Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

October 14, 2019

AllFamily FinancesInvestingNewsRetirementUncategorized

The word “recession” makes investors feel uneasy and with good reason; the correlation between a bear market and an economic recession is very high. For anyone with money in the stock market, especially those nearing retirement, this can be scary. The “r” word has been making headlines in recent months as investors worry about trade wars, the yield curve inverting, and drops in manufacturing activity. In this piece, we’ll unpack what a recession is, what it means for markets, and what can be done to protect a portfolio against one.

A recession is defined as a period of two consecutive quarters where economic activity declines on an inflation-adjusted basis. The main cause of this is economic activity decreasing; however high inflation and population growth can play a factor as well. For example, Japan has had three recessions in the last 10 years as their population has shrunk by 1.52%.

In the United States, economic activity is measured by the Bureau of Economic Analysis’ calculation of Gross Domestic Product (GDP). This measure takes three months to publish and is then revised each of the next two months before we are given a final reading. Because of the definition and the time it takes to report, we don’t know we’re in a recession until 9 months after it is upon us.

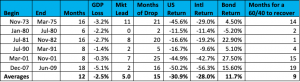

Regarding impact, we analyzed the six recessions we’ve seen over the last 50 years.

For example, in November 1973, a 16-month recession began in the United States which saw GDP shrink by 3.2%. The stock market peaked 11 months prior to the start of the recession (December 1972). It took 21 months to bottom out with a loss of 45.6%. During that time international stocks dropped 29% and five-year government bonds rose 4.5%. Fourteen months after the bottom, a balanced portfolio recovered all it had lost.

A recession’s impact on the market varies. Sometimes the impact is small (the drop we had in Q4 of last year was worse than the market’s reaction in three of the recessions) and other times it is very large. The thing that struck our team was how quickly a balanced portfolio recovers from a recession. A 60% stock portfolio that is diversified among international stocks, and is rebalanced quarterly, recovered on average 9 months after the market bottom. When you’re living through the drop, it can feel like a long time, but for investors whose money has a 30+ year investing horizon, it isn’t that long.

Another thing to remember is we don’t know when/if the next recession is coming. The Wall Street Journal Survey of Economists puts the odds of a recession in 2020 at less than 50%. Australia has gone 28 years since their last recession.

While there is no such thing as an average recession, let’s play one out. Say we begin a recession in January of 2020. We won’t know it’s a recession until next September. The market will have peaked this past July and will drop 31% before bottoming in October of 2020. A diversified 60/40 portfolio will decline 13.3% and recover those losses by July of 2021. Again, it’s not fun, but it’s not the end of the world.

And to reiterate, we don’t know when or if this will happen. We’d bet a lot of money a recession won’t start in January of 2020, not because we think we know what the economy will do, but because it’s a low probability event. In the 48 hours we took to research and write this piece, we’ve had a bit of good data and positive news from trade negotiations. The market is up 2.7% over that time and the headlines talking about a recession have vanished. That could easily change; the only point is that no one knows, and headlines are fickle and sensational.

If the fear of a recession is keeping you up at night, it’s a good idea to reach out to your advisor and discuss your asset allocation. A financial planning best practice is to periodically make sure you’re appropriately allocated for your long-term goals and individual risk tolerance. But alterations that are “short-term” by nature or “tactical” are usually mistakes. As Peter Lynch (one of the most successful investors of all time) once said, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” Our job as your fee-only fiduciary advisor is to make sure you don’t prove Peter Lynch right.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.