As retirement age approaches many questions arise about Social Security including the following:

- Should I start drawing benefits as soon as possible or postpone?

- If I do postpone, how long should I wait?

- If I am married or divorced, how can that impact my decision?

- When will I “breakeven” on my decision to postpone?

Rules of Thumb:

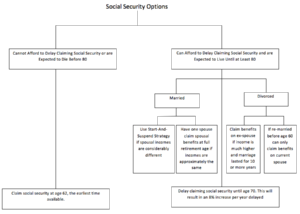

If you are expecting death in the near future, or do not have sufficient savings to postpone claiming Social Security, it is advised that you begin receiving Social Security at age 62, the earliest available time.

- If you must claim benefits at age 62 but continue to work and are able to pay the money back at age 70 it will be as if you never filed for benefits and at age 70 you will receive the 8% increase that you would have received if you never filed for benefits in the first place.

OTHERWISE…

- If you have enough saved, and are able to postpone receiving Social Security until age 70, this will result in an approximate 8% increase for every year you postpone. If you postpone until age 70 and live past the age of 80, your total gains from Social Security will be larger than if you began taking Social Security at age 62.

The decision to postpone results in several different options to maximize benefits:

- One strategy for married couples is called the “Start-and-Suspend” strategy; this should be used if one spouse has a much larger income than the other. The first step of this process is for the spouse with the larger income to file for Social Security benefits when they reach full retirement age, age 65-67 (depending on date of birth), and then immediately suspend their benefits. After this is done the spouse with the smaller income can file for benefits based on their spouse’s salary, and they will receive 50% of the benefits. If the spouse with the higher salary suspends his/her benefits until age 70 they will continue to receive the 8% increase even though their spouse is receiving benefits based on their salary.

- Another strategy for couples is claiming “spousal benefits”, which should be used when the incomes of each spouse are approximately the same. This strategy is carried out by one spouse filing for Social Security when they have reached full retirement age, age 65-67. After they have done this the other spouse can file for spousal benefits, which means they will receive 50% of the benefits from the other spouse’s income. This will allow the second spouse to continue receiving an 8% increase on their benefits while they are receiving benefits based on their spouse.

- If you are divorced you can claim benefits on your former spouse’s earnings, as long as the marriage lasted 10 years or more. However, if you remarry before age 60 you can no longer claim benefits on your former spouse, and are only eligible to claim benefits on your current spouse.

Resources: