Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

April 13, 2020

InvestingMarket Volatility

Stock Markets

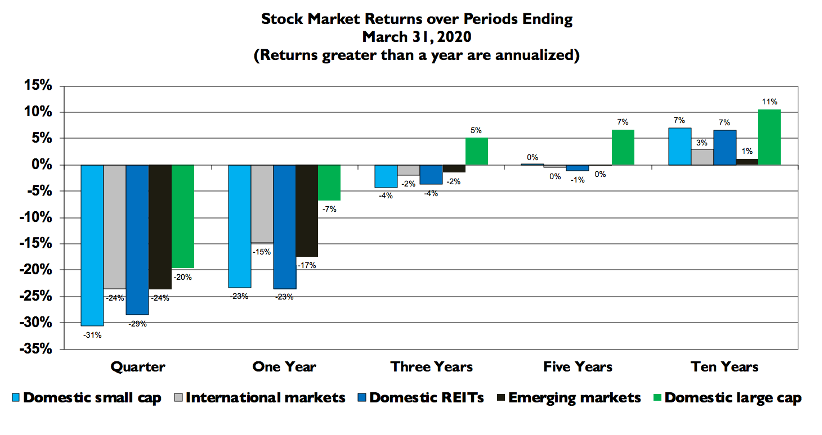

The damage to stocks from the Coronavirus pandemic is shown in the chart below as all markets are down dramatically. The domestic large cap stock market (S&P 500), driven by the largest tech companies, held up a little better. Except for this market, this quarter’s falloff brought the five-year returns to essentially breakeven and we must look to the ten-year numbers for returns that generally compensate for risk.

We are in uncharted territory and will be for a while. It’s not the usual economic “slowdown”, but a “shutdown”. Ben Bernanke, Fed Chairman during the 2008 financial crisis, likens to a natural disaster not a depression. Markets are clearly discounting the massive uncertainty of the trajectory of the Coronavirus pandemic, the global economic impact and government’s response.

It is reasonably clear that this health crisis and our response will alter the future economic landscape. There will be ups and downs as we move from where we are to where we are going. Today’s prices reflect current information about what is known and what is unknown about this journey. The expected return implied by these prices is not only positive but is apt to be better than what we have seen in the past to compensate for the greater risk in this period of heightened uncertainty. There is no reason to conclude this expected return won’t be realized eventually. To earn these returns means to remain committed to established investment plans.

Bond Markets

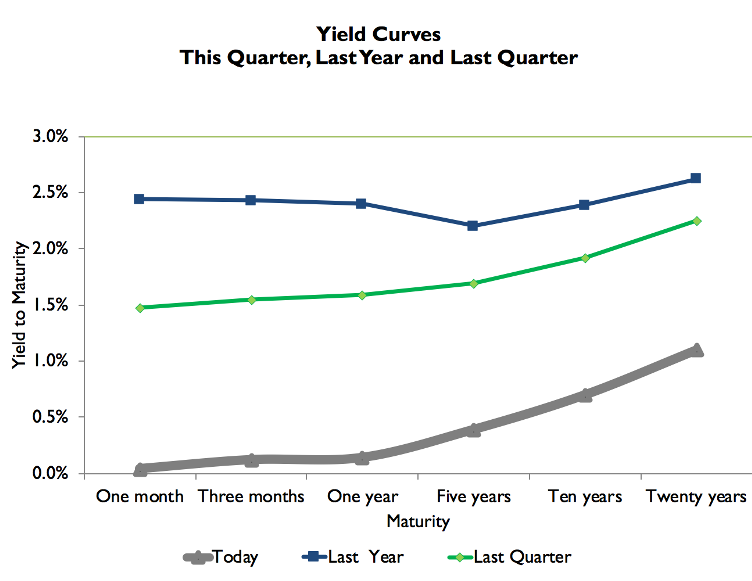

A yield is what you earn by holding a bond to its maturity. It has been shown to be a reasonable proxy for the return expected. Changes in yields drive returns – falling yields positive, rising yields negative. The longer a bond’s maturity the greater the impact a given change will have on prices and returns.

You can see to the right how yields have dropped over the last quarter. It’s only at maturities greater than five years when yields are better than zero. The falloff in bond yields of over one percent since last quarter reflects the Fed’s reduction in interest rates and its announced commitment to provide liquidity during this crisis. In addition to the activities of the Fed, yields at the longer end are consistent with a desire to avoid risk and the expectation of low rates well into the future. We have the Fed’s playbook from the 2008 liquidity crisis to give a sense of how they will apply the various tools.

The impact of the massive stimulus package is another uncertainty. No doubt we’ll see increased deficits, which is usually accompanied by inflation. However, inflation has been benign over the last ten years as we worked through the effects of the last recession. The same could hold true this time around, although the deficits are going to be greater. The bond markets are telling us to expect that inflation will remain in check.

Risk and Uncertainty

Uncertainty can’t be measured, but risk can as both are associated with an unknown future. The stock market, where investors buy and sell based on an uncertain future, is an example. Using historical data, we can construct expectations and a range of outcomes, which can be used to measure stock market risk. A pandemic is new territory and if we accept that how markets deal with uncertainty is reasonably consistent through time, then history provides some insight into describing what’s ahead.

Today it’s the uncertain trajectory of the Coronavirus. As more data is gathered through the ongoing testing’ the uncertainty is translated into measurable risk, which is then reflected in expected outcomes and variability. While the stimulus package signals Congressional support in lessening the economic fallout, there is not much history in implementing a package of this magnitude. Be prepared for a trial and error process, and volatility.

Where are We?

It is hard to imagine what we are going through won’t have a lasting social and economic impact. The level of expected unemployment claims and government spending is new territory. The highest priority right now is to reduce the uncertainty of the health crisis. It will take time to expand the testing to better understand this pandemic and for “social distancing” to begin to work. In the meantime, commitment and perseverance is our immediate future.

Markets look to the future, which is significantly murkier than a month ago. It may be a while before the future looks much clearer. While especially difficult in the face of today’s falloff, the time-worn prescription for investing in these times continues to be apt – maintain established commitments, endure the volatility in the near term and expect positive returns for bearing these risks over the long term.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.