Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

November 22, 2019

AllInvesting

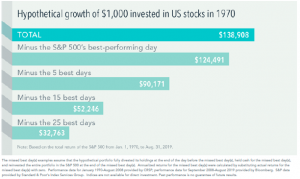

Trying to time the market is nearly impossible; there is no way to predict when the market is going to perform well and above what we expect it to. However, by buying and holding a low-cost, globally diversified portfolio, we know that we will not miss out on the returns of the top performing days in the market. Take the hypothetical situation below from our friends at Dimensional Fund Advisors which shows how the impact of missing just a few of the market’s best days can be profound.

A hypothetical $1,000 in the S&P 500 turns into $138,908 from 1970 through the end of August 2019. Miss the S&P 500’s five best days and that’s $90,171. Miss the 25 best days and the return dwindles to $32,763. There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst—so history argues for staying put through good times and bad. Investing for the long term helps to ensure that you’re in the position to capture what the market has to offer.

Source: Dimensional Fund Advisors

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.