Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

January 22, 2020

Investing

Stock Markets

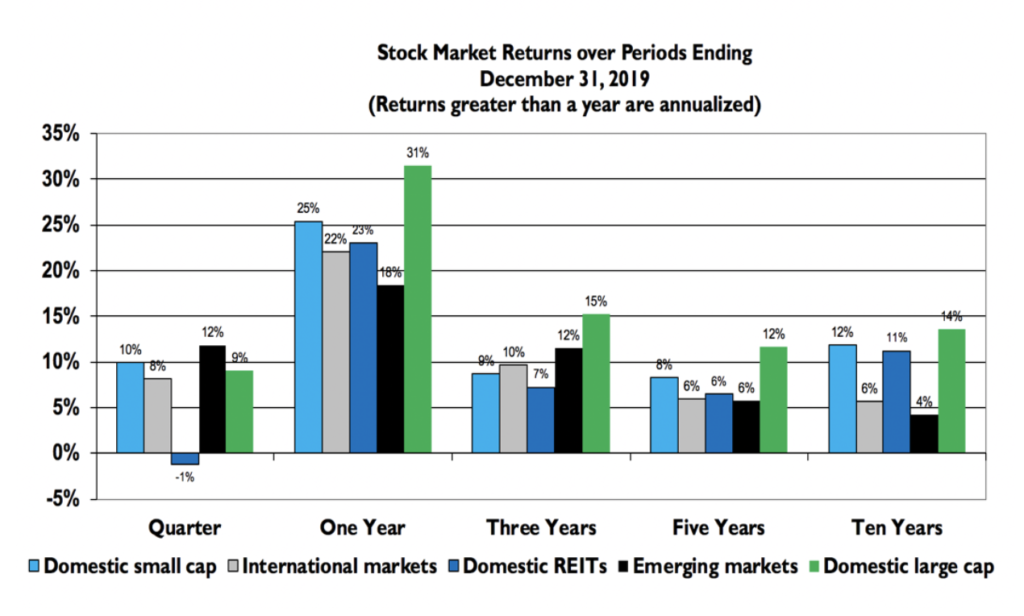

Stocks were up nicely this quarter except for Real Estate Investment Trusts (REIT) which is quite a turnaround from last year’s fourth quarter. The one-year numbers including REITs, are well above what it is reasonable to expect over the long run but are necessary from time to time to make up for the down markets we will endure going forward. Overall it has been a good year for stocks.

Domestic markets, especially large cap stocks (S&P 500), have outpaced both international and emerging markets over longer periods. Because many consider the S&P 500 as the “stock” market, looking backward makes it easy to focus only on allocations to this index. Investment decisions are made by looking ahead where global diversification is expected to payoff.

Bond Markets

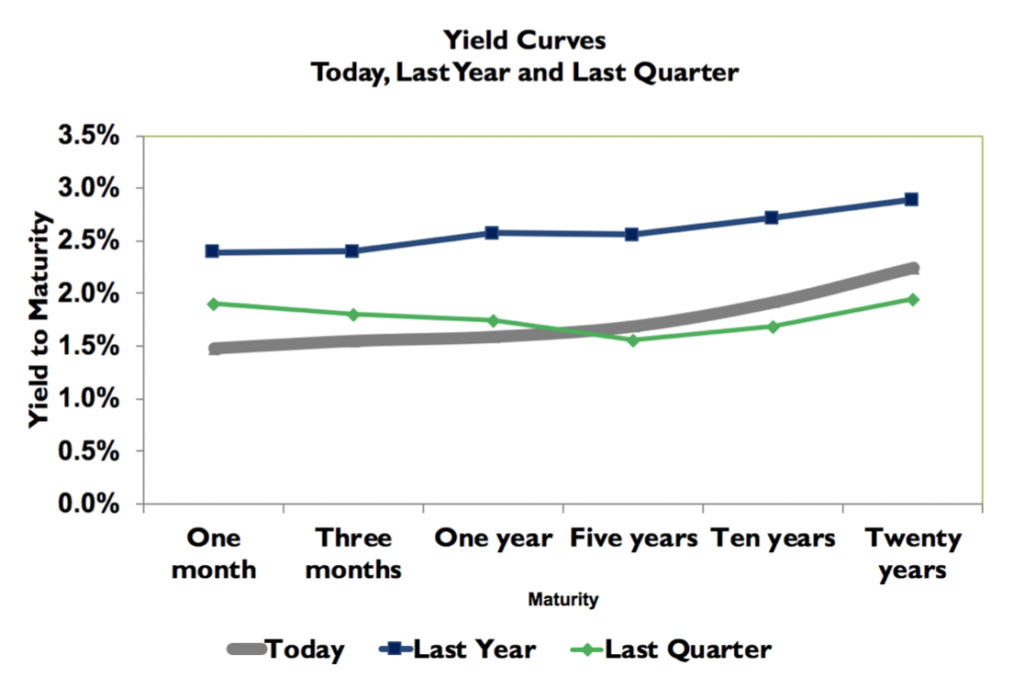

A yield is what you earn by holding a bond to its maturity. Changes in yields drive returns – falling yields are positive; rising yields negative. The longer a bond’s maturity the greater the impact a given change will have on prices and returns.

Financial Common Sense

Note, to the graph above that bond yields at the longer end ticked up but fell at the shorter end producing negative returns for longer maturing bonds and positive returns for short-term bonds. This twisting of the yield curve brought the pattern of yields across several maturities although low by historical standards back to its more “normal” upward sloping shape.

Impeachment

There is a lot of noise about a coming recession. While the numbers still look reasonable, the tools to respond may not be as potent this time around. The hue and cry for the Fed to reduce interest rates notwithstanding, with rates at historically low levels and massive Treasury securities on the Fed’s balance sheet there is not much room for monetary policy to make a difference. As far as fiscal policy is concerned, the Government is already running substantial deficits due to the recent tax cut. The positive impact may be behind us and with today’s political dysfunction the opportunity to do more with fiscal policy may not be available. With the large tax cuts in place and an accommodative Fed, we have enjoyed a nice ten- years that may be difficult to repeat.

A Twenty-Year Perspective

It’s been a good year, but let’s put it in perspective by looking at some history. The past twenty years produced an average 7% return from global equity markets amid significant ups and downs. Probably a reasonable long-term expectation. This year’s 24% return was well-above this average. Over this period, we had to endure some significant down years, including a three-year run of double-digit losses at the beginning. Seeking to avoid the pain of a fourth loss would mean missing the dramatic up market of the following year. Then after a few years of up markets, we went through the gut-wrenching drop of over 40% in 2008. This year’s results are not necessarily extraordinary in view of the ups and downs of the past twenty years – it’s how equity markets work. Seeking to avoid this variability is apt to mean missing out on years like this one. The past twenty years is reasonably representative of how equity markets behave over extended periods. Don’t pay any attention to the myriad of predictions that are typical for this time of year–they’re usually wrong. Focus instead on the appropriate tolerance for variability whilst expecting commensurate returns over the long run.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.