Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

October 9, 2013

All

Market returns continued their upward trajectory again this quarter. The US stock market (S&P 500) was up 5.2% while International stocks came roaring back with an 11.6% return for the quarter. The steady interest rate environment caused bond returns to remain flat, up .36% for the 3-month period ending September 30, 2013. The bond market, represented by the Barclays US Government/Credit Index, was still in negative territory for the year, down 2.3%. Please refer to the last page of our newsletter for historical returns from various financial markets over longer time periods.

September 2013 marks the five-year anniversary of the global financial crisis. Do you remember the fear and panic that seized the markets and the resulting doomsday predictions of the media? Here is a partial list of what we lived through back then:

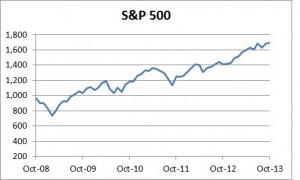

It’s hard to believe we actually made it through that period. The stock market imploded with the S&P 500 benchmark falling more than 50% to 752 on November 20, 2008. We have come a long way since that fateful month. The S&P 500 has averaged a healthy 10% annual return over the last 5 years (see chart) and the global economy continues to recover, although slowly.

It’s hard to believe we actually made it through that period. The stock market imploded with the S&P 500 benchmark falling more than 50% to 752 on November 20, 2008. We have come a long way since that fateful month. The S&P 500 has averaged a healthy 10% annual return over the last 5 years (see chart) and the global economy continues to recover, although slowly.

What did we learn from the events of the past five years? Fear and panic in financial markets cause us to question our decisions and despair about the future.

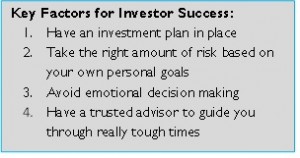

However, it’s important to note that a well-diversified portfolio helped investors to overcome one of the worst financial crises in American history. We continue to believe the keys to successful investing are simple but certainly not easy.

However, it’s important to note that a well-diversified portfolio helped investors to overcome one of the worst financial crises in American history. We continue to believe the keys to successful investing are simple but certainly not easy.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.