Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

January 26, 2021

Family FinancesInvestingRetirement

The defense and aerospace company, Saab Inc., has their US Headquarters, and several hundred employees in our hometown of Syracuse, NY. In addition to their 401(k) match and great pay, they offer one of the most appealing Employee Stock Purchase Plans we’ve ever seen.

At its core, this is an employee stock purchase plan that provides a match if the shares are held for 3 years. In order to get the free doubling of your investment, you must take on additional risk related to the health of your employer and currency risk. Still, it’s a tradeoff worth taking.

In this piece we go into detail on how it works, the financial aspects that make it so great, and a recommended strategy for it.

How it Works: For U.S. employees, you must either enroll in the plan in November or May. At enrollment you choose to have between 1% and 5% of your paycheck withheld for the Share Matching Plan. Once enrolled, you will have money taken out of each paycheck and set aside for purchases of Saab AB B. These purchases happen each month.

The stock, Saab series B shares, is custodied in an account in your name at Computershare. The shares carry both market risk and currency risk as they are held in Swedish Krona. The shares bought with money withheld from your paycheck are 100% yours the moment they are invested. You can sell the shares and withdraw the money at any time and pay the applicable taxes. If you sell them within a year, you will pay short-term gains or losses. If you sell them after holding them for a year, you will pay long-term gains or losses. If you sell them at the exact price you purchased them, you will owe nothing as the purchase was made with after-tax dollars from your paycheck. While you hold the shares, you will receive a cash dividend that you will pay taxes on.

Once the shares are held for three years, you will be matched 1 for 1, doubling your position. You will owe ordinary income taxes on the value of the match you are receiving at the time it is received. Taxes on the sale of the matched shares will be short-term gains/losses if done in the first year, and long-term gains/losses if done after one-year. If you sell the matched shares as soon as they become yours, your taxable gain/loss will be minimal.

The Benefit: You could think of this as free money, though it comes with risk. We will look to quantify how much the extra benefit is worth and how much Saab can underperform the market and still be profitable.

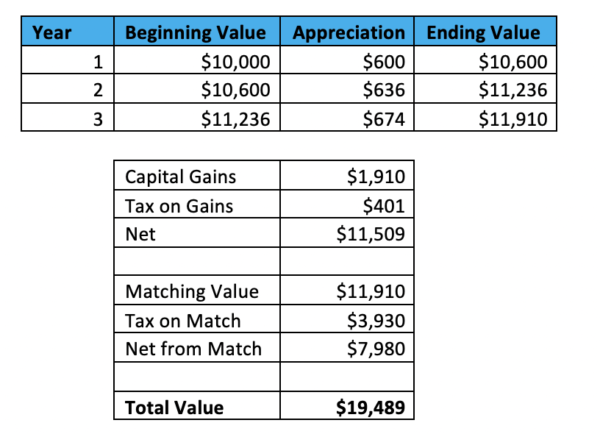

The following table outlines how the Share Matching Plan would work assuming a hypothetical employee with a $200,000 salary and doing the full 5% match. We assumed a 6% price appreciation and ignored dividends. We also assumed the employee sells all the stock as soon as it is matched in year 3. In reality payments are made each month, but we analyzed the data as if it were a year-long program to help visualize what is happening.

In this scenario, $10,000 worth of Saab stock grows to $11,910 by the end of the third year. When that is sold the employee pays long-term capital gains on the $1,910 of growth. Assuming a combined federal and state tax rate of 21%, they would owe $401 of taxes, leaving them with $11,509. At the same time, they also receive $11,910 worth of matched shares. That entire amount is taxable as ordinary income, at an assumed rate of 33%. That means $3,930 of taxes are paid on the $11,910 of benefit, for an after-tax net of $7,980. In total the employee is left with $19,489 at the end of the third year, roughly doubling their money.

Let’s say Saab didn’t have this program and instead the employee invested the $10,000 in a stock market index fund. Assuming the market appreciated by 6% (not including dividends), and at the end of 3 years the employee sold their position for cash, they’d have the same $11,910 of proceeds for an after-tax value of $11,509.

A good question is – how much can Saab underperform the market and have the participant still not be harmed by the Share Matching Plan?

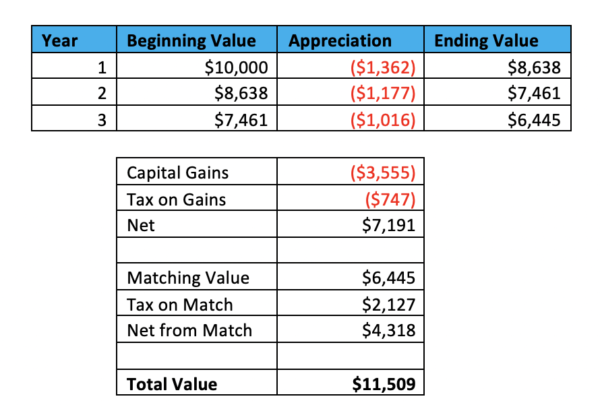

We can solve to find that Saab stock (plus the currency movement) can underperform the market by 19.6% and the plan is roughly a wash, as seen by the table below.

In this example, Saab stock is losing 13.6% per year for 3 years, and the end result is an after-tax balance of $11,509, the same as what you would have gotten from the stock market if the market returned a positive 6%. In total that’s roughly a 20% annualized difference.

There is no reason to expect Saab’s stock and the Swedish Krona to underperform by an annualized 20% making this plan attractive.

Recommendation: We recommend Saab employees take full advantage of the Share Matching Plan, putting in the 5% maximum each month. Once the shares are matched, they should be immediately sold. For a Saab employee with a $200,000 salary, and assuming market returns, you’d be reducing your monthly paycheck by about $830, but after three years in the plan, you are getting a $1,625 rolling after-tax cash out. In order to take advantage of this you’re exposing yourself to an additional $60,000 of market risk in Saab stock and the Swedish Krona.

Whether you’re an employee of Saab AB looking with further questions on the Share Matching Plan, or you’re a client with questions related to your employee stock purchase plan, please reach out to your advisor, e-mail us, or schedule a call.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.