Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

March 24, 2023

Investing

From social media feeds to financial news outlets, we’re constantly bombarded with a stream of updates, opinions, and analysis. Access to so much information can be empowering, but can also be overwhelming. How do we know which sources to trust and where should we focus our attention? With inflation making daily headlines, stock market volatility, political unrest and global tension, it’s easy to see why an investor might want to take a step back and seek safe harbor. Investors don’t need to look far to find a pundit claiming to have the answer, however, the lack of consensus between opinions is a reason for investors to be wary of making changes to their long-term strategy.

Given the rapid increases in interest rates as of late, bonds and CDs have garnered investors’ attention. From 2008 to 2019, the Federal Reserve kept interest rates at historic lows in response to the global financial crisis and the prolonged economic recovery. This resulted in the yield of the 10-year US Treasury Bonds falling to 1.37%. Even more recently the COVID-19 pandemic and economic downturn resulted in the 10-year yield dropping to 0.52%. Not exactly an attractive investment return. However, investors have recently taken notice in the uptick in return on secure investments, with some institutions like Ally Bank offering an 18-month CD with an APY of 5.0%. In any given year, you’d be hard pressed to find an investor that isn’t intrigued by a relatively risk-free 5% rate of return. With all the turbulence surrounding the economy, wouldn’t it make the most sense to move your portfolio to these safe and reliable investments?

First, let’s look at the historical returns for equities and bonds. According to a study conducted by Vanguard, the average annual return of the US Stock market has been 9.5% over the last 90 years. Comparatively, the average annual return of US bonds over the same period was 4.9%. While there may be uncertainty surrounding the stock market today, investors often benefit from a phenomenon called “reversion to the mean”. Over the long term, markets deliver average returns and periods of underperformance eventually revert to historical average returns. Given the headwinds facings the investment landscape today, why trust historical averages?

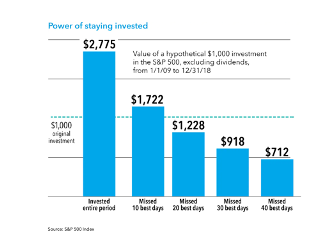

While it may seem like a “safe play”, to shift your portfolio away from equities, it can be more detrimental than one might realize. In attempting to time the market, investors often miss out on the most crucial days when markets rebound and they often re-enter the market too late, missing out on those large upswings. As illustrated below, this behavior typically results in returns that lag behind those who remained invested.

Investors also need to consider inflation, which can erode the purchasing power of your financial assets if you’re out of the market. According to the US Bureau of Labor Statistics, the average annual inflation rate in the US from 1991 to 2020 was 2.3%. In recent months we have seen year-over-year inflation on consumer prices as high as 9.1%. Hypothetically, if the stock market has an average (by historical measures) year, and returns 9.5% on your investment, and we see another year of exceptionally high inflation, you would have at least kept pace. An investor locked in to an 18-month CD at a rate of 5.0% would have lost purchasing power over that 18-month period, with a real rate of return of -4.1%.

The obvious question is, what if the market declines? While a 2023 market pullback is possible, as we saw above, attempting to time the market and bring emotion into your investment decisions often leads to less desirable long-term results. It’s important to remember that investment risk and return are directly correlated and the data supports investors staying committed to their investment strategy over the long-term.

So, should we turn a blind eye and ignore these relatively risk-free opportunities? Absolutely not. Depending on your investment goals and objectives these opportunities could provide moderate short-term returns that roughly keep pace with inflation. In the next six to twelve months, maybe you have a home improvement project planned, or a wedding or upcoming tuition expenses. Investors can sidestep short-term stock market volatility yet still allow your money to work for you. A high yield CD with a maturity coinciding with your expense timeframe could be a great solution for short-term goals but doesn’t replace your long-term investment strategy.

In conclusion, focus on what matters and stay the course with your investment strategy. Times like these can be a great barometer to measure your true risk tolerance and how it may align with your investment strategy. Revisit what you feel is an acceptable level of risk and align your portfolio to match your goals. As always, talk to your advisor with any questions or concerns you may have.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.