Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

July 23, 2020

Investing

Arguably the most important thing Rockbridge does is forecast what kind of lifestyle families can expect in retirement. We believe our attention to retirement planning, and all aspects of financial planning, separates us from other wealth managers in Syracuse and across the country. The fee-only fiduciary model puts clients first and delivers on things investors can control.

As we’ve been reminded again this year, one thing investors can’t control is the stock market. A healthy couple in their 50s may have a 40-year investment horizon for their assets. If that family will be relying in part or in whole on savings (401(k)s or otherwise), return assumptions become hyper important. Each year our firm looks at our return and inflation assumptions and makes updates as necessary. With the profound impact of the Coronavirus on capital markets we updated these assumptions in May.

Inflation: Inflation is one of the most important assumptions in retirement planning. Spending in retirement increases with inflation, it erodes fixed payments like pensions and high inflation can reduce the spending power of a portfolio if returns don’t increase commensurately. Many economists forecast inflation and the market has an implied inflation number based on the Treasury Inflation-Protected Securities (TIPS) market. Through the pricing of TIPS and the non-inflation adjusted treasury bonds you can back into a market implied inflation number. When Rockbridge forecasts inflation in retirement, we use the implied 30-year inflation rate. In May the market implied 30-year inflation was 1.4%, which is what we are currently using in our forecasting. This is down from the 2.1% we used in 2018 and the 1.8% we were using in 2016.

Bond Returns: Bond returns are fairly straight forward in that their expected return in the near future is denoted by their published SEC yield. If interest rates rise or fall during a period, the returns we realize over that period will be impacted (negatively or positively). However, in the event interest rates rise and realized returns suffer, higher interest rates mean a larger expected return going forward and vice versa. We are currently using 1.6% for expected return on the bond portion of our portfolios.

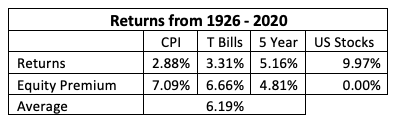

Equity Returns: The expected return on stocks is the most difficult to forecast and is historically the most volatile. One of the best way to think of equity returns is an “equity risk premium”, which means you expect equities to return an extra amount over a risk-free asset to compensate you for owning something volatile. How one defines a “risk-free asset” can vary. Over the last 90 years we’ve seen the following returns from stocks and assets that carry little or no risk.

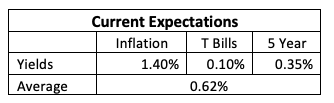

The average equity risk premium over that time has been 6.19%. If you average the current inflation expectations with treasury rates you get 0.62%

The historical equity risk premium plus the current risk-free average gets you to 6.8% which seems reasonable. Forecasting equity returns is challenging and even the most systematic forecasts have an element of subjectivity. Like any method, ours has flaws. The most notable is the treatment of equity returns during a recession. Typically, the middle of a recession comes with lower inflation expectations, and a drop in interest rates. Those conditions would lead to a lower expected return. However, if the middle of the recession comes at the same time as a large drop in stock market prices, then you wouldn’t expect a low return as we usually see a regression to the mean and a bounce back in stocks.

In the present situation, we think the lower expected return is warranted as the stock market has by and large recovered from the lows seen on March 23rd.

We will continue to monitor capital markets and update our financial planning assumptions as needed in order to deliver the best quality product to our clients. If you have any questions related to expected returns or how they fit into your retirement, please reach out to your financial advisor.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.