Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

January 18, 2024

Investing

Over the last two years, interest rates have risen at a historic clip. As a result, Rockbridge has dedicated moretime helping clients manage cash reserves to take advantage of the current market environment. In previous years, “high yield” savings accounts were (and some still are) paying less than 1%. Now, it is easy to find money market funds earning in excess of 5% annually.

However, we know that this won’t remain the case forever, and given the most recent guidance by ChairmanPowell, we’ll almost certainly enter a declining interest rate environment at some point in 2024. With that being said, now is an important time to review the goals of your cash reserves. We would classify these “goals” into three major categories:

Emergency Fund / Short-Term Use

For cash earmarked for known expenses within the next year, or cash acting as an emergency reserve for those worst-case scenarios, we recommend maintaining safe, liquid investments such as a purchased money market fund or high-yield savings account. While the interest earned in these accounts will trickle down as the Fed starts to lower short-term rates, this is still the best option for short-term cash reserves. Still, it’s important to make sure the interest rate you receive on these monies is competitive relative to market rates.

Intermediate Term Use / Goal Funding

This is the bucket for which we’d allocate cash earmarked for major expenses or cash flow needs in the next 1-3 years. Given this timeframe, we’d caution investors against taking stock market levels of risk and volatility, but we also know that fully liquid options won’t be as attractive as interest rates come down. For these intermediate term cash goals, it may be a good time to purchase a Treasury bond or Certificate of Deposit (CD). This allows you to lock in an interest rate today and ensure that level of interest is earned throughout the duration of the investment. These investments can still be sold if you need the principal sooner than expected, however, you might be selling at a premium or discount from face value.

Long Term Goals

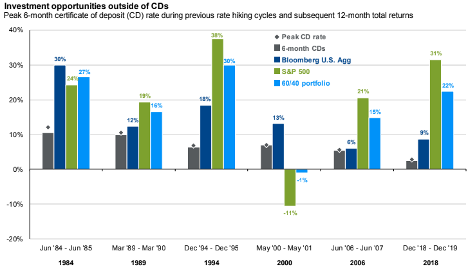

If you have cash on the sidelines that isn’t earmarked for a specific goal in the short or intermediate-term, we recommend putting a plan in place for getting this money invested in a diversified stock/bond portfolio. Shown below is a chart from J.P. Morgan’s Economic and Market Update as of 12/31/2023 that illustrates 12-month market performance following a peak period of 6-month CD rates:

While this doesn’t guarantee future market performance, this data is consistent with the correlation of positive stock market performance in declining interest rate environments.

Bottom Line

While earning 5% on cash reserves might feel like the best decision today, it’s important to consider the bigger picture. If you have questions about the status of your current cash reserves, a Rockbridge advisor would be happy to help develop a plan for you.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.