Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

May 3, 2021

Investing

Last week we saw some of the largest tech companies in the world report their earnings from the first quarter of 2021 and the numbers were impressive. Headlines on CNBC read:

“Apple reports blowout quarter, booking more than $100 billion in revenue for the first time”

“Tesla posts record net income of $438 million, revenue surges by 74%”

“Microsoft books biggest revenue growth since 2018”

“Amazon’s sales surge 44% as it smashes earnings expectations”

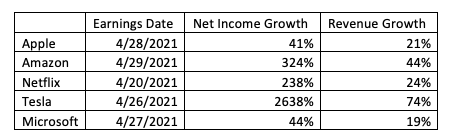

The following table breaks down the growth these companies (and Netflix) saw from a revenue perspective and an income perspective.

It’s hard to overstate how incredible these numbers are. Over the last 20 years, the average revenue and earnings growth rate of the S&P 500 has been in 3.2% and 3.7% respectively.

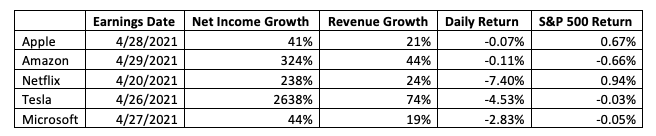

Surely these titanic earnings numbers corresponded to a dramatic increase in share price. Wrong! All five of these company’s saw their share price drop on the ensuing day of trading and only Amazon outperformed the S&P 500. The following table is expanded to include ensuing day performance.

How can this be? The answer is that the market expected better, especially over the long-term. Netflix reported fewer new subscribers than investors were anticipating, and shares of Microsoft dropped as their expectations for future revenue implied a slowdown in the rate of growth. It was more of the same for the others.

One challenge is when you get so large, it’s hard to keep growing. Apple’s stock is worth $2.25 trillion, a size that is hard to fathom. Another challenge is current valuation relative to profitability.

Despite Tesla’s Net Income growing over 2,600%, they still make very little money relative to their valuation. Over the previous 12 months, Tesla made $1.14 billion. With a market valuation of $670 billion, it will take nearly 600 years at their current rate of profitability to earn enough money to match their valuation.

Let’s compare that to JP Morgan. In the first quarter, JPM reported a net income of $14.3 billion. For the previous 12 months, they earned $40.6 billion. Despite making 35 times as much money as Tesla last year, JPM’s market capitalization is $200 billion less. If JPM continues to make money at the same rate as last year, they will earn their market cap in only 11.5 years.

The point of comparing Tesla and JP Morgan is not to say JPM is a better stock to own than TSLA. The point is that the performance of each company will be determined by how much better or worse each company fares relative to what the market anticipates from each.

The next time you think about Tesla’s income statement remember, Great Expectations have been in every line you have ever read.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.