Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

May 26, 2023

News

Emotional decision-making fueled by fear or greed can cloud our judgment and lead to irrational investment choices. Reacting to short-term market fluctuations or making impulsive trades based on attention-seeking headlines often leads to poor investment performance. By staying in your seat and focusing on your long-term investment strategy, you can mitigate the influence of emotions.

A disciplined investment strategy is designed to withstand market fluctuations and align with your long-term goals. Deviating from your strategy based on short-term market movements and the constant barrage of headlines can disrupt your financial plan and hinder your progress toward achieving your financial objectives.

2023 has been a year filled with recurring pessimistic headlines, tempting investors to revisit their investment strategy and take money out of the market. The Philadelphia Federal Reserve’s survey-based Business Outlook suggests some manufacturers have a very pessimistic expectation of the economy. The index is more negative than at any time since the onset of the Covid pandemic and on par with the Global Financial Crisis in 2008. In general, negative spikes in this index have closely aligned with economic downturns. But investors shouldn’t let this ominous sign deter them from stocks.

Since the index’s start in May 1968, the outlook was negative in 165 out of 648 months. The return of the S&P 500 Index over the next 12 months was positive for 76% of these 165 observations. To put that in perspective, the frequency of positive S&P 500 returns over any 12-month span during the period was 78%. And the average magnitude of the return following negative months, 13.4%, was higher than the unconditional average of 11.5%. Just another reminder that markets price in changes in economic states before they come to fruition.

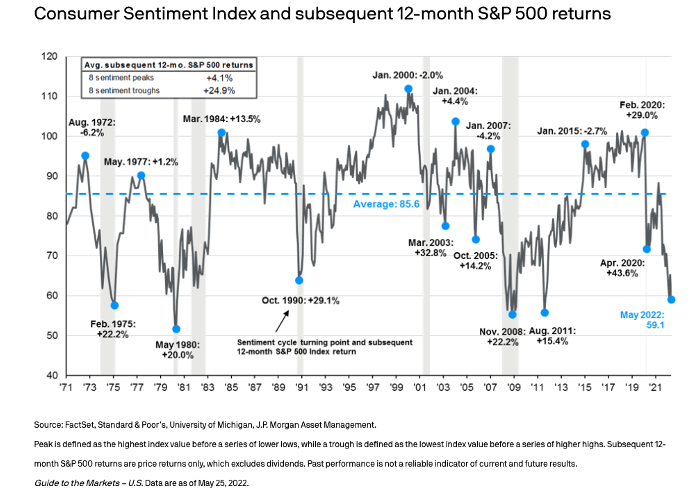

The below chart from JPMorgan Chase tracks the Consumer Sentiment Index at its peaks and troughs and compares how the S&P 500 performed in the 12 months following. On 8 separate occasions since 1971, the Consumer Sentiment Index has been recorded as in a trough, the average S&P 500 index return for the 12 months following that trough was +24.9%. Comparatively, on 9 separate occasions when investor confidence was high and the Consumer Sentiment Index was documented as a peak, the average S&P 500 index return for the 12 months following that peak was just +3.5%.

Historically, disciplined investors who resisted the urge to react to pessimistic headlines have allowed their investments time to capitalize on market recovery and minimize transaction costs and taxes. Remember, successful investing requires patience, discipline, and a focus on the long term.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.