Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

September 11, 2019

AllInvesting

Most people think of bonds like Certificates of Deposit (CDs). You loan someone money, they give you interest each year, and then at the end of the contract you get back the full amount you initially lent. Over that time, your return should be whatever the interest rate was and if you think of it from a cash flow perspective, at any point during that period your return should also be that (positive) interest rate.

But in reality, bonds can lose value over shorter periods of time, even if they don’t default. Last fall, we published a piece discussing this phenomenon. At that time, we had many clients reaching out with well-founded concerns that their bonds were losing money. Since then, bonds have gone up in value as interest rates have fallen. We haven’t yet had any concerned clients asking why their bonds have made so much money in the last 12 months, but we figure calls will soon be coming (haha). As your favorite Syracuse based fee-only fiduciary advisor, we wanted to revisit the issue to help explain it again.

Let’s say an investor bought a $1,000 face value, five-year bond that paid 2.0% for $1,000 (par) when it was issued. A year later, the investor has received $20 in interest payments and now owns a four-year bond. But market conditions have changed, and new four-year bonds are being issued with a yield of 3%. If the investor wanted to sell the bond he or she bought last year, other investors wouldn’t pay full price for something that will give them 2% when they can get 3% out in the market. As a result, the original investor would have to sell his bond at a discount. In this case, the investor would probably only be able to get about $960 for this bond. This combined with the $20 in interest leaves the investor with $980 in proceeds on something that cost $1,000. This works out to a loss of 2%.

Over the last year the opposite has happened. Interest rates have fallen and the returns on bonds have exceeded their yield.

To complicate things further, most of our investors don’t own individual bonds, but rather bond funds. These funds own thousands of individual bonds and are constantly buying newer, longer dated bonds with the proceeds from maturing bonds. Through this process, the bond fund never matures and maintains a somewhat steady duration.

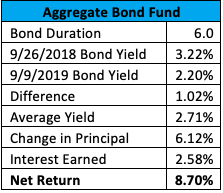

The most common fund our investors own is one which tracks the Bloomberg Barclays Aggregate Bond Market. The following table shows a first cut at how this fund has performed over the last year.

The decline in interest rates of 1.02% would lead to an estimated 6.12% increase in the mark to market value of the bonds it is holding. Over the last year it has also earned an estimated 2.58% in interest for a total return of 8.7%.

In reality, aggregate bond funds are up roughly 11%. The reason for the difference in this and the 8.7% we calculated above is two-fold.

The last 12 months has been great for bonds. Unfortunately, it’s nearly certain the next year, or five years, won’t be as good. Still, bonds add value to a portfolio by reducing volatility and earning a positive return over time. If you have any concerns regarding your bond holdings and how they impact your financial plan, please contact your advisor. It may be tempting to alter your investments based on future predictions of interest rates, but history has shown this to be difficult. Look for an article in our next newsletter documenting how poorly expert predictions were a year ago.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.