A question most investors ask themselves at some point is: “Is today a good day to buy into the market?” I waffle between two responses that sound the opposite but mean the same thing. It’s always a good day to buy and there is no such thing as a good day to buy. It’s always a good day to buy in the sense that markets go up over time and no one knows what the market will do tomorrow so it’s best to get your money into the market now. There are no such things as good days to buy in the sense that the question implies there are bad times to buy and you should wait until a good time, but you shouldn’t wait so there is no such thing as a “good day.”

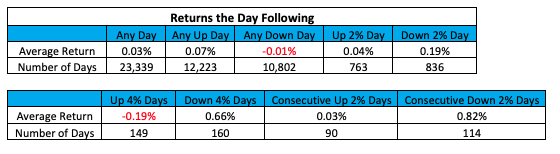

That said we looked at daily moves in the S&P 500 going back to 1928, to see if some days have presented historically good buying opportunities. We sorted days into groupings and then looked at the return on the ensuing day. The following table summarizes the findings:

Any Day: In aggregate, the market goes up an average of 0.03% each day.

Up Days: The average return of the stock market the day after it goes up is a positive 0.07%.

Down Days: Some might say buying on just any down day isn’t a good move as it is one of two scenarios where the ensuing day averages a negative return. But the average is barely negative, effectively 0.

Up 2% Days: When the market has a strong day, the next day rises about the same as an average day.

Down 2% Days: Now we start getting into interesting numbers. When the market drops by 2% or more, the ensuing day tends to be quite positive with an average return of +0.19%. On average we get a handful of days like this a year.

Up 4% Days: When the market has a very strong rally, it’s probably best to wait a day before buying stocks. Unfortunately, these large rallies are rare. Despite having 8 such days in 2020, we only saw one from 2012 – 2019.

Down 4%: When the market is tanking, it’s reasonable to expect a rebound the next day. On days when the market drops 4%, we typically see it regain two-thirds of a percent the following day. Like with up 4% days, these seem to only happen in times of extreme volatility.

Consecutive up 2% Days: These are very rare and very boring. When the market has two strong days the ensuing day averages the exact same as any given market day.

Consecutive down 2% Days: Again, very rare but this time very good. When the market slides by 2% on back-to-back days, the following day is often very positive, up nearly a full 1% on average. This year we had three such days with the following days showing returns of -0.38%, +9.29%, and +9.38%. Coincidentally, the market’s bottom on March 23rd was the second consecutive down 2%+ day (-4.34% & -2.93%). Again, these are so rare they are not worth waiting and the days after the ensuing day may be bad, but that ensuing day is usually pretty good.

What can we conclude from this? My only takeaway is that you should buy when you have the funds available with the exception of a day when the market is up BIG (4%+). While large down days do present good buying opportunities, they are rare and not worth waiting for. Most other days tend to have positive ensuing returns reaffirming the idea that money should be invested.

This is not to say there isn’t merit to dollar cost averaging. When you have money that has been sitting in cash and are concerned with the psychological impact of getting unlucky, it can make sense to buy in over a period of months on a set schedule.

The stock market can be cruel, volatile, inexplicable, and frustrating for those who try to pick the perfect time to buy. By investing when the funds are available, accepting perfect is impossible, and blocking out the noise, you position yourself to contently reap the benefits of investing. As we get through the holiday season, take a look at your finances and if you have the capacity to invest additional cash- please reach out, now is as good a time as any!