

There are several reasons for this. US Vaccination rates have been greater than expected, which has helped traditional companies (value) at the expense of technology companies (growth). Company specific earnings have likely made a difference, especially in financials which tend to be “value stocks”. However, the largest cause for the difference has probably been the rise in inflation expectations and interest rates.

At the start of the year, the U.S. 30-year Treasury Bond was yielding 1.65% and the market-implied 30-year inflation number was 2.02%. As of April 23rd, the 30-year Treasury Bond is yielding 2.25% and the market implied inflation is 2.25%. Rising inflation and interest rates help value stocks because the profit from value stocks comes sooner whereas growth stocks are more profitable further into the future. As inflation picks up, profits in the future are discounted more making them worth relatively less today.

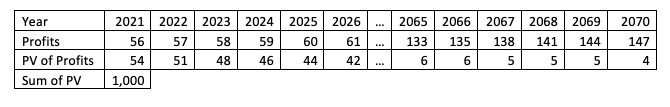

In an effort to put numbers on it, let’s discount future profits of Large-Cap U.S. Stocks. The following is based off current forward p/e ratios, a 2% long-term earnings growth rate, and a discount rate of 7.3%.

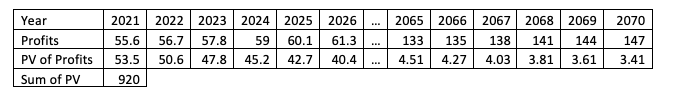

Assuming the discount rate has risen with the 30-year bond, the following table shows the present value with a 7.9% discount rate.

Here, the rise in rates has decreased the price of value stocks by 8%.

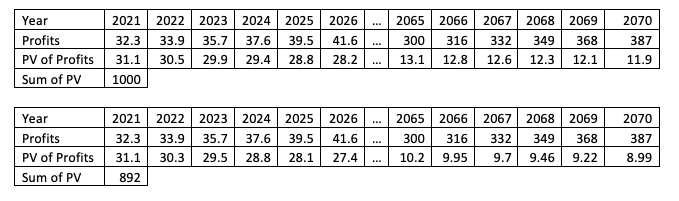

The following table shows the same exercise applied to growth stocks. Again, we use a 7.3% and 7.9% discount rate and an implied earnings growth rate of 5.2%. Notice the higher growth rate as these are growth stocks and a higher rate is needed to justify the current price/earnings ratio.

If we do the same exercise with growth stocks, we see a price decrease of 10.8%. This 2.8% difference explains more than half of the Value stock outperformance in 2021.

With small cap stocks it’s even more pronounced as the implied earnings growth rate of small-cap growth stocks is even higher. Right now, small-cap growth stocks are trading with a forward p/e ratio of 84.7. In order to justify this price, there have to be substantial profits in the distant future which is more susceptible to the increase in interest rates. When we did the same exercise with small-cap stocks, value had a 6.6% relative outperformance.

Again, stocks are up on the year, but not because of interest rates. Rather the increase in interest rates has been more than offset by better-than-expected earnings and higher perceived certainty of future earnings.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.