Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

April 21, 2020

Investing

Last week, the largest U.S. Banks reported earnings. Since then, sellers of news have been scouring the information in an attempt to entertain their viewers and readers with insights into the future of stocks and the economy. Let them, but know the real value to the investors is not in the headline earnings miss, the increased provisions for loan defaults, the updated economic outlook, or what might happen to tier 1 capital ratios and subsequent dividends. The real lesson is from the part of the banks that did well, their trading revenues.

Trading revenue is an abstract concept. When a bank sells a bond for $1,010 you might think that would equate to $1,010 of revenue but it doesn’t. If the bank had bought the same bond for $990 earlier in the day, that would equate to $20 of revenue. Trading revenue is the net the firm makes from being a market maker. Higher trading revenue was seen across all banks, with JP Morgan reporting a 32% increase for the quarter relative to Q1 in 2019. That’s a large increase, especially when you remember that volatility didn’t hit the markets until the last week of February.

The cause of the increase in revenue is from more volume and wider bid/ask spreads. More volume is straight forward, banks make money when people trade, and when people are trading more, they make more money.

Bid/ask spreads are more confusing. Banks are what are known as dealers, meaning they are willing to buy or sell a security at any time and hold it on their books. That exposes banks to the possibility that they won’t be able to get back to risk-neutral at a favorable price. As dealers, banks try to put a price on anything, so when markets get volatile, they charge wider bid/ask spreads to compensate themselves for the greater uncertainty that they won’t be able to get out of the position. When everything is averaged out, the greater risk generally means greater return which is what we saw this past quarter.

A good example of banks profiting off bid/ask spreads is seen with a corporate bond from CVS. CVS’s 3.7% maturing on 3/9/2023 is a very liquid bond. It has $6 billion outstanding and is heavily weighted in many bond indexes and funds. It’s the largest holding of one of our favorites, Vanguard’s Short-Term Corporate Bond Index Fund (VCSH). This is not an obscure bond; this is a very mainstream security.

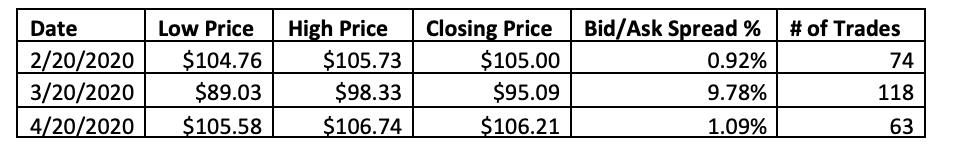

The data from Charles Schwab in the following table shows how volatility can affect the spreads and subsequent profitability by banks trading securities.

In February and April, trading volume was average, and spreads were reasonable. But March! As views of the world diverge, profits explode. There are desperate sellers who only know they want out and are willing to sell at $89/share, a 15% discount from recent levels. Meanwhile, buyers view $98 as an easy way to get a safe, investment-grade bond maturing in three years, at a 7% discount. The colossal difference between $89 and $98 is profit for the banks – Wall Street loves volatility.

In February and April, trading volume was average, and spreads were reasonable. But March! As views of the world diverge, profits explode. There are desperate sellers who only know they want out and are willing to sell at $89/share, a 15% discount from recent levels. Meanwhile, buyers view $98 as an easy way to get a safe, investment-grade bond maturing in three years, at a 7% discount. The colossal difference between $89 and $98 is profit for the banks – Wall Street loves volatility.

What is the lesson here? When the urge is greatest to do something, the best action is often doing nothing. Our advisors received numerous calls and e-mails in March asking what adjustments we were making to our portfolios to address these changing/uncertain times. We could have created a plan of actions that would have sounded sophisticated but the only one guaranteed to benefit from that would have been trading desks.

It’s important to remember the distinction between investing and playing the investment game. Investing is providing capital to entities who use the funds to create wealth. In exchange for providing the capital and enduring the ups and downs of the economy your funds appreciate over time. Playing the investment game involves keeping “dry powder” and “staying nimble.” It sounds sophisticated and exciting, and it may be good fun, but it’s a zero-sum game, akin to poker, and the banks are the house. At Rockbridge, we try our best to ensure you’re investing.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.